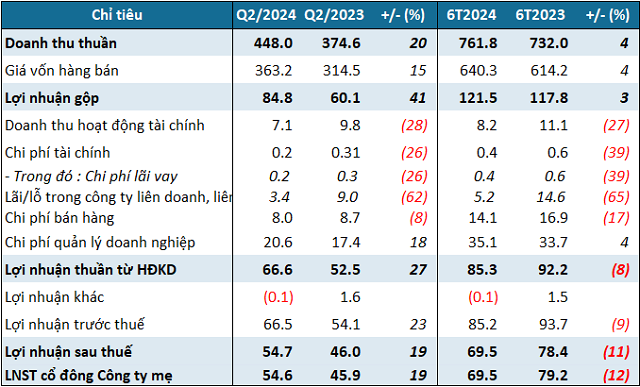

In Q2 2024, TCL recorded net revenue of 448 billion VND, a 20% increase compared to the same period last year. The main contributor to this growth was the depot services segment. After deductions, TCL reported a net profit of nearly 55 billion VND, an increase of 19%.

This quarter also marked the highest net revenue and net profit for TCL since its listing on the HOSE in December 2009. The results are a stark contrast to the previous quarter, Q1, which had a net profit of less than 20 billion VND, the lowest in 14 quarters.

| TCL achieves record revenue and profit since its listing |

|

Financial results for Q2 and the first half of 2024 for TCL

Unit: Billion VND

Source: VietstockFinance

|

The significant shift in financial performance was somewhat anticipated. At the Annual General Meeting held in June 2024, Director Le Van Cuong shared: “The decline in business performance in Q1 was due to the Tet holiday, which resulted in a significant drop in revenue. Additionally, some contracts had expired and were awaiting renewal. These contracts will be recognized in Q2, and we expect that 2024 will still meet the set plans.”

TCL’s AGM: Maintaining the allocation for reward funds, and a flat profit plan

As of the end of Q2 2024, TCL‘s total assets were nearly 1,019 billion VND, an increase of 8% from the beginning of the year. Notably, the scale of receivables was nearly 360 billion VND, mostly short-term receivables of nearly 340 billion VND, an increase of 37%. TCL primarily generates receivables from its parent company.

TCL allocated nearly 273 billion VND to financial investments, including nearly 130 billion VND in short-term investments, all in term deposits; and more than 143 billion VND in long-term investments, with the largest proportion being an investment in Tan Cang Ben Thanh JSC of nearly 85 billion VND, recognized as an investment in an associated company.

In terms of capital sources, TCL had nearly 433 billion VND in payables, an increase of 27% from the beginning of the year, accounting for 42% of total capital sources. The company’s liabilities are mainly short-term payables to suppliers of nearly 184 billion VND.