Shares of LDG Investment JSC [HoSE: LDG] witnessed a sharp decline to the floor price during the first trading session of the week on July 29, 2024. The stock price plunged by the maximum allowed limit of 6.7% to VND 2,100 per share.

This was the third consecutive session that LDG shares hit the floor price with no buyers. Selling pressure continued to mount, and by the end of the morning session on July 29, there were approximately 16 million shares, equivalent to 6% of the circulating shares, sold at the floor price with no corresponding buy orders.

Since the beginning of 2024, LDG’s stock price has lost nearly 30% of its value.

The downward trend intensified following the news of LDG being ordered to undergo bankruptcy proceedings. In the previous week, the People’s Court of Dong Nai Province decided to initiate bankruptcy proceedings against LDG. Within 30 days from the date of the Court’s decision, creditors must contact the People’s Court of Dong Nai Province to provide their debt claims to the appointed asset management officer and asset management and liquidation enterprise.

On the same day, the People’s Court of Dong Nai Province also decided to appoint Uy Nam Partnership Asset Management Company as the asset management and liquidation enterprise to oversee the management of assets, monitor business activities, and liquidate the assets of LDG Investment JSC. Phuc Thuan Phat Trading and Construction JSC is responsible for advancing asset management and liquidation costs to Uy Nam.

The decision to initiate bankruptcy proceedings against LDG is related to an unsettled debt between LDG and Phuc Thuan Phat Trading and Construction JSC. LDG has made payments to Phuc Thuan Phat for up to 95% of the value of the contracts. However, there are still some outstanding debts between the two companies that need to be resolved.

In a statement to shareholders, LDG affirmed that it “is not insolvent” and is still fulfilling its financial obligations. The company stated that it has been and will continue to negotiate and work with its partners to protect the rights and interests of all involved parties.

Former Chairman of the Board of Directors, Nguyen Khanh Hung, was prosecuted, and the business performance remained lackluster

A series of negative news has plagued LDG. In November 2023, the former Chairman of LDG, Nguyen Khanh Hung, was arrested on charges of “Deceiving Customers” in relation to the Tan Thinh Residential Area project (Doi 61 Ward, Trang Bom District, Dong Nai Province).

On April 11, 2024, the Dong Nai Provincial Police decided to prosecute and arrest Mr. Nguyen Quoc Vy Liêm, former Deputy General Director of LDG, for deceiving customers in the same project.

Additionally, Mr. Nguyen Khanh Hung was penalized for selling over 2.6 million LDG shares in August 2023 without proper disclosure. The transaction was later canceled, and Mr. Hung was fined over VND 500 million.

At the 2023 Annual General Meeting of Shareholders, Mr. Hung apologized to the shareholders for his undisclosed transaction, emphasizing that it was a personal oversight. He assured that there was no malicious intent, and he had cooperated with the State Securities Commission and received the administrative sanction decision.

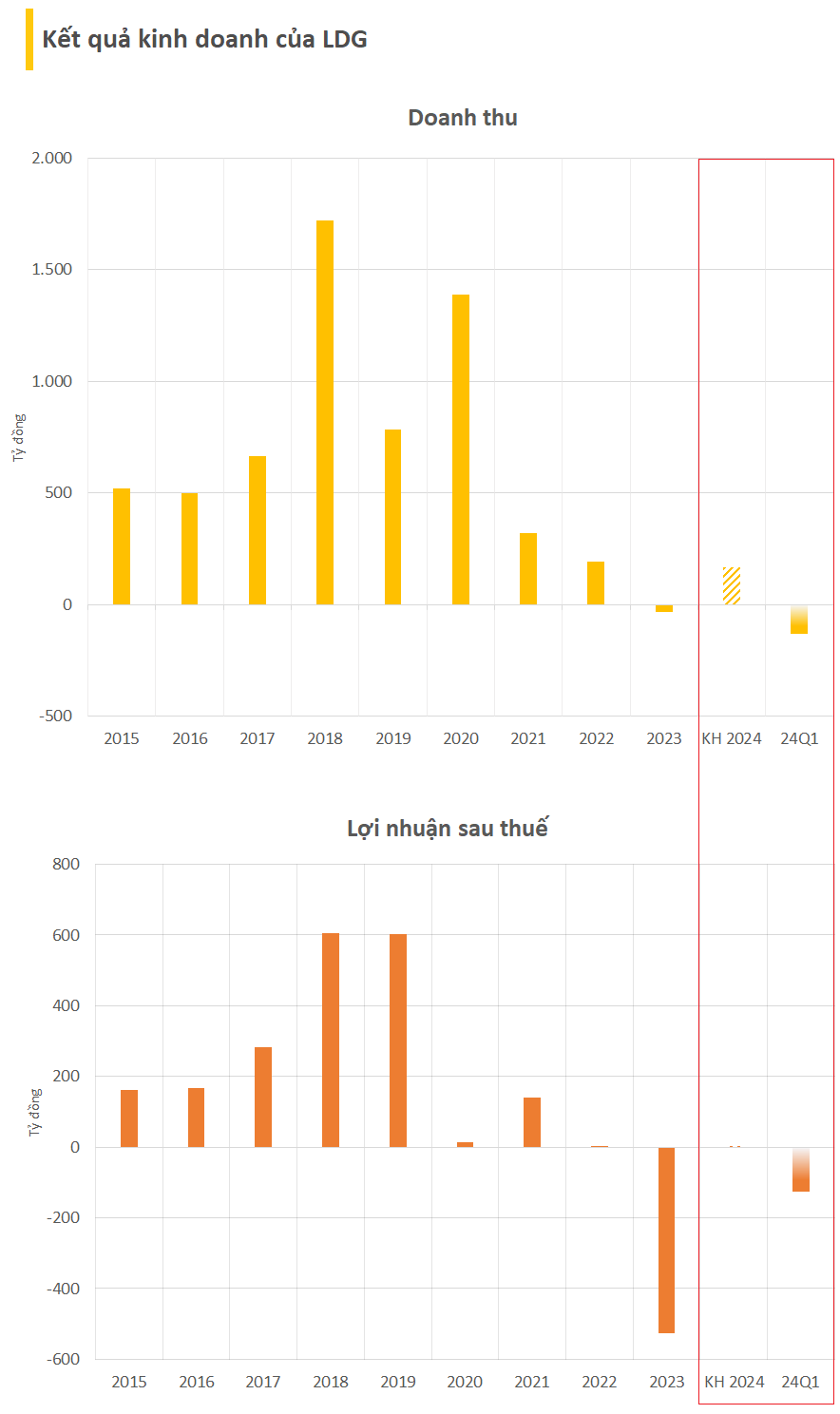

In terms of business performance, LDG set targets for 2024 with a revenue of VND 167 billion and a profit after tax of VND 2.5 billion. However, the situation remains challenging. In the first quarter, LDG recorded a negative revenue of over VND 130 billion due to deductions. As a result, the company incurred a loss of nearly VND 125 billion.

According to the financial statements, as of March 31, LDG’s total assets amounted to VND 7,200 billion. Short-term assets stood at VND 4,761 billion, including nearly VND 7 billion in cash. The value of inventory as of the end of the first quarter of 2024 was over VND 999 billion.