Shares of Hoa Binh Construction Group (ticker: HBC) and HAGL Agrico (ticker: HNG) plunged nearly 7% this morning, with buy-side orders notably absent following the opening bell.

By the end of the morning session, HNG managed to match just 2.2 million shares at the floor price, leaving over 10.4 million shares on the sell-side. In comparison, Hoa Binh Construction fared worse, with more than 12.5 million shares sold at the floor price and a meager turnover of merely 200,000 shares, significantly lower than recent sessions.

Last weekend, both companies received the unwelcome news of mandatory delisting from HoSE due to their unprofitable track record. Unlike HoSE, the UPCoM exchange allows for a wider price fluctuation of up to 15% per session, potentially leading to more rapid price changes for these stocks.

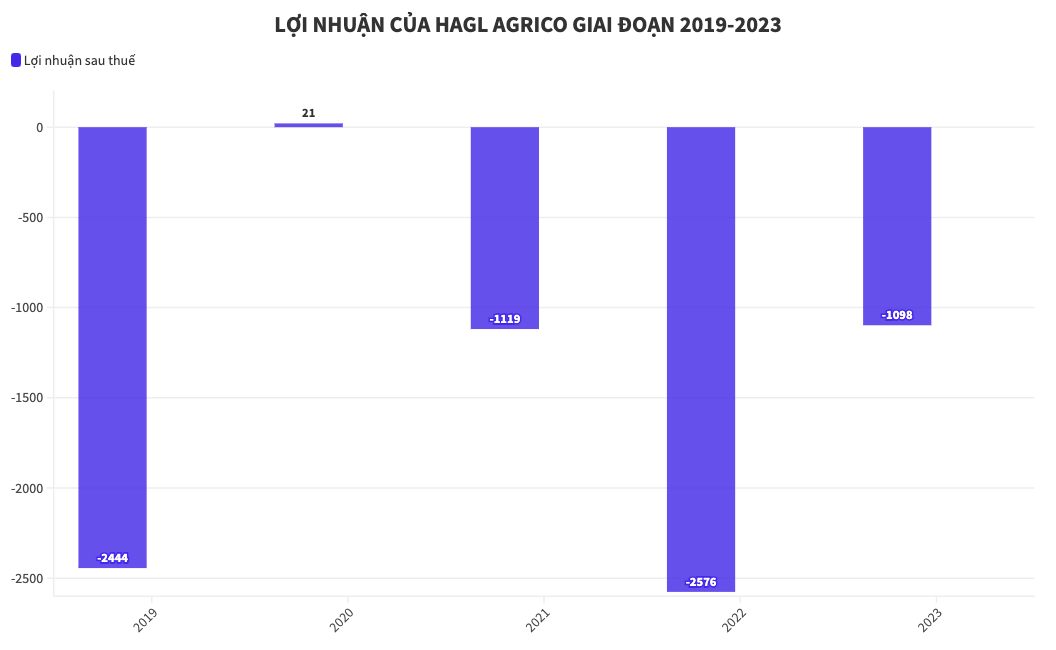

HAGL Agrico has posted consecutive years of losses for its parent company’s shareholders, with figures of VND 1,119 billion, VND 3,576 billion, and VND 1,098 billion for 2021, 2022, and 2023, respectively. This trend continued into the first quarter of 2024, with a 26% drop in revenue and a net loss of VND 47.1 billion. This marks the company’s 13th consecutive quarterly loss, although the figures have shown some improvement by remaining in double digits. As of the first quarter of 2024, HAGL Agrico has accumulated losses of VND 8,149 billion.

At a meeting earlier in May, Mr. Tran Ba Duong, Chairman of HAGL Agrico’s Board of Directors, acknowledged that they had anticipated the delisting scenario. However, the billionaire reassured shareholders that even if the stock were delisted and moved to the UPCoM exchange, the company would maintain transparent disclosures to its 33,000 shareholders, just as it had on HoSE. He expressed confidence that with proper management, the stock price could still rise despite the delisting.

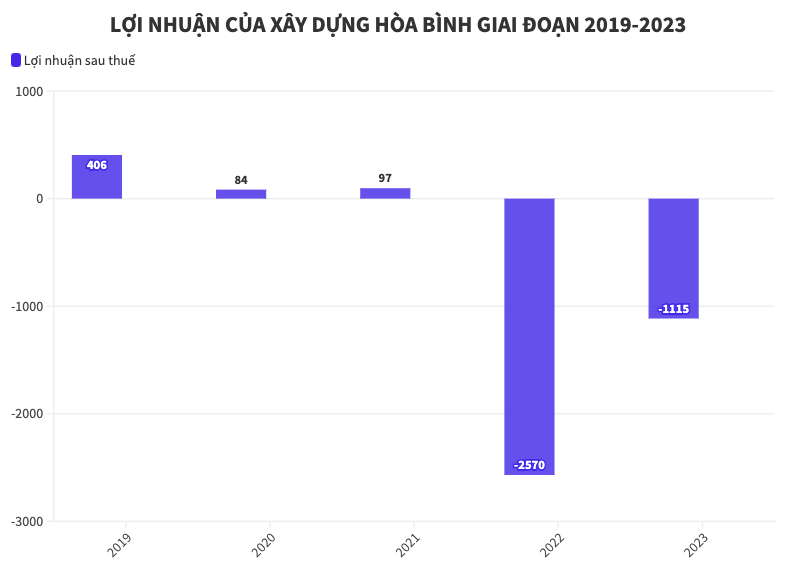

Turning to Hoa Binh Construction, the company faced a cumulative loss of VND 3,240 billion as of the end of 2023, surpassing its paid-up capital of VND 2,741 billion. In addition to these substantial losses, the company’s management has also undergone changes that could impact its governance capabilities.

However, in a statement to the media, Hoa Binh Construction’s Chairman, Le Viet Hai, assured that the shift to a new exchange would not affect the fundamental rights and interests of shareholders. The company remains committed to fulfilling its obligations without any changes from its previous arrangements.

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.