The banking group’s profits surged in Q2 2024, as evident from the recent figures released by the banks. As of July 25, 2024, 565 enterprises, representing 36.6% of the total market capitalization on HOSE, HNX, and UPCoM, have released their estimated business results or financial statements for Q2 2024, according to FiinTrade’s statistics.

Among them, the profit after tax of these 565 enterprises grew by 21.6% year-on-year in Q2 2024, higher than the 16.7% growth rate achieved in the previous quarter. The Finance group, led by the banking sector, remained the primary contributor to this growth, with a 34.2% year-on-year increase in profit after tax.

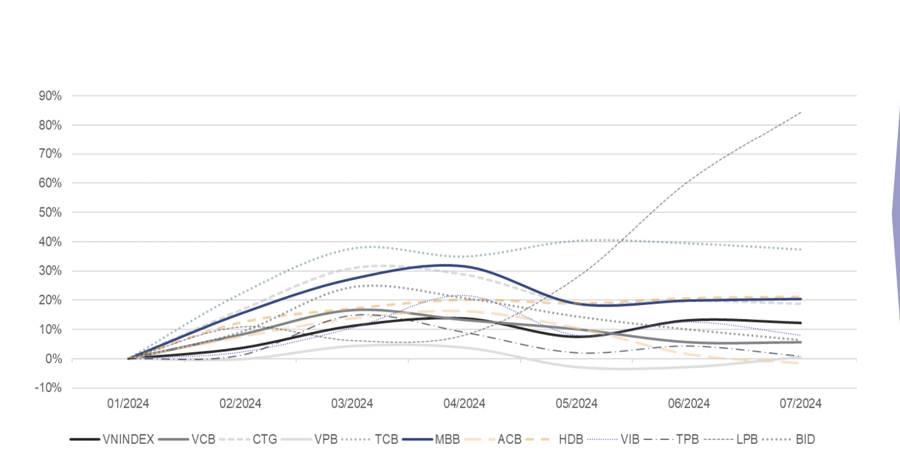

VnDirect also projected that the banking industry’s net profit growth for 2024 would reach approximately 23.8% year-on-year (Q1/24: 18.1%). VPB, LPB, and CTG are expected to be the banks with the highest growth rates in the industry.

After a period of price increases due to loose monetary policies and a low-interest-rate environment, bank stocks will continue to differentiate and adjust based on business performance.

Therefore, VnDirect believes that this is an opportune moment to selectively accumulate bank stocks based on their growth prospects. The reasons for this include: The evident recovery of the real economy in Q2/24, which alleviates concerns related to the banking system’s asset quality.

Reduced pressure on exchange rates as US interest rates decline, and a more stable overall economic environment will ease liquidity pressure on the system. The banking sector will be the first to benefit from the economic recovery. The industry’s P/B ratio is lower than the five-year average, and selling pressure from foreign investors is easing due to the aforementioned factors.

TCB and LPB, the two stocks with the highest price increases in the first half of 2024, are also the banks with the highest credit growth rates in the industry. This validates the investment thesis of focusing on future credit growth potential.

Based on this, VnDirect recommends MBB as a stock with a 25% upside potential. We project a 16% credit growth for MBB, attributable to the following factors: MBB receiving a larger credit quota after the Ocean Bank acquisition, expectations of a stronger recovery in the retail sector toward the year-end, benefiting MBB as retail lending accounts for 43% of its total credit balance, and a robust corporate client portfolio, comprising 49% of its credit balance, supporting credit growth as enterprises have better refinancing capabilities than individuals.

Net interest margin (NIM) is expected to increase due to improved asset yields, while funding costs remain unchanged, thanks to a high CASA ratio. MBB will leverage its corporate relationships to boost fee income, and its large corporate client base and strong connections with military-affiliated enterprises will enable it to increase cross-selling and fee-based income, thus maintaining its TOI scale in 2024.

The pressure on non-performing loans (NPLs) is expected to ease toward the year-end. We forecast a gradual decrease in MBB’s provision expenses in the latter part of the year, reaching 8,631, a 25% increase year-on-year, due to two main factors: 1) improved borrower repayment capability, leading to a reduction in NPL formation, and 2) a sharp increase in NPLs in Q1/24 due to affiliated CIC debt, with the expectation that economic recovery will curb the surge in NPLs and facilitate the adjustment of CIC debt back to standard debt, reducing the pressure on MBB’s loan loss provisions.

VPB is recommended with a 23% upside potential. The recovery in consumer demand will drive VPB’s strong credit growth from Q3/24 onward, as evidenced by a 9.5% increase in the RSI in May. This momentum will propel credit growth to 21%, significantly outpacing the industry’s projected growth rate of 15%, resulting in a 14% increase in TOI for 2024.

The successful restructuring of FE Credit will enhance VPB’s return on equity (ROE) in the long term. We project ROE to increase from 9.9% in 2023 to 17% in 2026, driven by the recovery of FE Credit’s profit. The restructuring process has shown positive signs as the company shifts its focus to customers with good credit histories. We expect FE Credit’s NPLs to peak in Q2/24 as the most severe credit issues come to an end. While FE Credit will incur a loss this year due to the loss in Q1/24, the expected improvement in consumer demand should boost profits in 2025.

VCB is also recommended with a 27% upside potential. Credit growth in the second half of 2024 is expected to improve, mainly driven by increased lending to FDI enterprises and large projects. Leveraging its relationships with state-owned enterprises, VCB has provided loans for significant projects such as the Long Thanh Airport ($1 billion) and Lot B-O Mon ($12 billion in total investment).

VCB held a 43% market share in foreign enterprise lending in 2022, the highest among listed banks, thanks to its strong brand, leadership in international trade, and low funding costs. NIM improved quarter-over-quarter due to an enhanced CASA ratio, and while it is projected to remain stable in 2024 as VCB continues to reduce lending rates following the SBV’s guidelines, it will be partially supported by maintaining low funding costs and an improved CASA ratio. Lending to large enterprises will contribute to an improved CASA ratio through payment, salary, and foreign exchange services.

VCB boasts the best asset quality in the industry, with the highest loan loss reserve (LLR) ratio of 200%, meaning it has ample room for provisioning as it did not handle any bad debt in Q1/24. The NPL ratio is expected to peak in Q2/24, while the NPL handling ratio may increase to 0.5% in 2024.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.