Circular 12/2024/TT-NHNN (Circular 12), issued by the State Bank of Vietnam, took effect on July 1, 2024, regulating the lending activities of credit institutions and amending and supplementing a number of articles of Circular No. 39/2016/TT-NHNN (Circular 39).

One of the important changes stipulated in Circular 12 is the regulation of small-value loans, which are defined as loans with a value not exceeding VND 100 million.

Notably, borrowers of small-value loans are not required to submit a feasible capital usage plan. Specifically, Clause 7, Article 24 stipulates that credit institutions must require borrowers to provide documents and data proving the feasibility of the capital usage plan, the financial capacity of the borrower, and the legality of the capital usage purpose before making a lending decision, except for small-value loans.

Circular 12 has somewhat “untied” consumer lending activities. Photo: Nam Khanh |

However, to prevent bad debts, Circular 12 also sets out certain requirements for small-value loans. Point c, Clause 2, Article 22 stipulates that for small-value loans, credit institutions must have measures to monitor and supervise the use of borrowed capital in accordance with the committed purpose and the repayment of borrowers, ensuring the ability to fully recover the principal and interest on time as agreed. This regulation also applies to large-value loans.

In addition, Article 24 of the Circular stipulates that for small-value loans, credit institutions must have a minimum of information about the legal capital usage purpose and the financial capacity of the borrower before making a lending decision.

Circular 12 has somewhat “untied” consumer lending activities, as consumer loans are usually small-value loans of less than VND 100 million.

However, the accompanying regulations of the Circular also make borrowers responsible for their loans, helping to ensure a reduction in bad debts.

According to Ms. Nguyen Linh Phuong, Deputy Director of the Monetary Policy Department (SBV), these changes help customers access small loans more easily, thereby curbing black credit in the market.

Regarding the regulation on consumer lending without having to prove the capital usage plan, SBV Deputy Governor Dao Minh Tu affirmed that this is not a loose regulation but actually aims to promote consumer finance and create real convenience for people to access consumer capital, especially people in remote areas and low-income earners.

“Circular 12 will definitely facilitate consumer lending, as consumer loans are usually small amounts of less than VND 100 million,” said Mr. Tu.

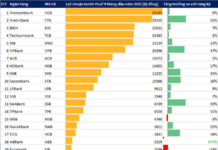

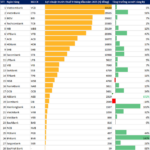

Consumer lending currently accounts for about 20% of the total outstanding debt of the entire industry, equivalent to 2.8 million billion VND. 16 credit institutions (including banks and finance companies) with the largest consumer lending outstanding debt are offering up to 30 consumer lending products.

According to the Deputy Governor, while it is necessary to create conveniences for borrowers, it is also essential to ensure the recovery of capital, a challenge that commercial banks must carefully consider and balance.

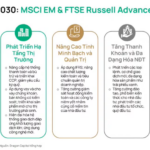

Introducing solutions to promote a healthy, efficient, and sustainable consumer finance market is crucial, contributing to the implementation of the National Financial Inclusion Strategy towards 2025, with a vision towards 2030: “developing consumer lending products suitable for consumer lending subjects, with reasonable interest rates, contributing to the prevention of “black credit.”

Tuân Nguyễn

Coteccons profits nearly 50% from investing in FPT stocks, sets aside full provision of 143 billion for Saigon Glory receivables.

In the first 6 months of this year, Coteccons achieved a net revenue of VND 9,784 billion, a nearly 5% increase, and a net profit of VND 136 billion, which is nearly 8.9 times higher than the same period last year.