|

VKC successfully held its 2024 Annual General Meeting of Shareholders on the morning of July 26, 2024, with a participation rate of over 46%. Previously, on June 29, VKC had attempted to hold the meeting but failed due to low attendance, with only 18.76% of the total shares with voting rights present.

|

During the second meeting, shareholders engaged in lively discussions regarding the company’s debt resolution strategies. One shareholder suggested that VKC reconsider the valuation of its land assets, arguing that the lots, purchased a long time ago for just 8 billion VND, could now be worth up to 500 billion VND if reassessed at government rates.

However, another shareholder disagreed, pointing out that revaluing the assets would only improve the appearance of the financial statements, as higher asset values do not necessarily benefit the company. They also highlighted the potential challenges, including a 20% tax burden on the increased value, which VKC might struggle to pay, and the fact that larger land areas are typically more difficult to sell and are subject to market prices.

Mr. Than Xuan Nghia, Chairman of the Board of Directors of VKC, shared a similar perspective. He acknowledged that while historical government rates may have been lower, current rates could be higher than market prices. As a result, finding buyers at government rates might prove difficult.

“We need to choose the optimal solution and negotiate with the bank to buy us some time. It’s crucial because, in August, the company will be in court regarding the VPBank appeal. Time is of the essence, or we may not be able to turn things around,” Mr. Nghia emphasized.

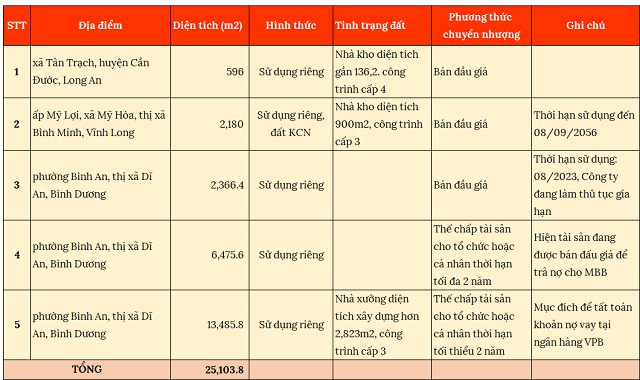

After extensive deliberations, VKC approved the decision to auction and mortgage five land lots with a total area of over 25,100 square meters to repay its debts. One of these lots, measuring nearly 6,476 square meters in Binh Duong, is currently under the management of MBAMC and is in the process of being auctioned to recover debts owed to MBB. As of May 7, 2024, VKC‘s total outstanding debt to MBB was nearly 88 billion VND, including approximately 70 billion VND in principal and over 17.8 billion VND in interest.

|

Source: Consolidated

|

Another land lot in Binh Duong, spanning almost 13,486 square meters, serves as collateral for a loan from VPBank. On June 14, VKC disclosed that it had received a lawsuit from VPBank, filed with the People’s Court of Dĩ An City, to recover a total debt of nearly 85 billion VND as of May 31, 2024. This includes approximately 67 billion VND in principal and over 17.3 billion VND in overdue interest.

Proceeds from the sale of a 2,366-square-meter land lot, also in Binh Duong, will be used to settle due debts or offset bond issuance debts. Additionally, VKC plans to liquidate fixed assets and obsolete inventory, including tires, oil, batteries, production materials, and cables that are no longer marketable. The funds generated from this liquidation will be allocated to settle due or overdue debts or supplement working capital.

Notably, three branches of VKC – in Vinh Long, Binh Duong, and Ho Chi Minh City – currently owe the parent company more than 80 billion VND. Regarding challenging-to-collect debts, Mr. Pham Hoang Phong, General Director of VKC, explained that these debts had existed for a long time, and despite multiple audits, there was no evidence to substantiate them. As a result, Mr. Phong proposed writing off these debts rather than keeping them on the books indefinitely.

VKC provided additional context, revealing that the company’s management between 2018 and 2022 had manipulated cash flow to inflate the revenue of the parent company. The branches offered sales discounts to customers, but VKC did not extend the same to its branches, effectively hiding losses and inflating profits over an extended period. Furthermore, there was a lack of periodic reconciliation between the branches and the parent company, and the branches did not have separate accounting departments, instead relying on VKC‘s centralized accounting function.

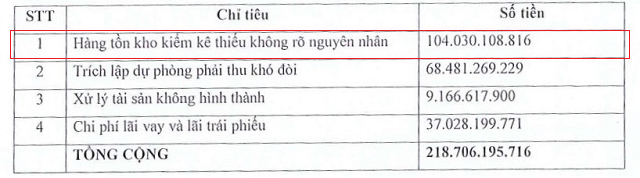

VKC concluded that the debts owed by its three branches were either non-existent or lacked sufficient grounds for collection under regulations. Additionally, the company proposed setting aside nearly 100 billion VND in provisions for difficult-to-collect debts, including 36 billion VND invested in Khang Gia Hung Company.

Shareholders also revisited the issue of over 100 billion VND in inventory shortages with unknown causes, as disclosed in the audited financial statements for 2022. On this matter, the Chairman shared that there had been allegations against the previous management, and the truth would be determined through an ongoing investigation by the police.

|

Source: VKC 2022 Audited Financial Statements

|

During the meeting, Mr. Le Minh Chi was removed from his position as a member of the Board of Directors. Three new members were appointed: Ms. Pham Thi Lan (a major shareholder with a 5.1% stake in VKC), Mr. Ta Ngoc Bich, and Mr. Nguyen Quang Huy. Additionally, Ms. Nguyen Thi Le was elected as a member of the Supervisory Board.

|

From left to right (holding flowers): Ms. Pham Thi Lan, Mr. Nguyen Quang Huy, Mr. Ta Ngoc Bich, and Ms. Nguyen Thi Le. Photo: Tu Anh.

|

Looking ahead, VKC aims to address lingering issues, resume production and business operations, and reduce loan debts in 2024. The company believes that resolving these challenges – including bond and credit debts, customer receivables, and unexplained inventory shortages – is essential for its future development. As a result, VKC has refrained from setting specific growth plans and will focus on maintaining operations with its limited remaining capital, emphasizing efficiency and cost-saving measures.

For 2024, VKC targets a total revenue of 20 billion VND and aims to reduce its pre-tax loss to 60 billion VND (compared to a loss of over 88 billion VND in 2023). In the second quarter of 2024, the company incurred a post-tax loss of over 29 billion VND, marking the ninth consecutive quarter of losses since the second quarter of 2022. As of the end of June, VKC‘s accumulated loss reached 350 billion VND, while its charter capital stood at 200 billion VND.

“The company is currently facing fixed losses, but we hope to achieve fixed profits in the future,” expressed the Chairman of VKC. Mr. Nghia also assured that, under his leadership, no one would be allowed to manipulate the company’s assets, and external pressures would not influence its operations, given its already challenging situation.

Dealing with Debt in Commercial Activities

The use of credit has become an indispensable part of commerce, enabling businesses to be flexible in sales and service delivery. Using credit is not only about understanding the financial situation of customers, but also a business strategy. However, determining the value of credit, the repayment terms, and the recovery process for maximum effectiveness is always a complex challenge for business owners.