For the first six months of the year, VIB’s total revenue exceeded VND 10,350 billion, a slight increase from the same period last year. Capital mobilization and outstanding loans grew by 5%, matching the industry average. Pre-tax profit reached VND 4,600 billion, with a return on equity (ROE) of 21%, placing the bank among the top performers in the industry. The bank has completed a 12.5% cash dividend payout and plans to distribute a 17% stock dividend to existing shareholders, along with over 11 million ESOP shares to employees in Q3.

Capital mobilization grew faster than the industry average, with credit growth picking up in Q2.

As of June 30, 2024, VIB’s total assets exceeded VND 431,000 billion, a 5% increase from the beginning of the year. Capital mobilization increased by 5%, outpacing the banking industry average of 1.5%. Outstanding credit as of the end of Q2 reached nearly VND 280,000 billion, a 5% increase from the beginning of the year, with growth across all four key segments: retail, corporate, SME, and financial institutions. Credit growth is on a recovery path, with a 1% increase in Q1 and a 4% increase in Q2 due to optimized capital costs and reduced lending rates, coupled with the launch of a range of innovative and competitive retail products, providing momentum for growth in the last six months of the year. Notably, the retail product suite includes:

- A VND 30,000 billion housing loan package with interest rates of 5.9% – 6.9% – 7.9% for fixed-rate terms of 6 months – 12 months – 24 months, with principal grace periods of up to 48 months;

- A loan package for over 1 million apartments with interest rates of 5.9% – 6.9% – 7.9% for fixed-rate terms of 6 months – 12 months – 24 months, with principal grace periods of up to 5 years and approval times of less than 8 hours;

- A loan package for repaying debts to other banks for home purchases, apartment purchases, and home repairs, with interest rates of 5.5% – 6.5% – 7.5% for fixed-rate terms of 6 months – 12 months – 24 months, offering pre-disbursement support and a simple and flexible process.

As one of the few banks ranked in the highest group by the State Bank of Vietnam, VIB has been granted a large credit limit for 2024 and is among the banks with the highest room for credit growth in the industry in the last six months of the year.

Safe risk management, lowest concentration risk in the industry, with interest and fee receivables accounting for only 0.6% of total assets.

In a context where credit demand has improved but remains weak, VIB maintains a cautious strategy, ensuring a balance between growth objectives, credit quality, and operational efficiency. Along with more positive credit growth than in the same period last year, asset quality has also improved, with the non-performing loan ratio remaining at 2.4%. Substandard debt decreased by nearly VND 2,900 billion in Q2 and by 17% from the beginning of the year.

VIB continues to be one of the banks with the lowest credit concentration risk in the market, with retail loans accounting for over 82% of its total loan portfolio. More than 90% of these retail loans are secured by residential and commercial real estate with full legal documentation and good liquidity. VIB also has one of the lowest levels of corporate bond investments in the industry, accounting for only 0.2% of total credit outstanding. All of these bonds are in the production, trade, and consumer sectors. For more than four years, VIB has had no exposure to BOT, renewable energy, corporate bond guarantees, or real estate bond investments.

Notably, VIB is one of the few banks with very low interest and fee receivables, amounting to approximately VND 2,600 billion, a 28% decrease from the end of 2023 and representing only about 0.6% of total assets, while this ratio for many banks is in the range of 1%-2%, and in some cases, as high as 3%. This reflects the quality of revenue recognized in the financial statements and VIB’s cautious approach to retail credit accounting.

Safety indicators are at optimal levels, with the Basel II capital adequacy ratio (CAR) at 11.8% (requirement: above 8%), the loan-to-deposit ratio (LDR) at 72% (requirement: below 85%), the short-term capital for medium and long-term loans ratio at 26% (requirement: below 30%), and the net stable funding ratio (NSFR) under Basel III at 117% (Basel standard: above 100%). By consistently adhering to and applying international governance standards, VIB continuously enhances its reputation, brand, and transparency in the domestic and international financial markets.

Revenue grew positively, with cautious risk provisions, resulting in an ROE of 21%.

In the first six months of the year, VIB’s total revenue reached VND 10,358 billion, a 1% increase year-over-year. While net interest income decreased by 8%, non-interest income increased by 50%. Due to the focus on high-quality customer segments with strong collateral and the introduction of competitive retail product packages, there was a slight decline in the net interest margin (NIM). However, VIB maintained a positive NIM of 4.2%. Non-interest income reached nearly VND 2,400 billion, reflecting positive growth compared to the same period last year and contributing 22% to total revenue. Notably, income from written-off loan recoveries contributed VND 500 billion, a 2.7-fold increase year-over-year, and foreign exchange operations added VND 330 billion. Fee income increased by 9%, driven by two main products: Credit Cards and Insurance. The credit card business surpassed 750,000 cards in circulation, and credit card spending reached a new record of nearly USD 2.4 billion in the first six months, a 42% increase year-over-year.

Operating expenses increased by 16% year-over-year due to investments in people, branch expansion, technology, digital banking, and marketing. The bank’s cost-to-income ratio (CIR) averaged 32% over the past 12 months and is expected to decrease by the end of 2024 as cost optimization initiatives are being aggressively implemented. In the first half of the year, VIB proactively increased its risk buffer, with an average quarterly provision of approximately VND 1,000 billion, a 36% increase compared to the first half of 2023 but a 38% decrease compared to the second half of 2023.

In summary, VIB’s pre-tax profit for the first six months reached over VND 4,600 billion, a decrease compared to the same period last year. However, the return on equity (ROE) remained at a healthy 21%, placing VIB among the top performers in the industry.

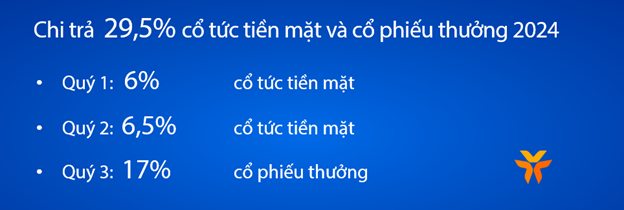

29.5% dividend payout in 2024, including a maximum foreign ownership ratio of 4.99% of charter capital.

In the first half of the year, VIB completed two cash dividend payments totaling 12.5% of charter capital. Currently, the bank is in the process of distributing a 17% stock dividend to existing shareholders and 11 million ESOP shares to nearly 2,000 employees in Q3.

During this period, VIB also successfully held an Extraordinary General Meeting of Shareholders for 2024, approving the bank’s charter, including a provision that sets the maximum foreign ownership ratio at 4.99% of charter capital.

According to VIB’s representative, amid a volatile market environment influenced by global macroeconomic and political factors, VIB remains committed to its vision of becoming a leading retail bank in Vietnam in terms of both quality and scale and a preferred partner for businesses and financial institutions. Dynamic and safe growth, maintaining a cautious risk appetite, remains the bank’s top priority, along with pioneering the adoption of international standards. Additionally, VIB focuses on building a modern and advanced digital banking platform with high information security to enhance its service capabilities and provide the best experience for each customer.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.