Vietbank’s General Meeting of Shareholders has agreed on a “cautious and realistic” business direction and growth plan for 2024, adopting two sets of target plans (KHCS and KHPD). This prudent approach reflects the market situation and the efforts of the system as a whole. Vietbank’s 2024 Semi-Annual Consolidated Financial Statements show that 3 out of 5 financial goals have been achieved ahead of schedule.

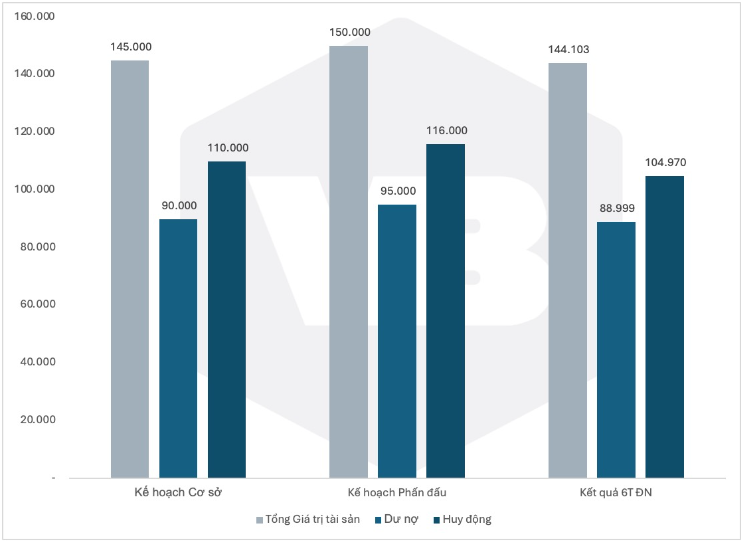

Base Plan, Stretch Plan, and 6-Month Performance for 2024 (in VND billion)

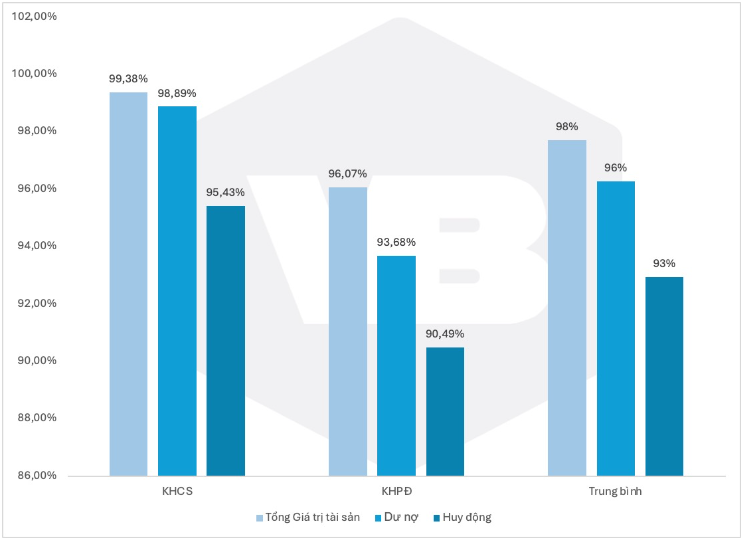

Vietbank’s Semi-Annual Consolidated Financial Statements show that three growth targets—fund-raising, outstanding loans, and total asset value—have already achieved over 90% of the stretch plan just halfway through the financial year. Notably, loan growth reached 10%, outpacing the industry average of 6% as of June 28, 2024.

Completion Ratio of Targets against KHCS, KHPD, and 6-Month Average for 2024 (in %)

The bank successfully maintained its non-performing loan (NPL) ratio at 2.4%, in line with TT11/NHNN’s requirement of keeping it below 2.5%. Additionally, the NPL ratio relative to total outstanding loans remained stable compared to the beginning of the year. Effective credit risk management and loan quality control measures contributed to Vietbank’s achievement in this area, and the bank also benefited from a recovery of VND 139,819 million in loan loss provisions. Vietbank’s capital adequacy ratio (CAR) exceeded 11%, surpassing the SBV’s requirement and the industry average.

Timely policy adjustments, interest rate management in line with market dynamics, and regulatory compliance contributed to a pre-tax profit of VND 410,541 million, representing 43% of the plan. The growth rate for the past six months reached 11.3%, with the second quarter making a significant contribution to the semi-annual results, achieving a 96.5% year-over-year increase.

One factor that impacted the bank’s profitability was the rise in operating expenses, with staff costs accounting for 65% of the additional expenditure. This approach contrasts with the industry trend of downsizing and reducing personnel costs. Vietbank’s representative affirmed, “The bank remains steadfast in its people-centric philosophy. Our three-pronged strategy for 2024 focuses on ensuring employee welfare (salaries, bonuses, and other benefits), investing in training, and digitizing HR management.”

In the fourth quarter of 2024, the bank plans to transition to an electronic “one-stop-shop” HR management system that will streamline processes and automate tasks, enhancing labor productivity. This system will cover various aspects, from operations and management to the provision of HR services across the entire network, and will be integrated with Vietbank’s upcoming recruitment website, scheduled for launch in the third quarter of 2024. This project not only enhances information security but also simplifies procedures, reducing manual interventions. In terms of training, the Board of Directors has passed a resolution to invest in a Training Center Headquarters (combined with a transaction point) in Ho Chi Minh City. This timely support and investment from the leadership demonstrate a strong commitment to fostering long-term and sustainable human resources development.

The dedication of the bank’s staff and the close involvement of its leadership have led to multiple domestic and international awards in just six months. These accolades include recognition for innovation, efficient operations, effective product and service innovation, fast growth, and digital transformation for the Core Banking and Cybersecurity projects.

To meet and exceed its annual plans, Vietbank must maintain its growth momentum and ensure efficiency and safety in its operations for the remainder of the financial year. Given the economic landscape and industry context, the bank will need to make timely and appropriate adjustments, particularly by introducing promotional programs with broad reach to enhance its appeal and competitiveness across platforms, with a special focus on digital ones.