ESG stands for Environment, Social, and Governance, a set of criteria used to measure a company’s sustainability and impact on society.

While it is a crucial trend that the banking sector needs to pioneer, the implementation of ESG in finance and banking still faces challenges. This was the main topic of discussion at the seminar “Promoting ESG Practice in the Banking Sector” organized by the Banking Times on July 25 in Hanoi.

Seminar “Promoting ESG Practice in the Banking Sector” organized by Banking Times – Photo: VGP/HT |

Nearly 90% of banks adopt ESG in their operations

In her opening remarks, Ms. Hoang Thanh Nhan, Editor-in-Chief of Banking Times, said that Vietnam is facing many environmental and social issues and is heavily affected by climate change, negatively impacting economic development and people’s lives.

Therefore, Vietnam has actively participated in implementing international commitments on green transition and reducing greenhouse gas emissions. At the COP26 conference, the Prime Minister committed to net zero greenhouse gas emissions by 2050. To realize this goal, practicing ESG is a must. As a financial intermediary and provider of capital to the economy, more and more banks and financial institutions in Vietnam are adopting ESG in their practices to contribute to sustainable development.

This is considered a solution that brings many benefits to the economy, promotes green growth and sustainable development, and enhances the prestige and position of banks domestically and internationally.

Ms. Hoang Thanh Nhan, Editor-in-Chief of Banking Times – Photo: VGP/HT

|

Recognizing the importance of implementing ESG in banking activities, the State Bank of Vietnam (SBV) has issued many policies to promote green banking, green credit, and sustainable development. The SBV has also developed a handbook to guide the assessment of environmental and social risks for 15 economic sectors with high environmental and social risks…

Following the SBV’s directions, credit institutions (CIs) have proactively cooperated and received green capital and technical support from international financial organizations to build internal regulations for managing environmental and social risks in credit activities for customers, and have made efforts in green credit lending…

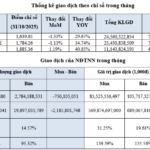

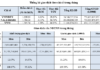

According to SBV statistics, 80%-90% of banks have applied ESG partially or wholly in their operations. Nearly 50% of banks have established risk management departments for environmental protection loans. Some banks have also issued “Green Credit Framework” and “Sustainable Loan Framework” to provide procedures for using and managing loan funds for projects in green and emission reduction fields. Several CIs have also published separate reports on sustainable development.

From a management perspective, Ms. Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors (SBV), said that 47 CIs reported green credit outstanding balance of nearly VND 640,000 billion, accounting for about 4.6% of the total outstanding loans of the economy. 34 CIs reported that they had conducted environmental and social risk assessments for outstanding loans of about VND 2,900,000 billion, accounting for nearly 21% of the total outstanding loans of the economy.

Challenges ahead

At the seminar, delegates said that the application of ESG standards by banks brings many benefits to the economy and the banks themselves. For the economy, banks can have positive impacts on the environment and society, promote the transition to sustainable development by prioritizing preferential financing policies for businesses that perform well on ESG issues, and limit funding for projects that negatively affect the environment and society. In addition, the development of ESG governance mechanisms in credit activities is also considered to guide producers and investors towards sustainable development…

Ms. Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors (SBV) – Photo: VGP/HT |

For banks, practicing ESG standards brings benefits such as enhanced prestige, expanded market share, strengthened competitiveness, improved risk management effectiveness, reduced operating costs due to savings in raw materials, reduced legal pressure, attracted preferential capital from international organizations, and improved investment efficiency…

However, Ms. Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors (SBV), pointed out that there are still challenges in implementing ESG. Firstly, there is a lack of national regulations on criteria and a list of green projects for sectors/fields according to the economic sector classification system, which serves as a basis for CIs to identify and fully statistics on green credit resources. Secondly, there is a lack of specific regulations and guidance from specialized management agencies on ESG.

Green credit lending requires in-depth technical knowledge about the environment, making it challenging for credit officers to assess and evaluate the effectiveness of projects and the repayment ability of customers. It is also difficult to monitor and manage risks when implementing credit activities, and additional costs are incurred for CIs to invest in building a management system that aligns with green growth targets, enhancing the professional capacity of bank staff in project financing, circularity, and sustainable development.

Investing in green sectors/fields often requires a long payback period and high investment costs, while the loan capital of CIs is usually short-term, making it challenging for CIs to balance capital and ensure the ratio of short-term capital for medium and long-term loans as prescribed. The capital demand for the National Green Growth Strategy is huge, while the capital support for businesses and investors from the financial market and the carbon credit market is still underdeveloped or not implemented, putting pressure on long-term capital for the banking system. The management capacity and strategic vision on ESG of enterprises, especially small and medium-sized enterprises, is a significant barrier, making the process of transitioning to a sustainable business model and practicing ESG in Vietnam difficult, affecting the effectiveness of credit activities and risk management of CIs…

Regarding future orientations, Ms. Pham Thi Thanh Tung said that the SBV will continue to guide CIs in green credit lending and reporting on credit activities for the National Green List after it is approved by the Prime Minister. The SBV will guide CIs in managing environmental risks according to Circular No. 17/2022/TT-NHNN, promptly removing difficulties in the implementation process. Promote international cooperation, create favorable conditions for CIs to access technical support and international resources to implement the National Strategy on Green Growth and promote ESG practice in Vietnam. Actively deploy training to improve the capacity of CIs in effectively deploying green finance tools.

Dr. Pham Minh Tu, Deputy Director of the Bank Strategy Institute (SBV), analyzed that the criteria and standards for applying ESG are very strict. Currently, there are pioneering units in the banking sector, such as Vietcombank, Agribank, and VPBank. Notably, BIDV has strongly promoted ESG practices by taking the lead in accessing foreign capital for green and sustainable development projects. However, even for pioneering banks, keeping up with ESG is still a challenging journey.

“However, this is an irreversible trend, and practicing ESG is like consuming high-quality food, which may be more expensive but is still better than dealing with health issues arising from consuming products of unknown origin,” said Dr. Pham Minh Tu.

From the perspective of a CI, Ms. Nguyen Thi Thu Ha, Director of the Training School and Deputy Head of the ESG Steering Committee of Agribank, said that in recent years, Agribank has promoted high-tech clean agriculture with interest rates reduced by 0.5% to 1% compared to conventional loans. Currently, Agribank continues to deploy credit with six key economic sectors, including green credit, and strengthens lending to support green businesses in production and export.

Ms. Nguyen Thi Thu Ha shared that Agribank’s leaders consider this a necessary task for Agribank and other CIs. Therefore, the implementation of ESG is a determined action from the highest level of the Board of Members, and relevant units. Agribank has publicly committed to implementing ESG on its website to communicate this strategy to its employees, turning it into a culture, and incorporating it into its annual business strategy. As a result, the bank’s staff clearly understands the need to implement ESG commitments…

Experts believe that, in addition to the efforts of CIs, promoting ESG practice in the banking sector requires the synchronous participation of ministries and sectors, especially in completing the legal framework on ESG. It is necessary to soon issue a National Green Project List to provide a legal basis for CIs to identify projects and project components that meet the conditions for green credit. Policies should be developed to promote the development of the carbon market, such as building regulations on carbon credits, emissions trading, and carbon credit trading; and establishing a carbon credit exchange operating mechanism… to accelerate the official operation of the carbon credit exchange in Vietnam.

In this process, the involvement of the press is also crucial in propagating policies and raising awareness among organizations and individuals about the importance of ESG implementation.

Khang Di

Sustainable Growth Trends in Life Insurance

The challenges and changes in 2023 have ushered in a new era for the life insurance industry in Vietnam, particularly in relation to sustainable development.

Strong and Practical Implementation of ESG Strategy at Masan

Masan, a leading Vietnamese company in the Consumer-Retail sector with billions of dollars in market capitalization, is not only known for its business achievements but also for pioneering the integration of ESG (Environmental, Social, and Governance) strategies into its operations. By prioritizing sustainable development, Masan aims to create a positive impact on both the company and the community as a whole.

Annual Vietnam Business Forum Commences

On the morning of March 19th, in Hanoi, the annual Vietnam Enterprise Forum and FDI Business Community Gathering will officially take place with the participation of the Prime Minister of the Government.