Urban Development JSC of Tu Liem (Lideco, code: NTL) has just announced its business results for Q2 2024 with a breakthrough growth in revenue and profit.

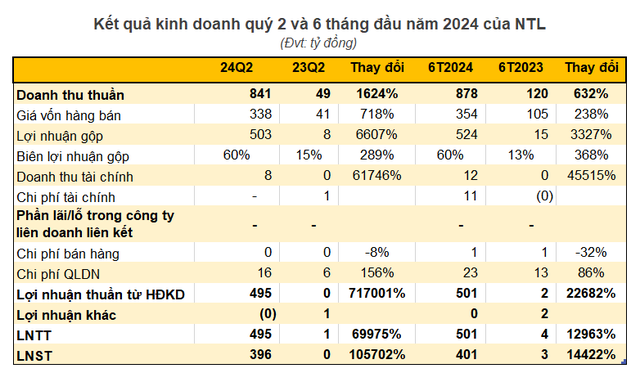

Specifically, Lideco recorded a revenue of VND 841 billion, up 1,624% over the same period last year. The cost of goods sold increased less than the revenue increase, leading to a significant improvement in gross profit margin from 15% in Q2 2023 to 60% in Q2 2024. Gross profit also surged by 6,607%, equivalent to 67 times the figure in the same period last year, reaching VND 503 billion.

In addition, financial revenue also increased significantly to VND 8 billion, compared to just over VND 12 million in the same period last year. Lideco did not incur any financial expenses in Q2 2024 as all loans had been fully repaid.

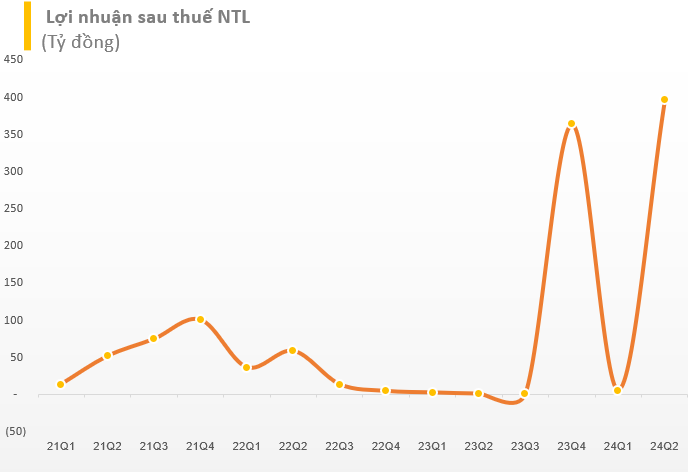

After deducting other expenses, Lideco reported a post-tax profit of nearly VND 396 billion in Q2 2024, equivalent to 1,058 times the figure in the same period last year. This is also the highest profit ever recorded in the operating history of the company.

According to the company’s explanation, the profit increase in Q2 2024 compared to the same period last year was due to the recognition of revenue from the sale of products with full payment received for the 23ha Bai Muoi project in Quang Ninh Province, resulting in a significant increase in profit.

It is known that the Lideco Bai Muoi Complex includes 4 subdivisions, one of which is the Lideco Bai Muoi Urban Area with an area of 23 hectares. This urban area is planned and constructed synchronously, including villas, townhouses, high-rise apartments, playgrounds, kindergartens, schools, and parks. The villa and townhouse subdivision has an area of 80-120m2/lot, with a maximum height of 5 floors, while the high-rise apartment subdivision offers units ranging from 40-70m2/unit, with a construction density of 48% in the center of Ha Long city.

For the first six months of the year, this real estate enterprise recorded a revenue of VND 878 billion and a post-tax profit of VND 401 billion, respectively 7 times and 145 times higher than the same period in 2023. In 2024, Lideco set a business plan with a revenue target of VND 750 billion and a post-tax profit of VND 256 billion, representing an 18% and 29% decrease compared to the results of 2023. Thus, the company has exceeded both revenue and profit targets after just six months.

As of June 30, 2024, NTL’s total assets stood at VND 2,658 billion, an increase of 31% compared to the beginning of the year. Cash and bank deposits increased from nearly VND 780 billion to VND 1,604 billion, accounting for 60% of total assets. In terms of capital sources, equity reached VND 1,685 billion, up 15% from the beginning of the year, while undistributed post-tax profit as of the end of Q2 2024 stood at VND 1,075 billion. Lideco no longer had any financial debt.

In the stock market, NTL shares are currently trading around VND 27,700/share, up nearly 20% from the beginning of July, approaching the historical peak of VND 28,000/share (recorded on July 12, 2024).

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.