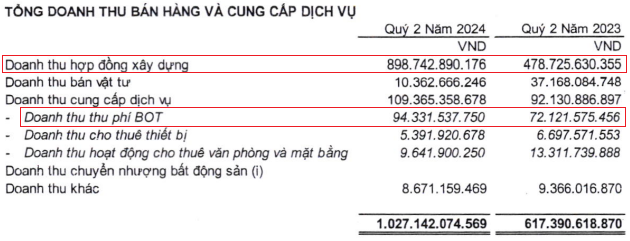

CIENCO4 Group’s revenue for Q2 2024 reached VND 1,027 billion, a 66% increase from the previous year. This growth was primarily driven by a significant 88% surge in revenue from construction contracts, amounting to nearly VND 899 billion. Additionally, revenue from BOT toll collection also witnessed a notable 31% increase, surpassing VND 94 billion.

In contrast, financial activity revenue decreased by 41%, settling at over VND 22 billion. This decline was largely attributed to a near 50% reduction in interest income from deposits and loans.

|

C4G’s revenue structure in Q2 2024

Source: C4G

|

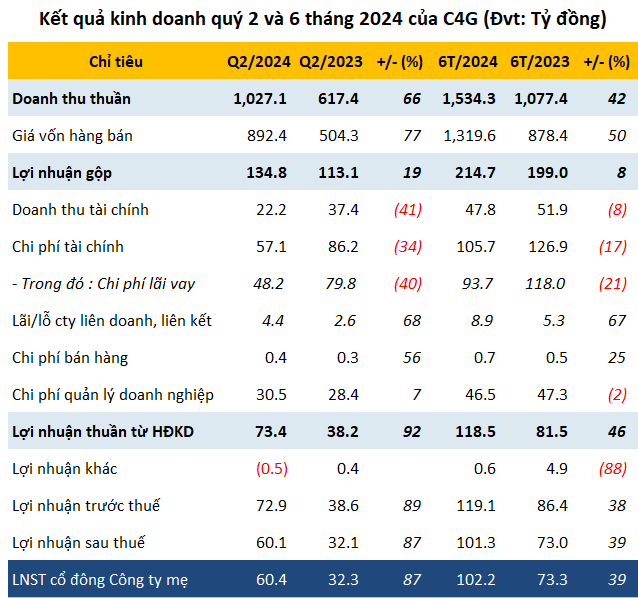

A positive aspect of this quarter’s report is the 23% decrease in total expenses, amounting to approximately VND 88 billion. Among these expenses, interest expenses accounted for more than VND 48 billion, reflecting a 40% reduction.

As a result of the increased revenue and decreased expenses, C4G achieved a net profit of over VND 60 billion in Q2, marking an impressive 87% rise from the previous year. This quarter’s performance represents the highest net profit since the company began trading on the UPCoM exchange in 2018.

| C4G’s net profit from Q1/2018 – Q2/2024 |

Building on this impressive performance, C4G’s six-month net profit surpassed VND 102 billion, indicating a 39% increase. In alignment with their 2024 goals, the company has successfully accomplished 35% of their targeted revenue of VND 4,500 billion and 41% of their projected after-tax profit of VND 250 billion.

Source: VietstockFinance

|

As of June 30, 2024, C4G’s total assets exceeded VND 9,668 billion, reflecting a slight 1% increase from the beginning of the year. Within this, cash and cash equivalents amounted to over VND 538 billion, marking a 24% decrease. Short-term receivables, on the other hand, neared VND 4,060 billion, a 2% increase, and accounted for 42% of total assets. Inventories stood at VND 916 billion, a 15% increase, with significant concentrations in projects such as Ben Thanh Suoi Tien (over VND 154 billion), Phan Thiet Dau Giay (over VND 81 billion), and Tan Son Nhat Airport improvement (nearly VND 52 billion), among others.

On the liabilities side, total liabilities amounted to over VND 5,823 billion, a modest 1% decrease from the start of the year. Financial borrowings accounted for nearly VND 2,921 billion, constituting 50% of total liabilities and 30% of the company’s capital structure.

Thanh Tú