In a market still rife with volatility, BFC stock of Binh Dien Joint Stock Fertilizer Company has staged a remarkable breakout session on July 29th. The share price soared to its daily limit, reaching a historic high of VND 47,600 per share. While sellers were absent, over one million units were queued to buy at the ceiling price.

Notably, the trading volume of this fertilizer stock witnessed a substantial spike, with nearly 1.7 million units changing hands in the morning session of July 29th, doubling the average of recent sessions. Market capitalization also doubled since the beginning of the year, surpassing VND 2,700 billion.

This breakout came on the heels of the company’s robust second-quarter financial results for 2024. For this period, Binh Dien posted net revenue of VND 2,916 billion, marking a 24.9% increase compared to the same quarter in the previous year. Gross profit also surged by 88% year-over-year, reaching VND 489 billion.

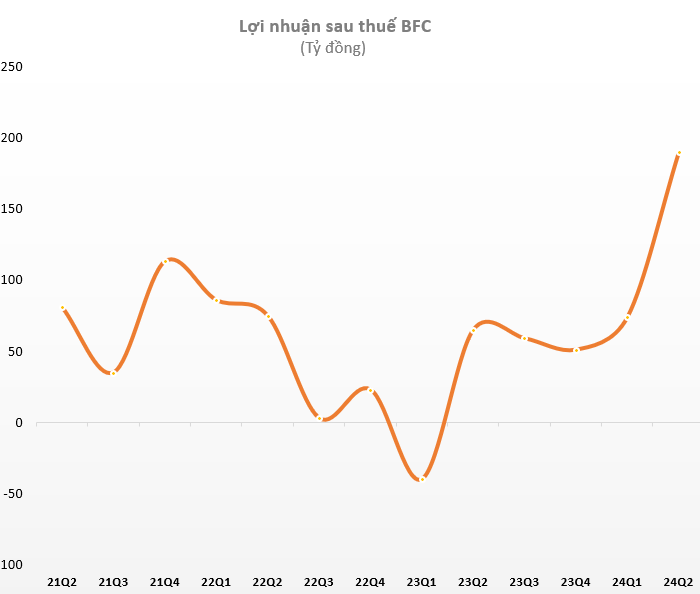

After accounting for expenses, the company’s net profit for the quarter stood at VND 190 billion, representing a 2.9-fold increase over the previous year’s performance. This quarterly profit also set a new record in the company’s operational history.

For the first half of 2024, Binh Dien’s net revenue reached VND 4,856 billion, reflecting a 32% year-over-year increase. The company’s net profit for this period was VND 264 billion, a tenfold increase compared to the same period last year.

As of June 30th, the company’s total assets amounted to VND 3,533 billion, a 2% increase. Inventory levels decreased by 20%, settling at VND 1,215 billion. This change was primarily driven by a reduction in finished goods inventory, namely various types of fertilizer, from VND 575 billion to VND 339 billion. The company’s non-term bank deposits also decreased from VND 329 billion to VND 220 billion.

In a previous report, SSI Research estimated a 40% year-over-year increase in the profits of fertilizer companies for 2024. The valuation of these companies is higher than the P/E ratio of 6x observed during 2021-2022, a period when they experienced abnormally high profits. However, it remains lower than the average P/E ratio of 12x from 2015 to 2020.

SSI Research attributes the positive outlook for fertilizer stocks to the prolonged conflicts in the Middle East, which could disrupt natural gas and urea supply in the region. This scenario would present opportunities for other urea-exporting countries, including Vietnam.

Additionally, the fertilizer industry is expected to benefit significantly from the proposed amendments to the Value Added Tax Law, which will be discussed during the May 2024 legislative session. The Ministry of Finance has proposed removing fertilizer from the list of goods exempt from value-added tax and instead subjecting it to a 5% tax rate. This change, which the industry has been advocating for over a decade, will allow companies to reclaim input tax, leading to a notable recovery in profits compared to previous years.