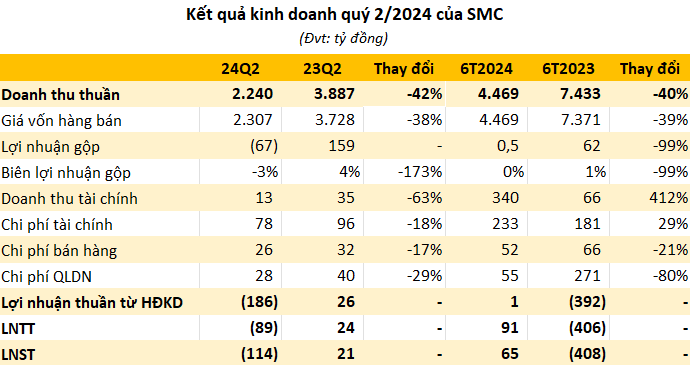

SMC Trading Investment Joint Stock Company (SMC) has published its Q2 2024 financial statements, reporting a 42% year-on-year decrease in net revenue to VND 2,240 billion. While cost of goods sold also decreased, it did so at a slower pace, resulting in a gross loss of VND 67 billion, compared to a profit of nearly VND 160 billion in the same period last year.

Financial income plummeted by 63% to VND 13 billion, while financial expenses decreased by 18% to VND 78 billion (with interest expenses accounting for over VND 49 billion). Selling expenses and general and administrative expenses both decreased compared to Q2 2023 due to lower bad debt provisions, amounting to VND 26 billion and VND 28 billion, respectively.

Notably, SMC recognized a significant surge in other income, which reached over VND 172 billion, primarily attributed to the liquidation and sale of fixed assets. The majority of this came from the sale of their headquarters located at 681 Dien Bien Phu, Ward 25, Binh Thanh District.

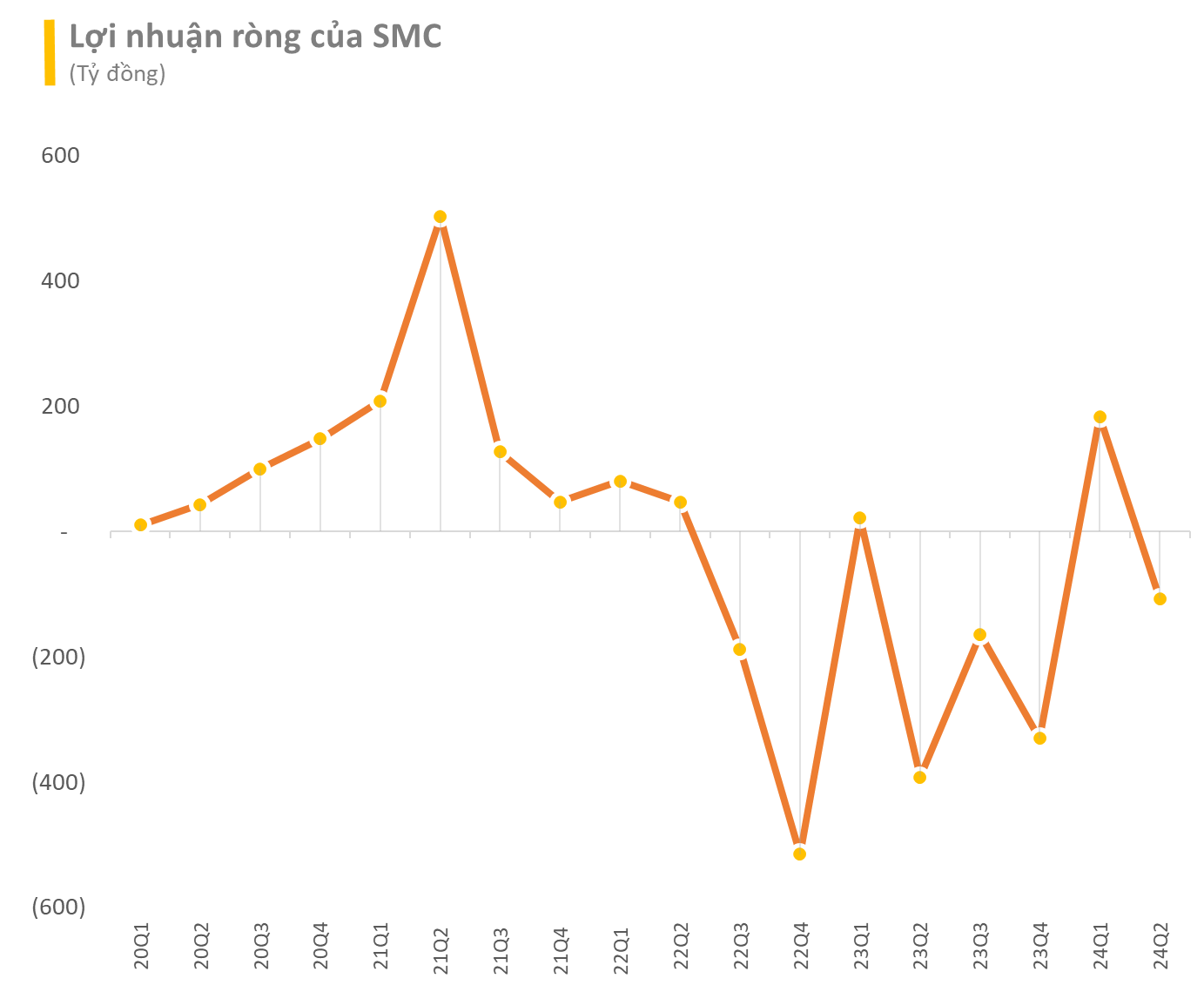

Despite these efforts, SMC incurred a pre-tax loss of nearly VND 89 billion in Q2 2024, compared to a profit of VND 24 billion in the same period last year. The after-tax loss amounted to VND 114 billion. Prior to this, the company had reported substantial profits in Q1 2024, breaking a streak of consecutive loss-making quarters. However, the situation has taken a turn for the worse, with the company plunging back into a significant loss in Q2.

For the first half of 2024, SMC’s net revenue stood at VND 4,469 billion, a 40% decline year-on-year. Thanks to the substantial profit in Q1, the company still managed to record a net profit of VND 91 billion for the six-month period, compared to a loss of VND 406 billion in the previous year. The six-month profit amounted to VND 65 billion. However, this profit was primarily derived from the liquidation of assets and the sale of financial investments, rather than their core business operations.

For the full year 2024, SMC Trading Investment JSC aims to achieve a revenue of VND 13,500 billion and an after-tax profit of VND 80 billion. With the results of the first half, the company has already accomplished 82% of its profit target.

As of June 30, 2024, total assets decreased by 16% from the beginning of the year to VND 5,193 billion. This included cash and cash equivalents of over VND 285 billion, a 57% drop from the start of the year. Inventory was valued at VND 746 billion.

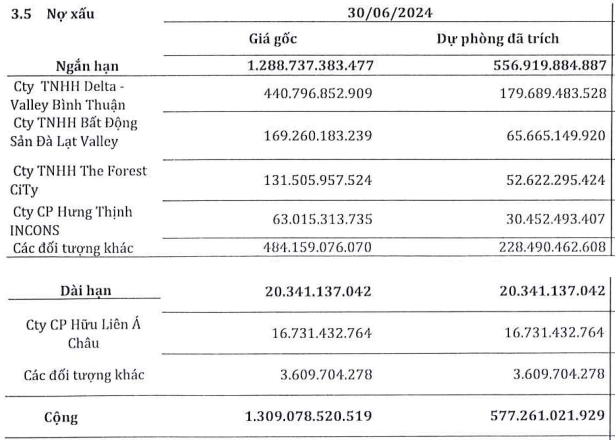

Short-term receivables from customers amounted to VND 1,948 billion, accounting for nearly 38% of total assets, with a provision of nearly VND 557 billion. This consisted mainly of short-term bad debts of VND 1,289 billion, with a provision of VND 553 billion, and long-term bad debts of VND 20 billion, which have been fully provisioned.

SMC’s Investments in Other Units

Long-term financial investments exceeded VND 252 billion, including nearly VND 121 billion invested in joint ventures and VND 124 billion in other units. Compared to the end of Q1 2024, SMC has completely divested from Pomina (POM). Conversely, the company invested nearly VND 105 billion in Hoa Binh Construction Group Joint Stock Company (HBC), for which a provision of VND 24 billion has been made, indicating a temporary loss of approximately 23% as of the end of Q2 2024. It is understood that Hoa Binh Construction Group conducted a private placement to convert debt, and SMC was among the creditors who participated in this debt-to-equity swap.

Payables decreased by 17% from the beginning of the year to VND 2,507 billion, while owner’s equity stood at VND 863 billion. Accumulated losses amounted to over VND 92 billion as of the end of Q2.

SMC’s shares remain on the HoSE warning list and are not eligible for margin trading. As of the market close on July 29, SMC’s share price stood at VND 14,200 per share, a 22% decline since the beginning of Q3.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.