“Foreign sell-off” is likely a term that Vietnamese stock investors have heard the most recently. For two consecutive months in May and June, the value of net selling on HoSE exceeded VND 15,000 billion. Although the intensity has cooled down and the intensity is less fierce, foreign investors still sold a net VND 7,400 billion in July.

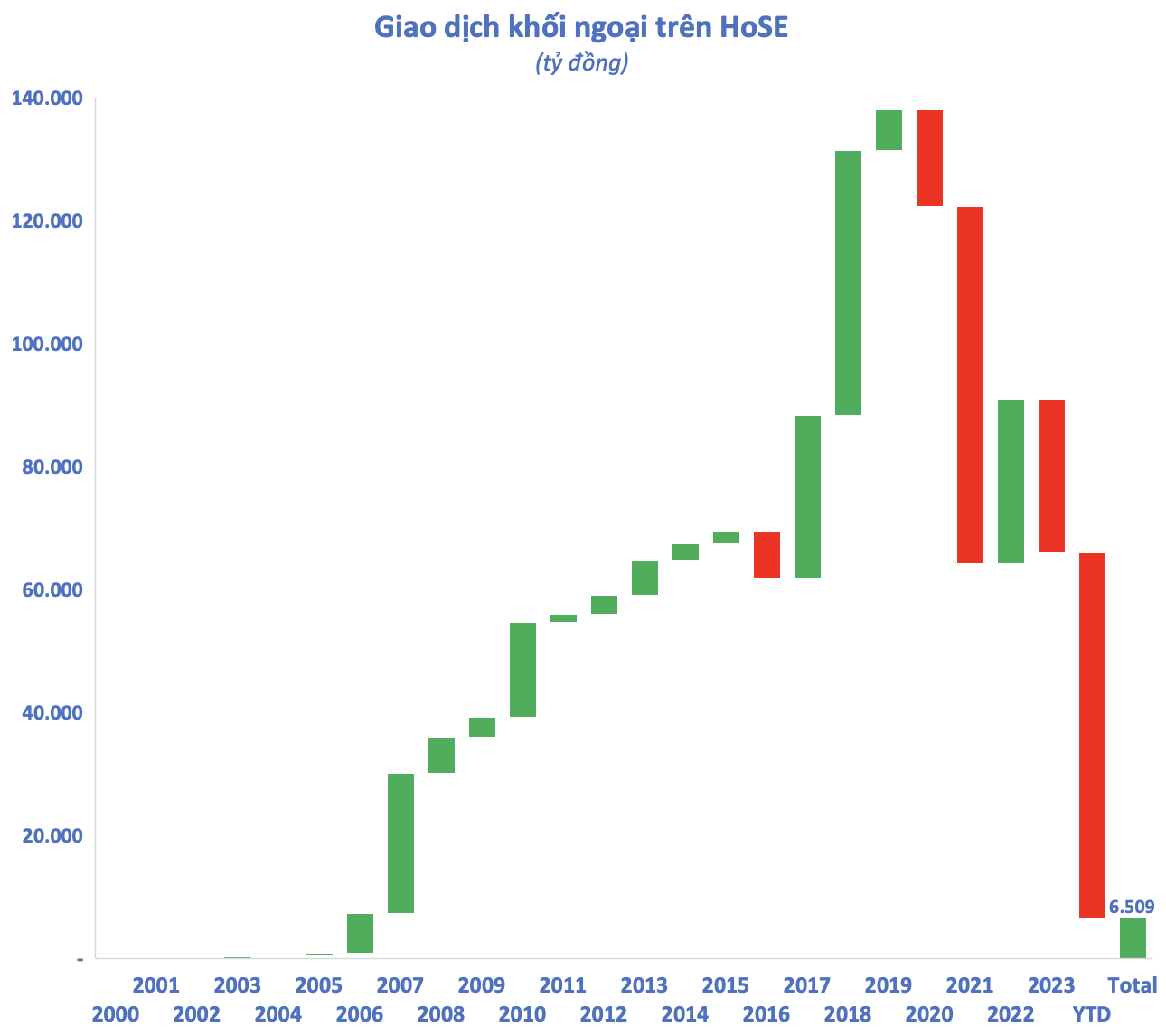

Since the beginning of 2024, foreign investors have net sold VND 59,500 billion on HoSE, surpassing the previous record high in 2021. Accumulated since the Vietnamese stock market operated in 2000 up to now, the net buying value of foreign investors is only VND 6,500 billion (according to HoSE statistics, only taking into account matching and matching transactions on the floor). This is a very modest figure compared to the market capitalization of over VND 5 million billion and liquidity of about VND 15,000 billion/session on HoSE.

In fact, foreign investors had a period of continuously pumping money to buy Vietnamese stocks through matching and floor agreements. The accumulated net buying value at one point reached nearly VND 140,000 billion at the end of 2019. However, this achievement was quickly blown away when the trend reversed from 2020. In a sense, foreign investors are building a “pine tree” model for capital flows in the Vietnamese stock market.

There are many reasons for the net selling of foreign investors, such as (1) profit-taking actions; (2) interest rate differentials cause capital to tend to withdraw from emerging and frontier markets, including Vietnam; (3) exchange rate pressure affects the investment efficiency of foreign funds in the Vietnamese stock market.

However, the above factors are only short-term and cannot explain a long-term trend. The key issue is the lack of quality goods. In the past, foreign capital flowed steadily into the market when the market continuously had waves of enterprises listing on the stock exchange, including both the private sector and the State through equitization and divestment.

In recent years, this activity has been much more subdued. Lack of new stocks while the stocks that foreign investors are interested in are full, causing choices to be narrowed down. Some stocks that were once the destination of many foreign investors, but changes in the macro and internal business situation have caused foreign capital to be withdrawn.

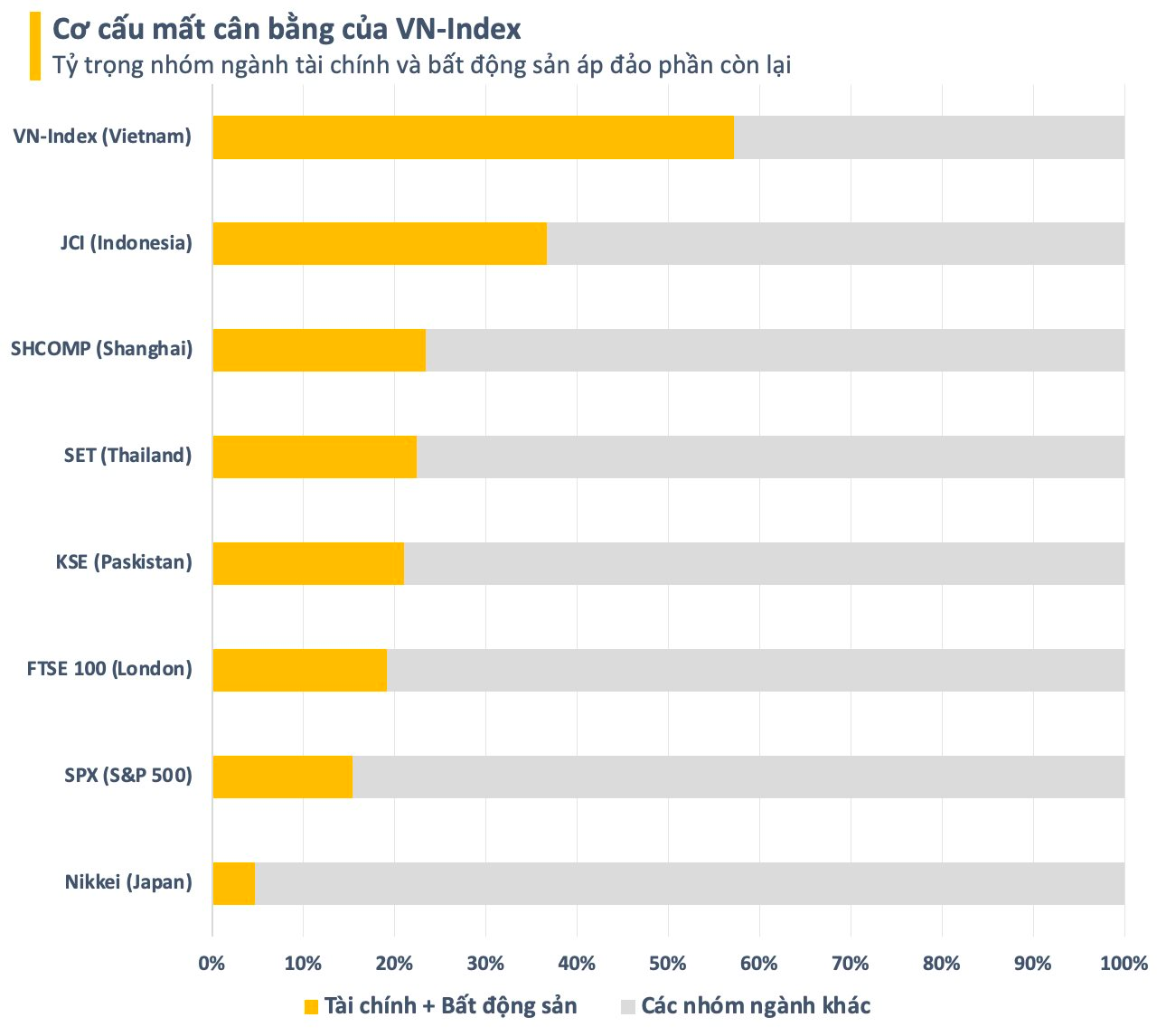

The lack of goods also affects the portfolio restructuring activities of large foreign funds. The portfolios of the “sharks” mainly consist of familiar names. The reference indices for ETFs are also similar, mainly composed of banking, securities, and real estate stocks. Investors have no other choice.

The Vietnamese stock market is becoming more and more polarized, making it difficult for fund performance to break through impressively. Some even recorded quite poor performance. This leads to difficulty in attracting capital, typically the case of BlackRock deciding to close the iShares Frontier and Select EM ETF after 12 years of operation.

More flexible but active funds, open-ended funds are also not easy to build a diverse portfolio when the structure of the Vietnamese stock market is still too skewed towards the financial and real estate groups. Meanwhile, “hot trend” industries such as technology, retail, healthcare, energy, etc. do not have many prominent representatives. This will continue to be a barrier to foreign capital in the future.

In theory, Vietnamese securities can welcome foreign capital inflows of up to tens of billions of dollars if they are upgraded from frontier to emerging markets. However, the number of stocks that meet the criteria to be included in the portfolios of large foreign funds specializing in investing in emerging markets is not much. Conversely, funds specializing in investing in frontier markets will sell a large number of Vietnamese stocks.