Single-family homes and apartment buildings offer stable and profitable investment opportunities.

|

The rental property investment yield has been on a continuous upward trajectory for three years post-pandemic.

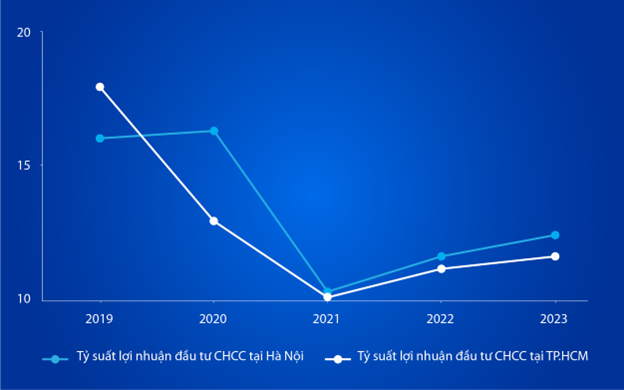

The rental property investment yield is the gross return on investment, taking into account both the annual rental income and the potential for property price appreciation. According to Batdongsan.com.vn, between 2015 and 2023, the average selling price of apartments in Hanoi and Ho Chi Minh City increased by 56% and 82%, respectively. As apartments continue to appreciate in value and maintain high demand, investing in apartments from 2015 to 2023 yielded an average return of 12.5% per year. Notably, the yield has been on a recovery path for the last three years, climbing from a low of 10.1-10.3% in 2021, impacted by the pandemic, to 11.6-12.4% in 2023. Pre-pandemic, this figure stood at 16%-17.9%.

Rental property investment yields have been on the rise for the past three years. (Source: Batdongsan.com.vn)

|

Regarding single-family homes, according to DKRA Group, land and single-family home/villa prices in Ho Chi Minh City and its vicinity increased by 1-5% in the first quarter of 2024, leading to a corresponding increase in rental prices for this type of real estate.

Many experts predict that, in the second half of 2024 and beyond, single-family homes and apartment buildings will continue to attract investors, especially with the upcoming enforcement of three new laws on Land, Housing, and Real Estate Business, effective from August 1.

A Profitable and Stable Investment Direction

Given the high average yields and the current low-interest-rate environment, investing in single-family homes and apartment buildings for rent in major cities like Hanoi and Ho Chi Minh City through bank loans offers a stable and profitable opportunity. This is especially true when capital costs are optimized with special loan packages like VIB’s market-leading “Fast Borrowing, Easy Repayment” program, offering rates of 5.9% – 6.9% – 7.9% fixed for 6, 12, and 24 months, respectively, with no principal payments for the first 4-5 years.

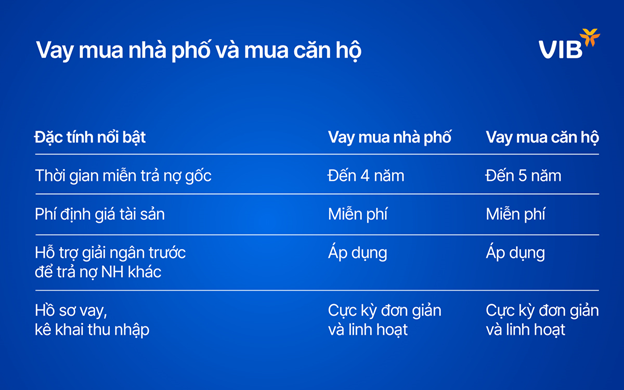

VIB’s market-leading loan package for single-family home purchases.

|

With VIB’s single-family home and apartment building loan packages, investors can choose from three attractive interest rates: 5.9% – 6.9% – 7.9% fixed for 6, 12, or 24 months. This helps reduce financial costs and increase investment profits. For investors looking to transfer their loans to VIB, the bank offers an additional 0.4% interest rate discount and supports advance disbursement to repay existing loans with other banks, along with free property appraisal. Furthermore, VIB provides flexibility in income proof requirements.

By borrowing from VIB, investors can benefit from both attractive interest rates and the option to defer principal payments for the first two years. This financial flexibility allows investors to maximize their investment returns when property prices meet their expectations.

Borrowing from VIB provides the opportunity to maximize investment returns when property prices meet expectations.

|

Additionally, VIB offers borrowers control over their capital with a loan-to-value ratio of up to 85% for apartment buildings and 80% for single-family homes, a loan term of up to 30 years, and the option to defer principal payments for up to 5 years for apartment building loans and 4 years for single-family home loans. Borrowers can also choose to repay the principal on a monthly, quarterly, or graduated basis.

The State Bank’s policy of continuing to reduce interest rates to support credit growth, coupled with the upcoming enforcement of the three new laws mentioned above, will contribute to a more vibrant market and present investors with numerous opportunities. For detailed advice on financial solutions to support your real estate investments, please contact our hotline at 1900 2200 or visit our website.

Where to invest money for better returns, with interest rates falling?

The “free-falling” savings interest rates are driving investors to heavily shift towards the real estate market to seize the strong market recovery momentum, while taking advantage of the “golden opportunity” brought by supportive policies with a 1-0-2 punch.