The VN-Index witnessed a tug-of-war during the first trading session of the week. Positive buying pressure helped the index maintain its green streak throughout the trading day. The VN-Index closed on July 29 with a gain of 4.49 points, reaching the 1,246 mark. However, liquidity on the HOSE plunged, reaching just over VND 11,300 billion.

Foreign trading was a downside, as they net sold a total of VND 316 billion on the market.

On the HOSE, foreign investors net sold VND 224 billion.

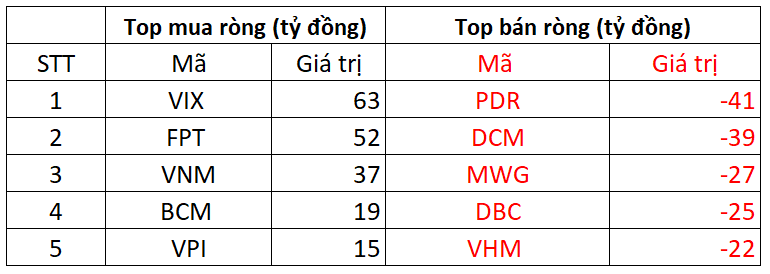

On the buying side, VIX shares were the focus of foreign net buying, with a value of VND 63 billion. This was followed by FPT and VNM, which were also accumulated by VND 52 billion and VND 37 billion, respectively. Additionally, BCM and VPI saw net buying of VND 19 billion and VND 15 billion.

On the other hand, PDR faced the strongest foreign selling pressure, with nearly VND 41 billion, while DCM and MWG were also offloaded by VND 39 billion and VND 27 billion, respectively.

On the HNX, foreign investors net sold VND 74 billion

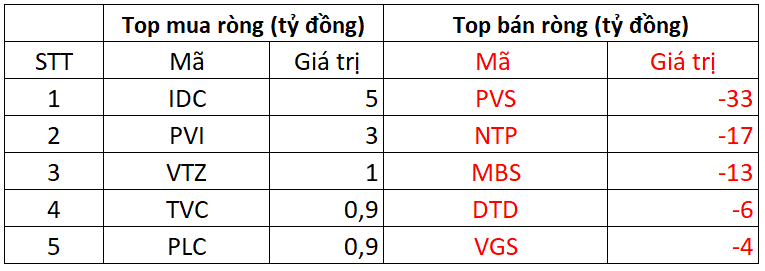

In terms of buying, IDC witnessed the strongest net buying, with a value of VND 5 billion. PVI followed closely, with net buying of VND 3 billion. Foreign investors also spent a few billion dong to net buy VTZ, TVC, and PLC.

On the opposite side, PVS faced net selling pressure from foreign investors, with a value of nearly VND 33 billion. NTP, MBS, and DTD also witnessed net selling of a few billion dong.

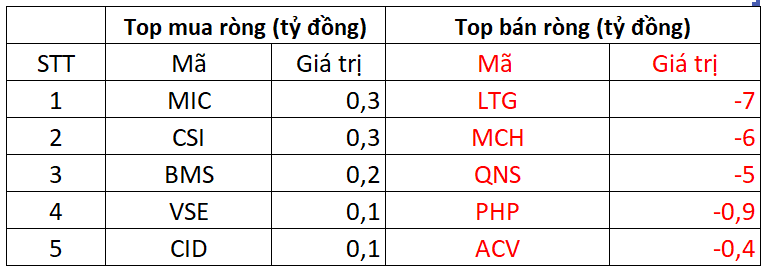

On the UPCOM, foreign investors net sold VND 18 billion

Contrarily, LTG faced net selling pressure from foreign investors, with nearly VND 7 billion. Additionally, MCH, QNS, and others also witnessed net selling from foreign investors…