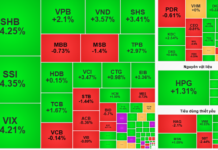

The Ho Chi Minh Stock Exchange (HoSE) saw a positive start to the week on July 29, with the VN-Index continuing its recovery trend. However, two stocks, HBC of Hoa Binh Construction and HNG of HAGL Agrico, moved against the market trend.

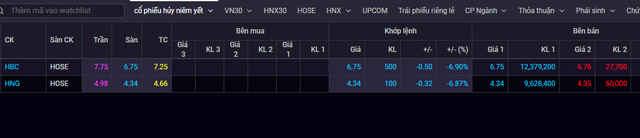

HBC shares witnessed a “white knight” situation, plunging to the maximum allowed limit of VND 6,750 per share, with more than 12 million units offered at the floor price. Similarly, HNG shares also hit the daily limit down, falling to VND 4,340 per share, with a massive 10 million units stuck at the floor price.

HBC and HNG shares plummeted to the maximum allowed limit.

This unexpected downturn followed the recent announcement by HoSE regarding the compulsory delisting of these two stocks. HoSE notified that Hoa Binh Construction Group Joint Stock Company’s (HBC) shares would be delisted due to the company’s negative retained earnings, which exceeded its paid-up capital, as per the audited consolidated financial statements for 2023.

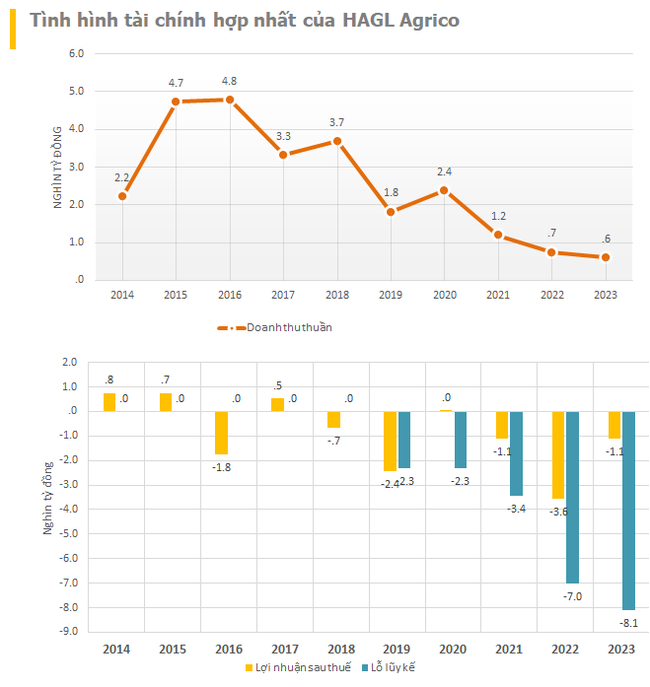

On the same day, the Ho Chi Minh Stock Exchange (HoSE) announced the compulsory delisting of HNG shares of Hoang Anh Gia Lai International Agricultural Joint Stock Company (HAGL Agrico). This decision was based on the company’s negative retained earnings for the years 2021, 2022, and 2023, as per their audited financial statements.

The delisting of HBC and HNG was mandated by the company’s consecutive years of operating losses. According to Clause 1e, Section 1, Article 120 of Decree No. 155/2020/ND-CP dated December 31, 2020, one of the conditions for compulsory delisting is “The company has been operating at a loss for three consecutive years, or the total loss exceeds the paid-up capital or the owner’s equity is negative in the audited financial statements of the previous year.”

Meanwhile, Vietnam Airlines (HVN) on the HoSE has been trading despite recording its fourth consecutive year of losses. In their 2023 audited financial statements, HVN reported a post-tax loss of VND 5,632 billion, resulting in a cumulative loss of VND 41,057 billion as of the end of 2023. The company’s owner’s equity is negative VND 17,026 billion. HVN shares are currently restricted, and investors can only trade them during the afternoon session.

In terms of business performance, HAGL Agrico’s first quarter of 2024 results showed a 26% decline in revenue. Operating at a gross loss and burdened by additional expenses, the company posted a post-tax loss of VND 47 billion. This marked the thirteenth consecutive quarter of losses for the company, although the loss has narrowed to a double-digit figure. As of the first quarter of 2024, HAGL Agrico has accumulated losses of VND 8,149 billion, leaving its owner’s equity at only VND 2,487 billion.

For the full year 2024, HAGL Agrico targets a revenue of VND 694 billion, a 14.5% increase compared to 2023. The company expects a post-tax loss of VND 120 billion for the year.

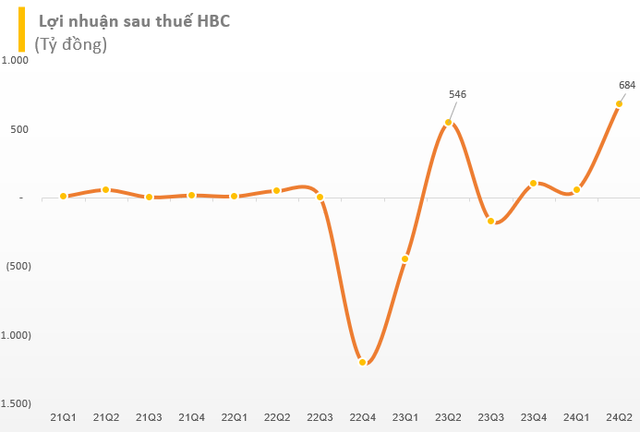

In the second quarter of 2024, Hoa Binh Construction recorded a slight decline in revenue, reaching nearly VND 2,160 billion, a 5% decrease compared to the same period last year. However, their gross profit plummeted by 74% year-on-year to nearly VND 100 billion due to a 10% increase in cost of goods sold, which totaled over VND 2,060 billion.

The company reported a remarkable post-tax profit of VND 684 billion, a significant improvement compared to the loss of VND 268 billion in the second quarter of 2023. This profit was largely attributed to the reversal of provisions of over VND 220 billion and a surge in other income of VND 515 billion. The post-tax profit attributable to the parent company’s owners stood at more than VND 682 billion, the highest quarterly profit since its establishment.

For the first six months of 2024, Hoa Binh Construction’s revenue reached VND 3,811 billion, a 10% decrease compared to the same period in 2023. The company’s profit after tax surged to VND 741 billion, in sharp contrast to the loss of VND 713 billion in the previous year. With these impressive results, the company has already surpassed 71% of its full-year 2024 profit target.

In terms of capital, Hoa Binh Construction still faces a cumulative loss of VND 2,498 billion as of the second quarter of 2024. However, their owner’s equity has improved significantly to VND 1,567 billion, up from just VND 93 billion at the beginning of the year. The company’s financial borrowings stand at VND 4,485 billion, nearly three times their owner’s equity.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.