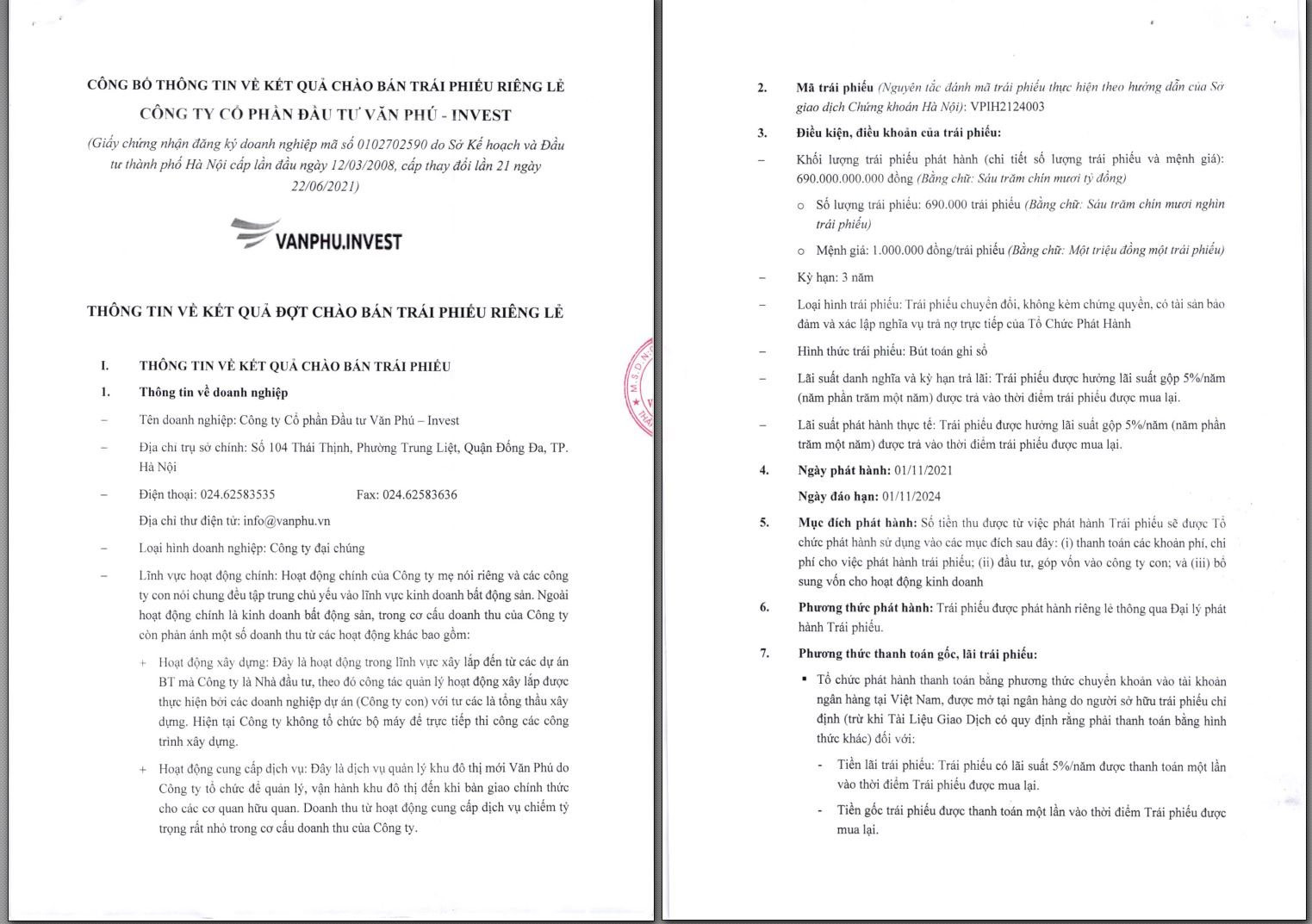

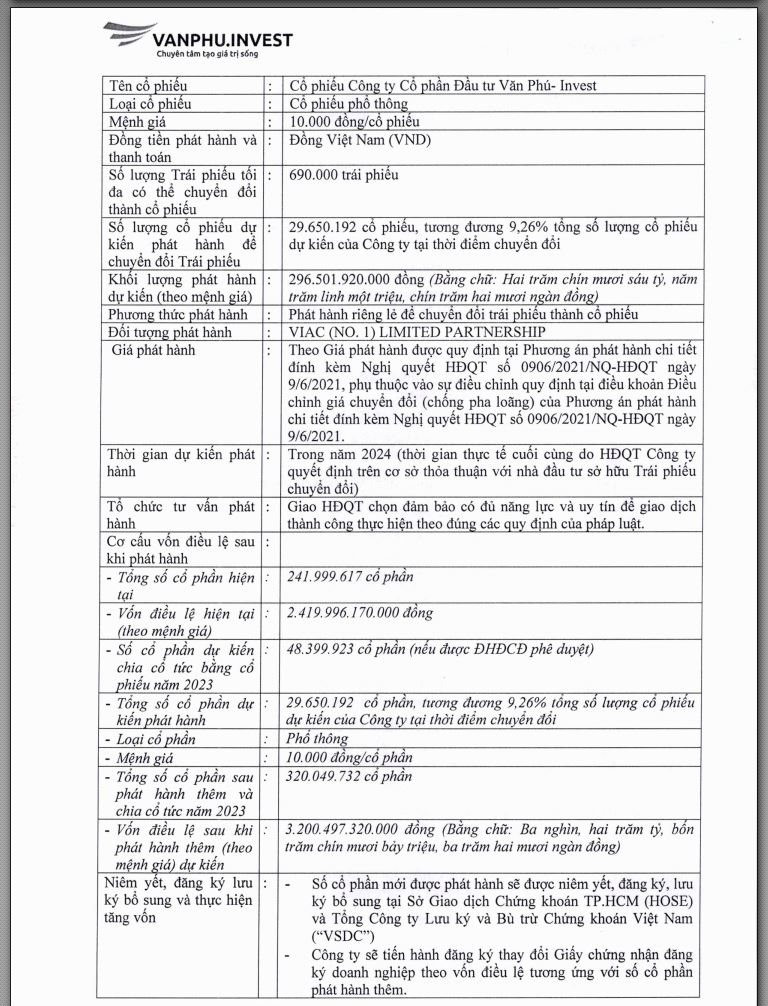

According to public information, Van Phu – Invest JSC (VPI) and bondholders have reached an agreement on the conversion of bonds into shares for the bond code VPIH2124003. This bond has a par value of VND 1 million/bond and an issuance volume of 690,000 bonds.

Source: VPI

The conversion price is determined to be VND 23,271 per convertible share, and the number of convertible shares is 29.65 million.

Thus, the above conversion price is equal to about half of the market price of VPI shares at the closing of the session on July 26, at VND 57,600/share.

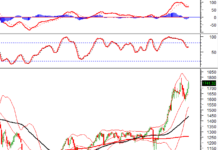

VPI shares have been on a strong uptrend in the past year, closing the session on July 26 at VND 57,600/share. Source: Fireant

At the annual general meeting of shareholders held early this year, the plan to issue shares to convert this bond package was also approved by VPI.

Accordingly, the issuance of 29.65 million shares to convert bonds for bondholders will be equivalent to 9.26% of the total expected number of VPI shares at the time of conversion.

VPI’s plan to issue convertible bond shares. Source: VPI

According to the announcement, the bondholder of the VPIH2124003 bond code is a foreign investor. The conversion price is VND 35,000/convertible share, subject to adjustments specified in the conversion price adjustment clause.

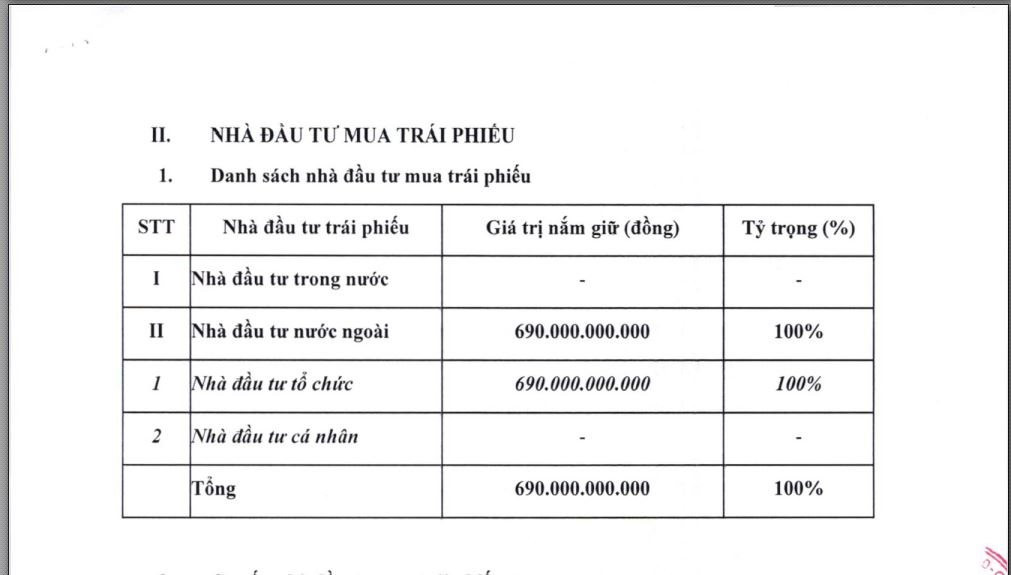

List of investors buying VPIH2124003 bond code. Source: VPI

VPI has total assets of nearly VND 12,000 billion and a massive project portfolio spanning the country, notably: Van Phu Urban Area, The Terra – An Hung, Grandeur Palace Giang Vo, Vlasta – Sam Son,… The company is accelerating the implementation of a series of key projects such as The Terra Bac Giang, Vlasta Thuy Nguyen – Hai Phong…

In 2024, VPI sets a target revenue of VND 2,775 billion and a post-tax profit of VND 350 billion.

At the recently held annual general meeting of shareholders, answering shareholders’ questions about the cost of projects in 2024 being much higher than that of projects recorded in 2023, VPI’s leaders said that in 2022, Van Phu – Invest launched the Vlasta Sam Son – Thanh Hoa project, capturing the right favorable moment of the market with good profit margins, thus creating good revenue for 2023 with high profit margins.

In addition, at the time of Q3 2022 and 2023, when the Bac Giang project was eligible for sale, it encountered an economic crisis, leading to a delay in the project’s sales plan compared to expectations, resulting in financial costs arising and pushing up the project cost, which greatly affected the gross profit margin in 2024, expected to reach 75-80% compared to 2023.

Saigon Glory Bond Scandal: Bitexco Chairman’s Plea for Payment Extension

Mr. Vu Quang Hoi, Chairman of Bitexco Group, has recently sent a heartfelt letter to the bond investors of Saigon Glory Company requesting an extension for the payment deadline.