According to our statistics, as of July 31st, all enterprises in the VN30 group have published their financial statements.

Among them, 28 companies reported profit increases, with 22 of those companies experiencing growth of 10% or more, and 16 of them seeing a surge of over 20%.

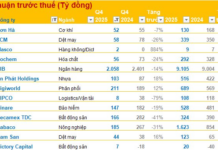

The group’s total pre-tax profit reached nearly VND 107,300 billion, an increase of VND 18,300 (21%) compared to the same period. The banking group, represented by 13 institutions, achieved a total profit of VND 65,600 billion, a slightly lower growth rate than the group’s average, at 19%.

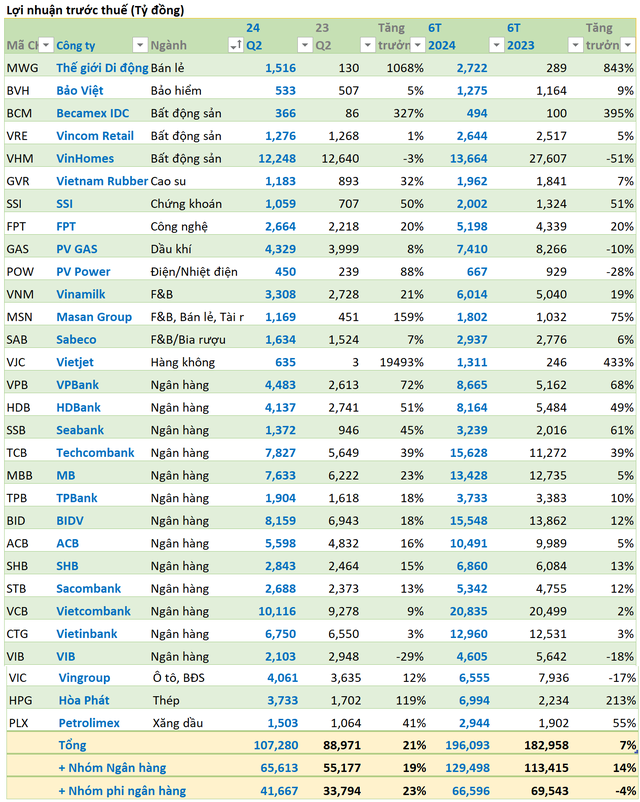

However, the cumulative 6-month total pre-tax profit of the group increased by only 7%, reaching over VND 196,000 billion. While the banks grew by 14%, the other 17 enterprises saw a 4% decrease in total profits, mainly due to Vinhomes’ very low profit in the first quarter.

Vinhomes (VHM) is the most profitable enterprise in the VN30 group. Specifically, in the second quarter of 2024, the company generated more than VND 28,200 billion in revenue and earned VND 12,248 billion in pre-tax profits. Although the company’s profit slightly decreased compared to the same period last year, it significantly increased compared to the previous two quarters.

Vinhomes’ results for this quarter showed improvement over the previous two quarters due to a boost in its real estate business. As of June 30, 2024, Vinhomes’ total assets and equity reached VND 494,461 billion and VND 206,783 billion, respectively, an increase of 11.2% and 13.2% compared to the beginning of the year.

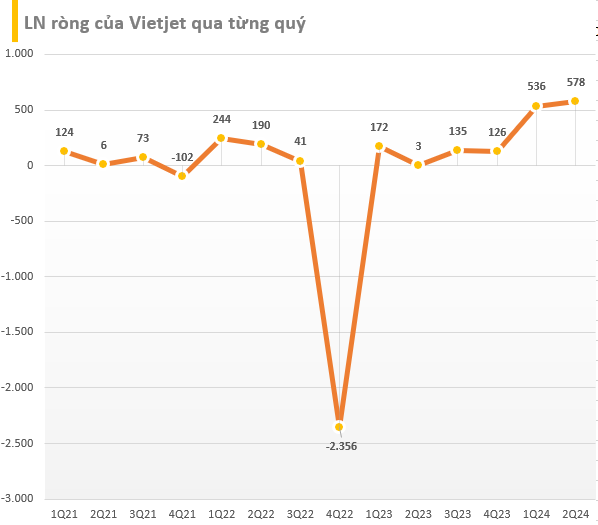

Vietjet was the enterprise with the strongest profit growth in the second quarter of 2024, achieving VND 635 billion, a surge of 19,500%. In the second quarter of 2023, the airline’s profit was a mere VND 3 billion.

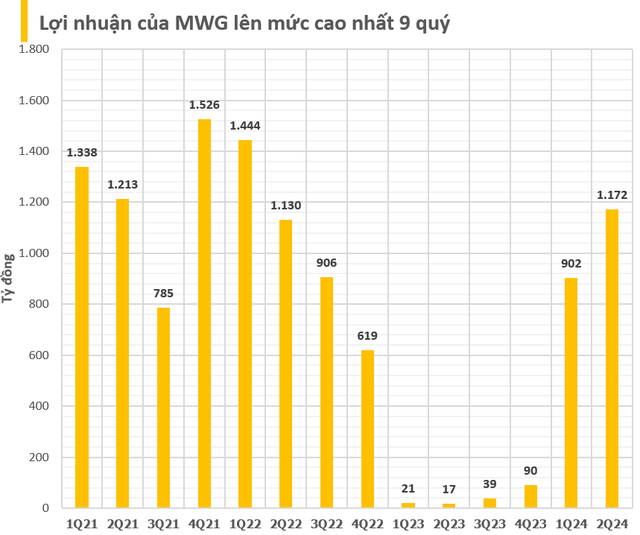

The Gioi Di Dong (MWG) was the next enterprise to record a four-digit profit increase. In the second quarter of 2024, the company’s net revenue reached VND 34,234 billion, an increase of nearly 16% compared to the same period last year.

After deducting expenses, MWG’s pre-tax profit was VND 1,513 billion, and its after-tax profit was VND 1,172 billion, an increase of over 1,000% and 6,800%, respectively. This was the fourth consecutive quarter of positive growth for this retail company, and it also marked the highest net profit in the last nine quarters.

As of the end of the second quarter, The Gioi Di Dong (including Topzone) had 1,046 stores, a decrease of 24 stores compared to the beginning of the month. Similarly, Dien May Xanh also saw a reduction in scale, with 87 fewer stores than at the start of the month, leaving them with 2,093 stores. Likewise, the number of An Khang pharmacies also decreased significantly, with 45 fewer stores in June, bringing the total to 481.

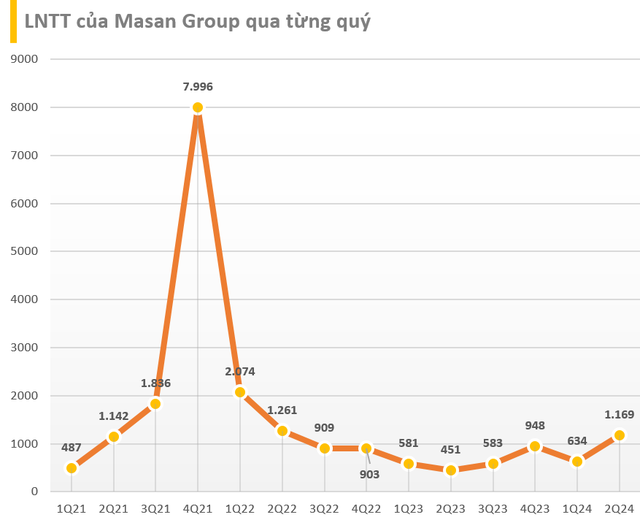

In the VN30 group, three more companies achieved profit growth of over 100%: Masan Group (MSN), Becamex IDC (BCM), and Hoa Phat (HPG).

Becamex IDC witnessed a significant profit increase despite a decline in revenue. This was mainly due to a substantial rise in profits from joint venture and associate companies. Masan Group’s improved performance was driven by its consumer retail business, the recovery of non-core activities, and a reduction in net financial expenses of VND 138 billion.

Hoa Phat, on the other hand, reported a 120% surge in profit compared to the same period last year, thanks to increased revenue and reduced financial expenses.

Within the VN30 group, banks dominate in terms of both number and capitalization. Major players such as Vietcombank (VCB), BIDV (BID), Vietinbank (CTG), Sacombank (STB), and ACB (ACB) all reported profit growth. Vietcombank maintained its position as the most profitable bank, with a pre-tax profit of VND 10,116 billion, an increase of 9%.

VIB (VIB) was the only bank to report a decrease in pre-tax profit, experiencing a 29% drop to just over VND 2,100 billion.