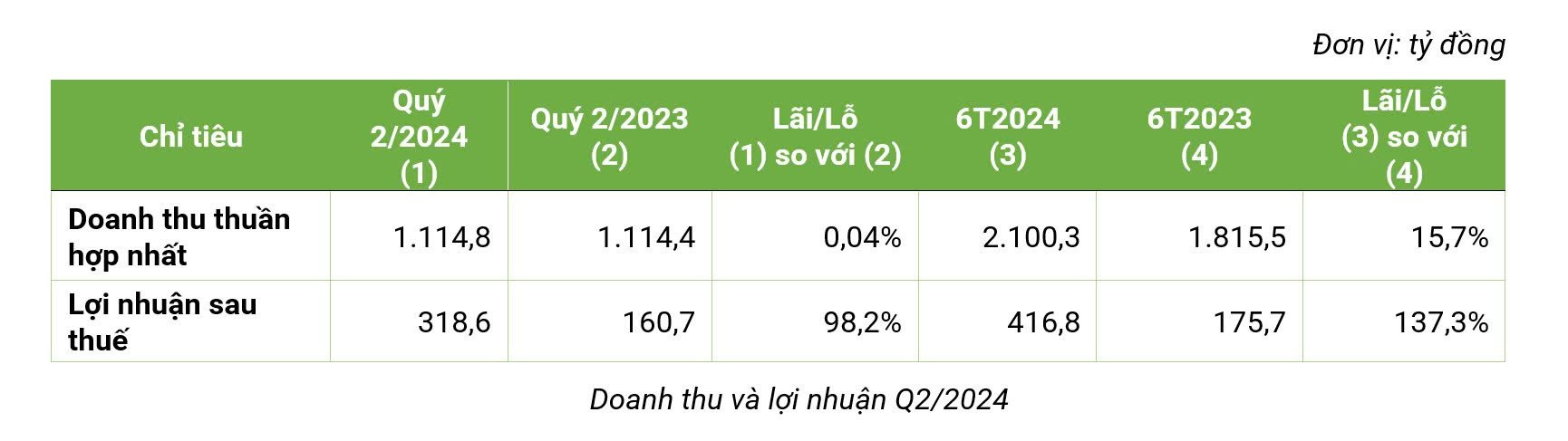

Bamboo Capital Group (HoSE: BCG) has released its financial results for Q2 2024, reporting a modest 0.04% increase in revenue to 1,114.8 billion VND compared to the same period in 2023.

The group’s revenue was primarily driven by three key segments: Renewable Energy (369.4 billion VND), contributing 33.1%, Construction Infrastructure (338.5 billion VND) with a 30.4% share, and Financial Services (180.2 billion VND), accounting for 16.2% of the group’s total revenue.

Notably, net profit for Q2 2024 witnessed a significant surge, climbing to 318.6 billion VND, a remarkable 98.2% increase compared to Q2 2023.

For the first half of 2024, Bamboo Capital’s consolidated revenue reached 2,100.3 billion VND, representing a 15.7% year-on-year increase. The Renewable Energy segment led the way with a contribution of 689.8 billion VND (32.8%), followed by Construction Infrastructure at 560.7 billion VND (26.7%), and Financial Services at 366.0 billion VND (17.4%). The impressive performance in the Renewable Energy segment can be attributed to the efficient operations of solar power plants, particularly the Phu My plant, which recorded a 44.9% year-on-year increase in electricity output.

Net profit for the first six months of 2024 stood at 416.8 billion VND, reflecting a substantial 137.3% increase compared to the same period last year. This remarkable growth was largely due to effective financial cost management, with a significant reduction of 413.0 billion VND (32.1%) compared to the previous year.

As of June 30, 2024, the group’s total assets amounted to 45,308.3 billion VND, a 7.9% increase from the beginning of the year, following the integration of Tipharco Pharmaceutical Joint Stock Company (HNX: DTG) into the Bamboo Capital ecosystem.

Notably, BCG’s equity as of June 30, 2024, stood at 20,987.9 billion VND, a 20.2% increase from the start of the year. This improvement can be attributed to the successful completion of the capital increase to 8,002 billion VND through a public offering of shares in Q2 2024. As a result, the group’s financial leverage ratio has decreased to a safer level.

During the first half of 2024, Bamboo Capital refrained from external investments and focused on its core business segments. The group’s cash flow from financing activities turned positive, moving from negative 1,073.9 billion VND to positive 2,466.8 billion VND in Q2 2024, thanks to proceeds from the public offering of shares. This capital injection supports the group’s business operations while maintaining a healthy liquidity position.

With these results, Bamboo Capital has achieved 34.4% of its revenue plan and 43.8% of its net profit plan for 2024, as presented at the 2024 Annual General Meeting of Shareholders.

In the real estate segment, BCG Land is preparing to hand over and operate the entire Malibu Hoi An condotel block, while accelerating the progress of the King Crown Infinity, Hoian d’Or, and the remaining parts of Malibu Hoi An projects. In Q3 2024, BCG Land plans to launch the sale of the remaining units in the King Crown Infinity project.

Regarding the energy segment, BCG Energy, a subsidiary of Bamboo Capital, reported impressive results for the first half of 2024, with a 22% increase in revenue to 689.8 billion VND and a remarkable 33-fold surge in net profit to 290.7 billion VND compared to the previous year. On July 31, 2024, BCG Energy will officially list on the UPCoM exchange under the ticker symbol BGE, with a reference price of 15,600 VND per share.

Additionally, BCG Energy is expediting the development of the Dong Thanh 1 (80 MW) and Dong Thanh 2 (120 MW) wind power projects in Tra Vinh province and the Khai Long 1 (100 MW) wind power project in Ca Mau province. These projects are expected to be operational by 2025, further boosting BCG Energy’s total power generation capacity.

Furthermore, BCG Energy recently broke ground on the Tam Sinh Nghia waste-to-energy power plant in Cu Chi, Ho Chi Minh City. With a total investment of 6,400 billion VND, the first phase of the plant, to be implemented from 2024 to 2025, will have a waste incineration capacity of 2,600 tons per day and a power generation capacity of 60 MW, producing an estimated 365 million kWh of electricity per year.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.