On July 31, the Hanoi Stock Exchange (HNX) witnessed the debut of BCG Energy Joint Stock Company (Stock Code: BGE) on the UPCoM market, with a reference price of VND 15,600 per share and a trading band of +/- 40% for the first session. With 730 million shares registered for trading, corresponding to a market capitalization of VND 11,388 billion, BGE’s debut marked a significant milestone.

Addressing the ceremony, Mr. Ng Wee Siong Leonard, Chairman of BCG Energy’s Board of Directors, shared, “This is an important milestone in our journey, symbolizing not only our growth but also our commitment to shaping the future of Vietnam’s renewable energy market.”

“As a publicly-traded company, we are committed to maintaining the highest standards of corporate governance and transparency. Our adherence to these principles will ensure that we operate with integrity, maintain the trust of our shareholders, and create long-term value for all stakeholders,” emphasized the Chairman of BCG Energy.

Mr. Ng Wee Siong Leonard, Chairman of BCG Energy’s Board of Directors

BCG Energy is a pivotal member of the energy sector within the Bamboo Capital Group (HoSE: BCG). Established in 2017, the company has grown to a chartered capital of VND 7,300 billion. Currently, BGE’s total assets have reached VND 20,000 billion, with owners’ equity accounting for nearly VND 10,000 billion.

In recent years, BGG Energy has consistently demonstrated robust financial performance. In 2021, the company recorded a revenue of VND 760 billion, followed by a significant 40% growth in 2022, reaching VND 1,064 billion. For 2023, BCG Energy’s net revenue increased by 5.8%, surpassing VND 1,125 billion.

For the first half of 2024, BCG Energy’s consolidated net revenue amounted to VND 698.8 billion, reflecting a notable 22% increase compared to the same period last year. Consolidated after-tax profit reached VND 290.7 billion, an impressive 33-fold surge from the first half of 2023. This remarkable improvement in profitability is attributed to the company’s effective financial cost reduction, particularly in interest expenses. Additionally, BCG Energy’s growth momentum is driven by its 600 MW solar power system, which ranks among the top three in Vietnam.

BCG Energy has also demonstrated significant enhancement and stabilization in its capital structure over the years. The debt-to-equity ratio, which stood at 1.9 times at the end of 2022, has decreased to 0.99 as of June 30, 2024. Moreover, the loan-to-equity ratio has improved from 1.25 at the end of 2022 to 0.64 as of June 30, 2024.

The consistently controlled ratio of loan debt in total capital from year to year indicates that BCG Energy maintains a safe financial leverage, thereby minimizing risks associated with the macroeconomy.

BCG Energy’s renewable energy segment has become a crucial pillar, contributing the most significant revenue to the Bamboo Capital Group. Specifically, for the first six months of 2024, the Group’s cumulative revenue reached VND 2,100.3 billion, a 15.7% increase year-over-year. BCG Energy’s renewable energy segment alone accounted for VND 698.8 billion, equivalent to a remarkable 32.8% of Bamboo Capital’s total revenue.

BCG Energy boasts a portfolio of nearly 1 GW approved under the Power Development Plan VIII, with a vision for implementation until 2030. Notably, the company will commence the development of large-scale wind power projects this year, including Dong Thanh 1 (80 MW) and Dong Thanh 2 (120 MW) in Tra Vinh province, and Khai Long 1 (100 MW) in Ca Mau province. These projects are expected to be operational by 2025, increasing BCG Energy’s total power generation capacity by approximately 53% and solidifying its position as a leading renewable energy enterprise in Vietnam.

Another notable aspect of BCG Energy’s business operations is its foray into waste-to-energy projects. On July 20, the Bamboo Capital Group and BCG Energy commenced the construction of the Tam Sinh Nghia waste-to-energy power plant in Cu Chi district, Ho Chi Minh City.

The first phase of the plant, with a total investment of VND 6,400 billion, will be implemented from 2024 to 2025. It is designed to incinerate 2,000-2,600 tons of garbage daily, generate 60 MW of electricity, and produce up to 365 million kWh of electricity annually. This output is anticipated to meet the electricity demands of approximately 100,000 households while reducing CO2 emissions by around 257,000 tons per year.

The second phase, scheduled for 2026-2027, will witness an increase in incineration capacity to 6,000 tons of garbage per day and a power generation capacity of 130 MW, making it the world’s largest waste-to-energy plant. The third phase, planned for 2027-2029, will further enhance the plant’s capacity to incinerate 8,600 tons of garbage daily and generate 200 MW of electricity.

In tandem with the construction of the Tam Sinh Nghia waste-to-energy power plant in Ho Chi Minh City, BCG Energy will soon initiate similar projects in Long An and Kien Giang provinces. This expansion into the waste-to-energy domain is expected to diversify BCG Energy’s revenue streams while contributing to Vietnam’s transition to cleaner energy sources.

To meet the capital requirements for developing additional large-scale energy projects, BCG Energy can leverage its UPCoM listing to facilitate capital mobilization for prospective energy ventures, in addition to securing funds from domestic and foreign banks and financial institutions.

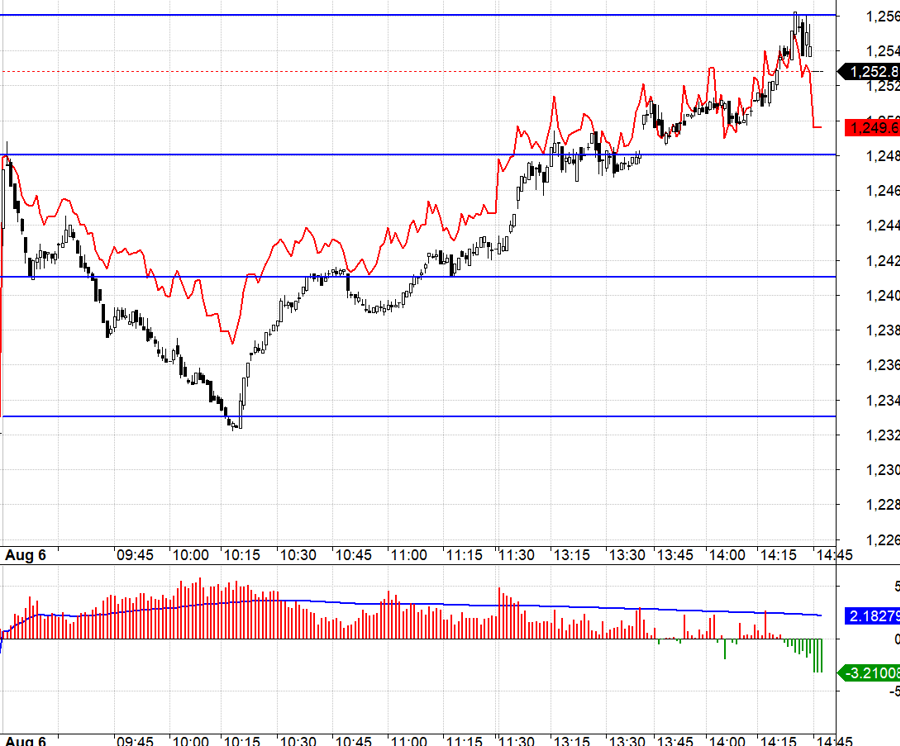

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.