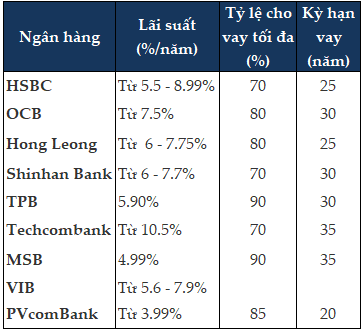

PVcomBank is offering attractive interest rates on real estate loans, starting at just 3.99%/year (fixed for the first 3 months). This package is available for loans with a tenure of up to 20 years and a loan limit of up to 85%.

MSB offers a competitive interest rate of 4.99%/year on home loans (applicable for the first 3 months). With a tenure of up to 35 years and a loan limit of up to 90% of the property’s value, this package also offers a grace period of up to 24 months on principal repayment.

Techcombank provides fixed interest rates on home loans starting as low as 10.5%/year. With early repayment fees ranging from 0.5-1%/year, waived off from the 6th year onwards, and interest rate reductions of up to 1.2%/year during the floating rate period for select customer groups, Techcombank offers a loan limit of 70% and a repayment tenure of up to 35 years.

At OCB, there are several home loan packages available, such as the “An Cư” package for individuals aged 25-50 who are employed and receive a stable income through salary transfers to credit institutions. With a maximum tenure of 30 years and a grace period of up to 24 months on principal repayment, OCB offers attractive interest rates starting at 7.5%/year and a loan-to-value ratio of up to 80%.

VIB recently launched a home loan package in July, with a total limit of up to VND 30,000 billion, to cater to the recovering demand for home purchases in Q3 2024. With fixed interest rates for 6, 12, and 24 months, starting at just 5.9%, customers can rest assured about their financial stability and not worry about market interest rate fluctuations. Additionally, customers who transfer their loans from other banks to VIB are eligible for an additional 0.4% interest rate discount. According to VIB representatives, this competitive interest rate aims to target high-quality customers and meet the market demand for real estate in the last six months of the year.

Foreign banks also offer real estate loan interest rates ranging from 5.5-6.8%/year, depending on the tenure.

|

Home loan interest rates at select banks, as of early July 2024

|

Despite the attractive interest rates, many young people are still hesitant to take the plunge into homeownership.

For instance, Ms. N.T.T, a 25-year-old office worker earning approximately VND 30 million/month, shared that while the current interest rates are favorable, her funds are invested in other channels, making home purchase less of a priority at the moment compared to the returns she’s getting from her current investments.

On the other hand, Mr. N.Q, a 30-year-old family man with a combined family income of about VND 60 million/month, is actively considering purchasing a home. He feels that the current interest rates are quite low and is exploring loan options from various banks for an apartment in the price range of around VND 2.5 billion.

The market presents a favorable opportunity for genuine home buyers.

Mr. Nguyen Quang Huy, CEO of the Finance and Banking Faculty at Nguyen Trai University, shared his insights on the current market. He noted that the demand for home loans is high, especially in the segment of properties priced between VND 2-5 billion. This segment caters to the middle class and those with genuine housing needs. However, the market currently lacks sufficient supply in this price range. Properties priced above VND 6 billion are more abundant but exceed the affordability of most citizens, leading to challenges in sales. Young people and those with moderate incomes are advised to consider purchasing smaller apartments with 1-2 bedrooms and redesigning them to create a comfortable living space. By opting for apartments in less central locations but with good public transport infrastructure, they can reduce the financial burden of homeownership. Mr. Huy emphasized that the current low interest rates on real estate loans, coupled with competitive offerings from banks, make it a favorable time for those with genuine needs to buy a home.

However, when taking out a home loan, buyers should be cautious and consider potential risks.

Firstly, there are legal risks. If the developer has not paid land use taxes for the project, the buyer may encounter issues with obtaining the pink book (land/house ownership certificate). Additionally, if the developer mortgages the project without informing the buyer and faces financial difficulties, the project could be auctioned off, putting the buyer’s investment at risk. Furthermore, if the developer does not follow the approved plan, the project may not pass the inspection, causing further delays or issues with obtaining the pink book.

Secondly, there is the risk of interest rate fluctuations. When the market changes, an increase in deposit interest rates can lead to higher loan interest rates, which have reached up to 15-20%/year in the past. If the annual debt repayment, including principal and interest, consumes 50-60% of the buyer’s income, it can create a financial strain, especially during challenging economic times. In such cases, the buyer may struggle to repay the loan, potentially leading to bad debt.

Developers may commit to paying interest on behalf of the buyer for a certain period (1-3 years), but if they encounter financial difficulties, they may stop or fail to fulfill this commitment, resulting in bad debt and disrupting the buyer’s financial plans.

Another consideration is the bank’s ability to provide funds when the payment deadline to the developer arrives. There is also the possibility of purchasing a property involved in legal disputes. Buyers should carefully review and consider any additional costs, such as early repayment fees and other potential charges.

Upcoming policies are expected to address legal hurdles and boost market supply.

Mr. Huy also highlighted that, starting from August 1, 2024, the Land Law, Housing Law, and Real Estate Business Law will come into effect. While implementing decrees and guidelines are necessary, and there may be a lag before these policies fully permeate the market, he believes that this regulatory change will significantly contribute to resolving legal obstacles for projects and increasing market supply. This improved supply will positively impact the real estate market, especially for social housing and commercial properties targeting genuine buyers.

Supply is expected to improve in the latter part of Q3 and Q4. In Hanoi, approximately 9,000 new apartments will be offered for sale, while Ho Chi Minh City will see around 8,000 new apartments entering the market in the last six months of the year. Looking ahead to 2025, supply is anticipated to increase even further. Among the new offerings, over 70% will be high-end products, priced between VND 50-60 million/m2. In contrast, properties priced below VND 3 billion will make up less than 10% of the market.