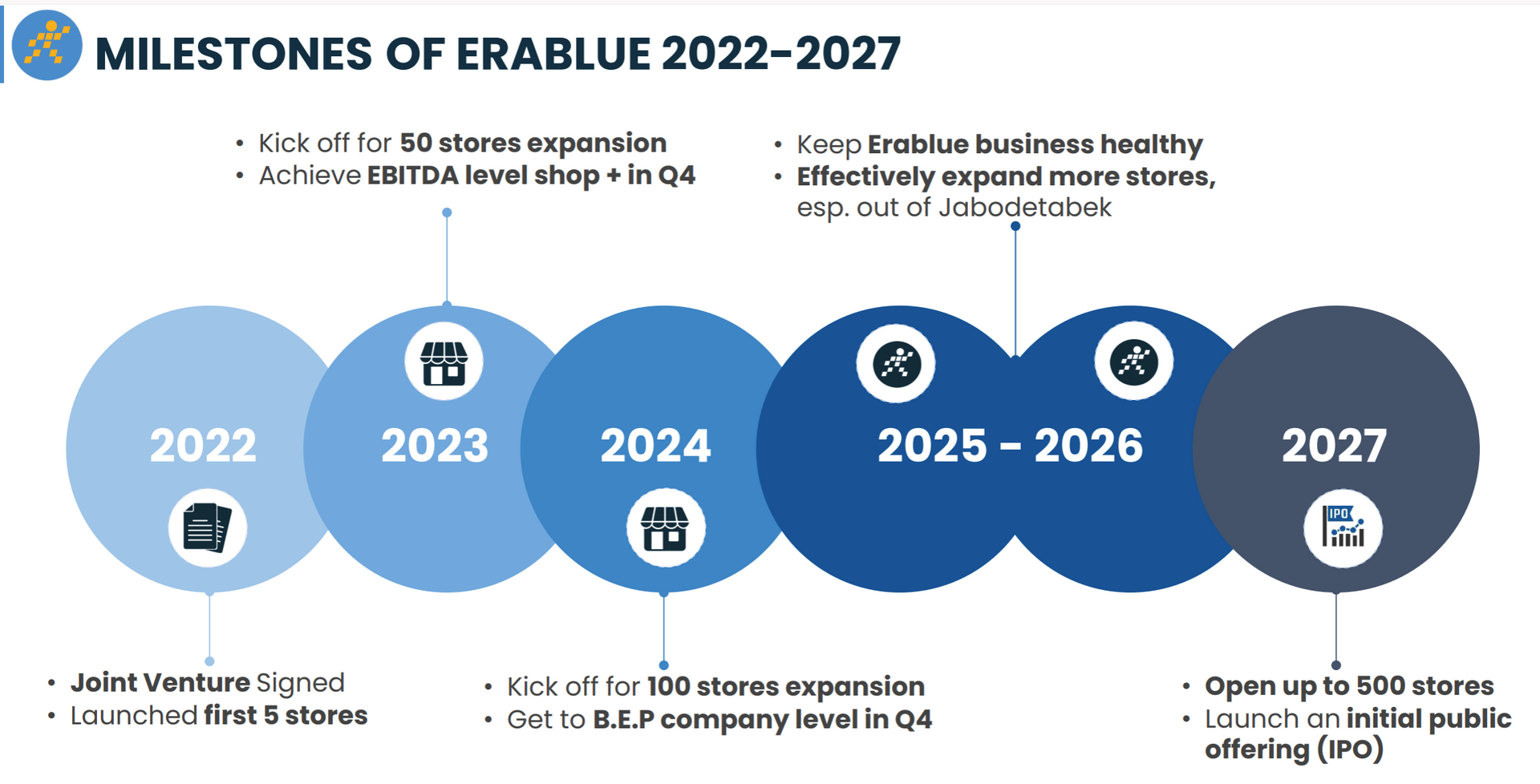

On August 2, representatives of the EraBlue joint venture between The Gioi Di Dong and Erajaya met with the aim of reaching new milestones. Accordingly, the two sides agreed on the goal of achieving profitability at the company level before the fourth quarter of 2024. The clear signals from the business results provide a basis for accelerating the expansion of EraBlue this year and in the coming years.

With the number of stores set to increase to nearly 100 by the end of 2024 and 500 by 2027, the goal is to establish EraBlue as a leading retailer in Indonesia, with a similar stature, reputation, and revenue to that of Dien May Xanh in Vietnam.

In just under two years since its inception, EraBlue has become the largest modern retail chain in Indonesia. As of July 2024, the chain had 65 stores in the satellite areas of the capital, Jakarta, including 37 mini-sized stores (size M, with an area of approximately 280-320 square meters) and 28 supermini-sized stores (size S, with an area of 180-220 square meters).

Notably, EraBlue stores generate almost double the revenue compared to similarly-sized Dien May Xanh stores in Vietnam. Specifically, the monthly revenue of size M stores is 4 billion VND, while size S stores generate 2.2 billion VND.

Despite being a newer model, EraBlue has rapidly become one of The Gioi Di Dong’s fastest-growing chains. This model was conceived during the Covid pandemic through online meetings between the two joint venture partners. By the end of 2022, the first stores were launched, and less than three years later, EraBlue entered a phase of rapid growth, aiming for 500 stores by 2027.

EraBlue’s Development Roadmap in Indonesia

Between 2025 and 2027, at least 10 EraBlue stores are expected to be inaugurated each month. Upon reaching the target of 500 stores, both parties do not rule out the possibility of an IPO in Indonesia after 2027.

According to The Gioi Di Dong’s leadership, there are several reasons for their confidence in EraBlue’s future prospects. First, the electronics and appliance retail market in Indonesia is still fragmented, with the largest chain having only about 60 stores, while the demand is significant.

Second, despite Indonesia’s similar traffic conditions to Vietnam, with customers mainly traveling by motorbike, all modern retail chains are located within shopping malls. In contrast, the EraBlue model is more accessible, with stores located on busy roads, making it easier for customers to identify and access them anywhere.

Third, delivery and installation services for electronic devices in Indonesia are quite rudimentary. It can take up to 7-10 days to purchase and install a washing machine, whereas EraBlue offers a 4-hour delivery and installation service. The culture of service and dedication, a strength of The Gioi Di Dong, has been applied to EraBlue and has won over Indonesian customers.

Last but not least is the pricing. Despite offering modern-equivalent services, EraBlue’s prices are comparable to traditional models.

“Even though it has been less than two years, we have made significant strides, and EraBlue has a lot of potential ahead. We believe that EraBlue will help The Gioi Di Dong leave its mark on the regional retail map and be a source of pride for Vietnam as we venture into the international market,” said Mr. Doan Van Hieu Em, CEO of The Gioi Di Dong.

Erajaya, a leading retailer and listed company in Indonesia, brings to the joint venture a deep understanding of the market and strong capabilities across the board. EraBlue, a combination of the top retailers from both countries, is poised for expansion in Indonesia.

The Gioi Di Dong’s second-quarter 2024 financial report showed a loss of 26.7 billion VND in the second quarter from the joint venture PT Era Blu Elektronik (EraBlue), bringing the total loss for the first half of the year to 47.2 billion VND. In this joint venture, MWG holds a 45% stake. Thus, EraBlue incurred a loss of approximately 105 billion VND in the first half of 2024.

As of June 30, 2024, the fair value of this investment was over 239.5 billion VND.

Shopee, Lazada bite into the market share, Thế Giới Di Động implements “finding the loophole” strategy, ceases price war

MWG’s online revenue in 2023 has decreased by 11% compared to the same period last year. The retailer expects to continue growing online sales and estimates the contribution of the online channel to the revenue of various product categories from 5% to 30%, amidst intense competition in the e-commerce market.