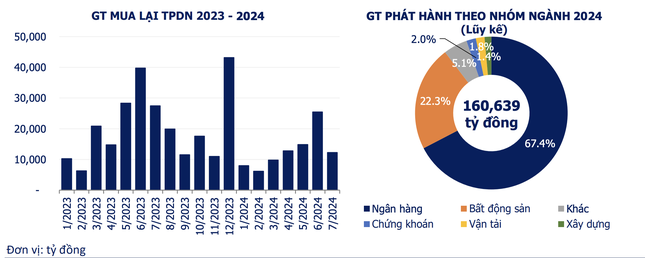

According to data from the Vietnam Bond Association (VMBA), there were 21 corporate bond issuances in July, with a total value of over VND 13,600 billion. Cumulatively, from the beginning of the year, the market recorded 11 public offerings (VND 11,777 billion) and 158 private placements (nearly VND 150,000 billion).

Bond buyback value and new issuance value over time (VMBA statistics).

The recovery signal in private bond issuance came from the return of banks. MBS Securities reported that, since the beginning of the year, banks have issued the highest value of bonds, approximately VND 96,200 billion, with an average interest rate of about 5.4%/year and a term of 4 years. The banks with the largest issuances were Techcombank (VND 17,000 billion), ACB (VND 12,700 billion), and MBBank (VND 8,900 billion).

The banks’ simultaneous push for bond issuance is believed to be aimed at strengthening medium and long-term capital sources to meet businesses’ lending needs.

The real estate group had the second-highest issuance value in the market, raising about VND 32,600 billion. The interest rates of real estate enterprises remain among the highest today, with an average of up to 12%/year and a shorter term of about 2.7 years.

In addition to the revival of new issuances, MBS also noted that the late payment ratio continued to rise rapidly as many enterprises faced significant maturity burdens. July saw three more enterprises announcing payment delays, bringing the total number of delayed enterprises to 116.

Currently, the total value of corporate bonds with delayed payment obligations is estimated at nearly VND 210 billion, accounting for 21% of the market’s outstanding balance, with the real estate group continuing to account for the largest proportion, about 68%.

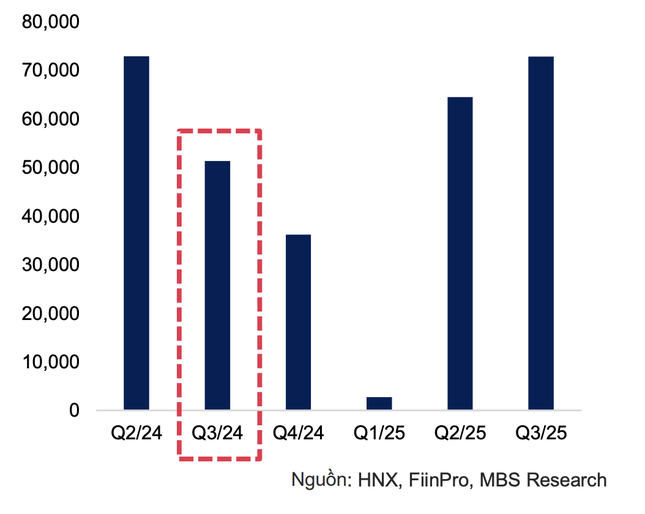

Bond maturities decrease in the last two quarters of the year.

In the remaining months of this year, the total value of bonds maturing is nearly VND 131,000 billion, of which more than 41% belong to the real estate group, followed by banks at 14.6%.

Despite the heavy maturity pressure, many enterprises continue to plan to raise capital through bond issuances in the future. IPA Joint Stock Company (code IPA) is about to issue a maximum of VND 1,096 billion to repay maturing bonds. In June, IPA also successfully issued two lots of bonds, raising a total of VND 1,042 billion. Both lots of bonds had an interest rate of 9.5%/year and a term of 5 years.

Also for the purpose of debt restructuring, Nam Long Investment Joint Stock Company (NLG) is expected to issue VND 500 billion worth of bonds in Q3. The new bond issue is projected to have a term of 3 years, with collateral of nearly 34.5 million shares of Southgate Joint Stock Company owned by Nam Long.

Banks have also approved several large plans. In Q3 and Q4 of this year, LienVietPostBank (LPB) plans to issue a maximum of 12 bond issuances, totaling VND 6,000 billion, to increase Tier 2 capital and lend to customers.

The Bank for Investment and Development of Vietnam (BIDV) has approved a plan to issue private placement bonds this year with a total maximum value of VND 3,000 billion. These are non-convertible bonds, without warrants, with no collateral, a face value of VND 100 million/bond, and a term of 5-10 years.

VietinBank is expected to have two issuances of public offering bonds. These are non-convertible bonds, without warrants, and with collateral, with a maximum value of VND 8,000 billion.