The latest figures from the General Statistics Office reveal that the total retail sales of goods and consumer services in July 2024 reached an estimated VND 528.3 trillion, a 9.4% increase compared to the same period last year. For the first seven months of 2024, the total retail sales of goods and consumer services were estimated at VND 3,625.7 trillion, an increase of 8.7% from the previous year (a 10.6% increase in 2023 for the same period).

In the stock market, Phu Nhuan Jewelry Joint Stock Company (PNJ) reported a significant rise in revenue and post-tax profits for the second quarter of 2024, with figures reaching VND 9,518 billion and VND 428 billion, respectively, marking a 43% and 27% surge compared to the same period last year.

In a recently published update on the jewelry industry outlook, Rong Viet Securities Company (VDSC) forecasts a slower market growth in the coming years.

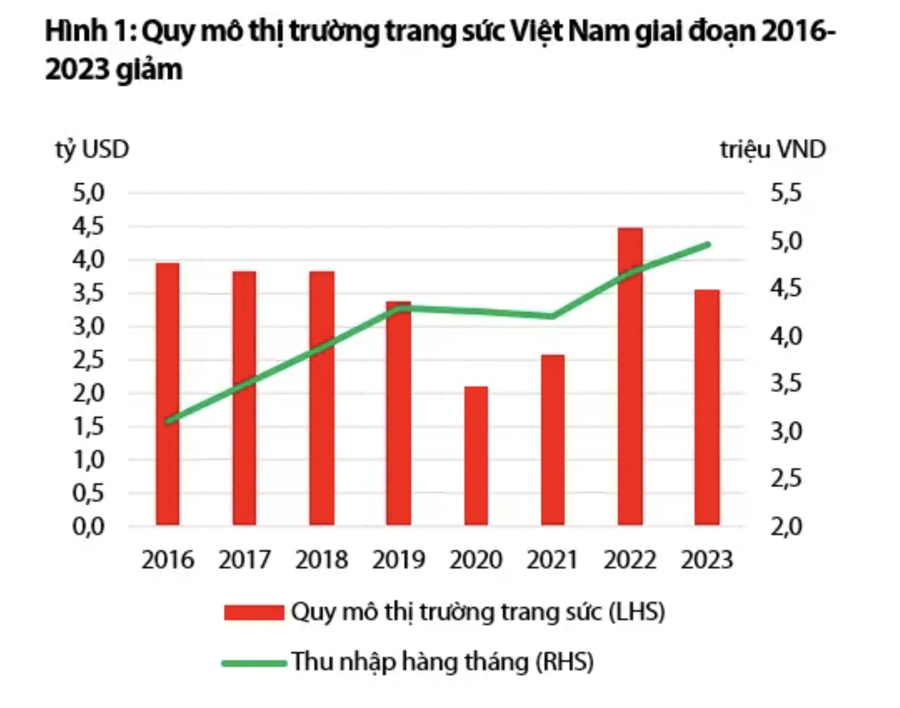

The Vietnamese jewelry market is estimated to have experienced a slight slowdown during 2016-2023, dropping from USD 4.0 billion to USD 3.6 billion, translating to an average annual decrease of 0.6%. To eliminate the impact of economic cycles, VDSC considered the average market size during two distinct phases: the growth phase of 2016-2019 (pre-COVID), and the decline phase of 2020-2022 (COVID and post-COVID eras).

Consequently, the average spending on jewelry during the economic downturn years hovered around USD 3.1 billion annually, falling short of the USD 3.8 billion spent annually during the growth phase. Following the economy’s recovery, jewelry spending in 2023 surpassed USD 3.6 billion, reflecting a 16.2% increase compared to the 2020–2022 average.

Interestingly, while the monthly income of Vietnamese citizens has been on an upward trajectory, rising by 7.0% annually to reach nearly VND 5 million per month, jewelry spending has followed a contrasting path. This dynamic has resulted in a decline in the monthly expenditure allocated to jewelry over the years, dropping from 2.6% in 2016 to 1.4% in 2023.

These trends can be understood from the perspective of jewelry spending serving two distinct purposes: asset preservation and adornment.

Specifically, in addition to gold bars, jewelry made of gold (18K and 24K) is considered both decorative and a means of storing wealth. However, the issuance of Decree No. 24/2012/ND-CP in 2012, aimed at tightening gold trading activities and curbing the “goldization” of the economy, coupled with the sustained low prices of gold in the global market during 2013–2020, diminished the appeal of gold as an asset class.

Consequently, savings and investment funds gradually shifted towards alternative investment avenues, such as stocks and real estate, which offered attractive returns during the same period. Between 2016 and 2023, the real estate market witnessed a substantial expansion, with its scale surging from VND 155,752 billion to VND 205,205 billion, excluding inflation. Similarly, the stock market capitalization relative to GDP followed an upward trajectory, climbing from 33.2% in 2016 to 44.2% in 2023.

Recently, the State Bank of Vietnam acknowledged the need to amend Decree 24/2012/ND-CP due to the limitations imposed by stringent gold trading regulations. However, the bank reaffirmed its unwavering commitment to countering the “goldization” of the economy and maintaining macroeconomic stability, with a strategic focus on channeling gold resources from the public into productive business and investment activities.

Despite the impending amendments, gold trading, including the jewelry gold segment, will remain under stringent control (as a conditional business sector) to align with the aforementioned macroeconomic objectives. Consequently, no abrupt growth in sales volume is anticipated for the gold jewelry market in the medium to long term.

Based on this analysis, VDSC projects that the jewelry market will grow at a rate of 2.4% annually during 2023-2030, reaching USD 4.2 billion by 2030. While Vietnam’s disposable income is forecasted to increase rapidly at a rate of 7.7% per year, according to the World Economic Forum, the ratio of jewelry spending to disposable income is expected to continue its previous downward trend, approaching levels observed in countries with similar jewelry consumption patterns to Vietnam, such as China and India, at approximately 1.0%.

Firstly, with the current regulatory stance on the gold market, as mentioned earlier, gold trading activities, including jewelry gold, will remain under strict supervision.

Secondly, alternative investment avenues, such as stocks and real estate, will continue to be irreplaceable growth assets, competing with jewelry as an investment option.

Thirdly, Vietnam is among the fastest-aging countries globally. Individuals aged 60 and above constituted 11.9% of the total population in 2019, and this figure is projected to surpass 25.0% by 2050. By 2036, Vietnam will enter a phase of an aging population, transitioning from an “aging” to an “aged” society, as defined by the United Nations. As Vietnam’s population continues to age, health care and quality of life considerations will likely take precedence over aesthetic and social status-related expenditures.

The experiences of China and India, two powerhouses in jewelry consumption currently grappling with rapid population aging and low, declining jewelry expenditure ratios over the past decade, underscore the likelihood of subdued jewelry consumption in Vietnam.

Gold prices: SJC gold and plain gold rings surge simultaneously

On the morning of January 31st, the prices of SJC gold and 24k smooth gold rings in Vietnam saw a simultaneous increase compared to the previous day.