Vietnam’s manufacturing sector maintained its strong growth trajectory in July, following on from the robust expansion seen in June. New orders continued to rise sharply, causing manufacturers to ramp up production, with the rate of growth nearing a record high. However, the surge in new orders outpaced companies’ capacity, leading to a drawdown in stocks of finished goods to one of the greatest extents ever recorded, despite efforts to boost employment and input purchasing. Meanwhile, input costs and output charges continued to rise significantly, although inflation eased slightly compared to June.

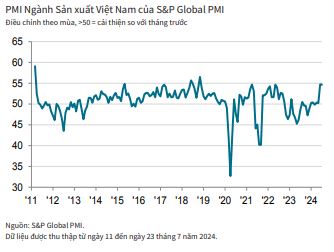

The Manufacturing Purchasing Managers’ Index™ (PMI®) for Vietnam remained unchanged at 54.7 in July, signaling a marked improvement in the country’s manufacturing business landscape. In fact, the last time growth was recorded faster was in November 2018. This significant advancement was observed across all categories of consumer goods, intermediate goods, and investment goods.

New orders increased for the fourth consecutive month in July, with the rate of expansion only slightly slower than June’s near-record high. Panelists attributed this to stronger market demand and a growing customer base. New export orders also rose, albeit at a softer pace than total new orders. Some companies mentioned that demand for exports was impacted by high shipping costs.

Faced with a surge in new orders, manufacturers substantially ramped up production in July. Moreover, the rate of output growth outpaced that of June and was the second-fastest ever recorded, second only to the initial data collection month of March 2011.

Despite the robust production, companies had to rely on their existing inventories to fulfill new orders. As a result, stocks of finished goods declined to the second-lowest level ever recorded, surpassed only by the reading in February 2014.

Firms sought to boost capacity by increasing both input purchasing and employment at the start of the third quarter. Input buying rose considerably, with the rate of increase being the sharpest since May 2022. In contrast, staffing levels rose only marginally and at a slower pace than in June. Meanwhile, backlogs of work accumulated for the second month in a row.

Suppliers’ delivery times improved for the second month running, making it easier for manufacturers to source materials, although the improvement in vendor performance was marginal, with some reports still indicating delays in sea freight transportation. Inventories of purchases declined for the eleventh straight month, with the rate of depletion accelerating to the sharpest since April.

Input costs continued to rise markedly in July, with the rate of inflation only slightly softer than the two-year high seen in June. Suppliers were reported to have raised their selling prices, while increased transportation costs also played a role.

Confronted with escalating input costs, manufacturers raised their output charges for the third month in a row in July. The rate of increase was solid, albeit slower than in the previous survey period. Expectations of continued new order growth in the coming year bolstered business confidence regarding future output. Around 40% of respondents expressed optimism, but sentiment eased to the lowest since January and was weaker than the historical average for the series.

Commenting on the Vietnamese PMI® survey, Andrew Harker, economics director at S&P Global Market Intelligence, said: “The fact that Vietnam’s manufacturing sector was able to carry the strong growth momentum from June into July adds to the optimism that we are entering a phase of solid expansion that will propel the economy forward. The key challenge for companies now is keeping up with demand. While production has been ramped up, firms have had to draw on their inventories to meet new orders, resulting in one of the sharpest declines in stocks. Manufacturers will need to step up hiring and continue securing additional inputs if the current trend in new orders is to be sustained in the coming months.”