The VN-Index ended July 2024 at 1,251.51 points, a slight increase of 6.19 points or 0.5% from the previous month, while liquidity fell sharply.

The average trading value of the three exchanges reached 19.367 trillion VND in July – the lowest in the last six months. The matched trading value averaged 17,282 billion VND, down 23.8% from the June average and -24.9% from the five-month average.

Foreign investors sold a net 8,372.15 billion VND, and their matched trading sold a net 9,267.3 billion VND.

The main net buying sectors for foreign investors were Oil and Gas and Communications. The top net buying stocks included VNM, BID, PC1, BCM, NLG, PLX, VCB, GMD, TPB, and STB.

On the net selling side, Real Estate was the top sector for foreign investors. The top net selling stocks were FPT, VRE, VHM, MSN, TCB, SSI, HSG, DXG, and DGC.

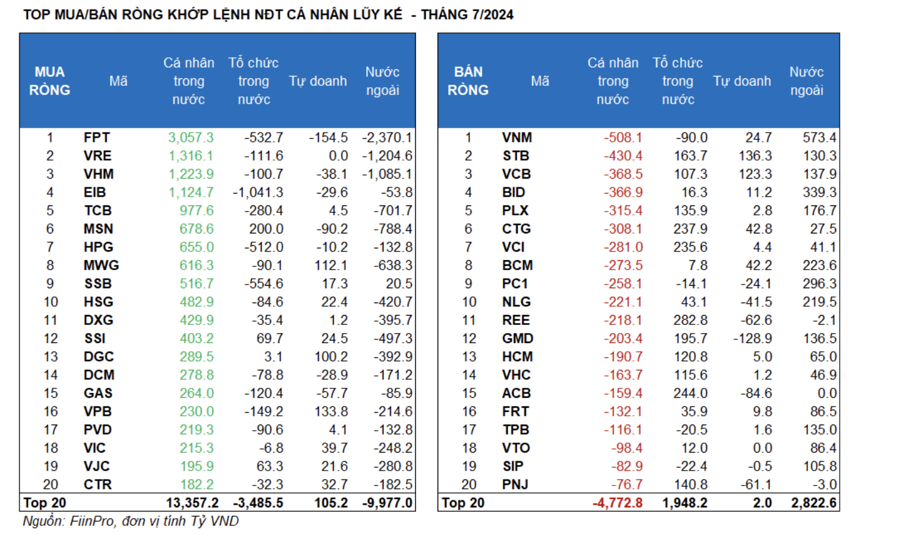

Individual investors bought a net 9,232.7 billion VND, of which 10,544.7 billion VND was net buying. In terms of matched trading, they net bought 11 out of 18 sectors, mainly in Real Estate. The top net buys for individual investors included FPT, VRE, VHM, EIB, TCB, MSN, HPG, MWG, SSB, and HSG.

On the net selling side, they net sold 7 out of 18 sectors, mainly in Industrial Goods & Services, and Oil & Gas. The top net sells included VNM, STB, VCB, BID, PLX, CTG, BCM, PC1, and NLG.

Proprietary trading sold a net 8 billion VND, and their net buying in matched trading was 533.1 billion VND.

In terms of matched trading, proprietary trading net bought 10 out of 18 sectors. The top net buying sectors were Banking and Financial Services. The top net buying stocks included FUEVFVND, STB, VPB, VCB, KBC, MWG, DGC, SBT, PVT, and CTG.

The top net selling sector was Information Technology. The top net sold stocks were FPT, GMD, DBC, MSN, ACB, REE, PNJ, GAS, NLG, and FUEVN100.

Domestic institutional investors sold a net 852.5 billion VND, and their net selling in matched trading was 1,810.4 billion VND.

In terms of matched trading, domestic institutions net sold 7 out of 18 sectors, with the largest value in Banking. The top net sells included EIB, SSB, FPT, HPG, TCB, KBC, VPB, SAB, GAS, and VRE.

The sector with the highest net buying value was Financial Services. The top net buys were REE, ACB, CTG, VCI, MSN, GMD, GEX, STB, PNJ, and PLX.

On a monthly basis, the money flow weight fell to a 10-month low in Securities, Construction, Agriculture & Seafood, Electrical Equipment, and Oil Equipment & Services. It increased in Banking & Personal Goods and peaked or remained around the peak in Retail, Food, Power, Oil Production, Textiles, Rubber & Plastics, Aviation, and Water Transport.

In the group with a high money flow weight, most sectors experienced price declines (except for Oil Production, Food, and Retail). This indicates high selling pressure in the remaining sectors, including Livestock, Seafood, Power, Aviation, and Water Transport. Meanwhile, the sectors with low money flow weights lack compelling narratives to attract capital back into the market.

In terms of market capitalization, money flow continued to increase and concentrate in the large-cap VN30 group, with a money flow weight of 46.2% in July, up significantly from 41.7% in the previous month. In contrast, the money flow allocation in the mid-cap VNMID and small-cap VNSML groups decreased from 41.4% to 37.2% and from 12.1% to 11.7%, respectively.

Analyzing money flow by size, the average trading value decreased in all three market capitalization groups. The mid-cap VNMID group experienced the sharpest decline, falling by 3,270 billion VND (-34.1%). This was followed by the large-cap VN30 group, which decreased by 1,808 billion VND (-18.7%), and the small-cap VNSML group, which dropped by 813 billion VND (-29%).

In terms of price movements, the VN30 index once again outperformed in July with a positive return of +1.62%. Conversely, the VNSML and VNMID indices declined by -2.78% and -2.14%, respectively.