Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 658 million shares, equivalent to a value of more than 16 trillion VND. The HNX-Index reached over 57 million shares, equivalent to a value of nearly 1.1 trillion VND.

The VN-Index opened the afternoon session on a positive note as buying pressure reappeared, although there was some fluctuation. The buying side continued to prevail, helping the index to recover and close above the reference level at the end of the session. In terms of impact, GVR, PLX, SSB, and VJC were the codes with the most positive influence on the VN-Index, with an increase of more than 3.1 points. On the other hand, HVN, MWG, SSI, and LPB were the codes with the most negative impact, taking away more than 1.5 points from the overall index.

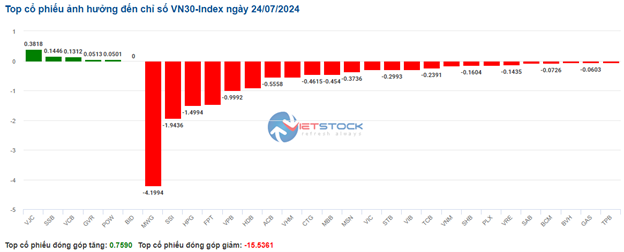

| Top 10 stocks with the highest impact on the VN-Index on 24/07/2024 |

The HNX-Index also had a positive performance, with positive contributions from NTP (+5.52%), VCS (+2.84%), MBS (+2%), and PVS (+1.23%), among others.

|

Source: VietstockFinance

|

The plastic and chemical manufacturing industry was the group with the strongest gain, increasing by 4.07%, mainly driven by GVR (+6.86%), DGC (+1.48%), DCM (+2%), and DPM (+0.72%). This was followed by the agriculture, forestry, and fisheries sector, and the electrical equipment industry, with increases of 2.36% and 2.3%, respectively. On the other hand, the accommodation, food, and entertainment services sector experienced the largest decline in the market, falling by -1.16%, mainly due to VNG (-0.95%) and DSN (-0.18%).

In terms of foreign trading, this group returned to net buying on the HOSE floor, focusing on VNM (81.38 billion), HPG (56.35 billion), HDG (37.6 billion), and DBC (36.18 billion). On the HNX floor, foreign investors net bought over 49 billion VND, mainly investing in PVS (32.18 billion), IDC (6.53 billion), MBS (6.51 billion), and TNG (5.62 billion).

| Foreigners’ Buying and Selling Behavior |

Morning Session: Recovery Effort Fails, VN-Index Continues to Fall

After a series of sharp declines in the market, investor sentiment remained pessimistic during the morning session of July 24. The VN-Index temporarily stood at 1,229.28 points, down 2.53 points, or 0.21%; the HNX-Index fell 1.57 points to 233.03. The market breadth tilted towards sellers, with 446 declining stocks and 195 advancing stocks. The VN30 basket followed a similar pattern, with 18 declining stocks and 8 advancing stocks.

The trading volume of the VN-Index in the morning session increased significantly compared to the previous session, reaching nearly 422 million units, with a value of over 10 trillion VND. The HNX-Index recorded a trading volume of over 34 million units, with a value of nearly 778 billion VND.

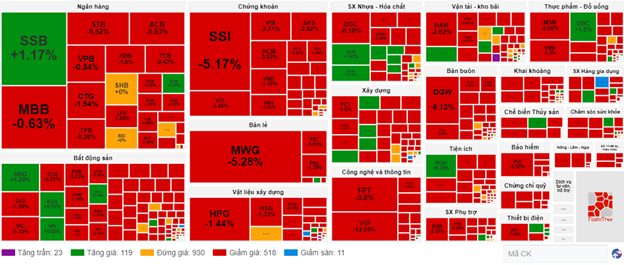

Red dominated the sector performance, with 19 out of 25 sectors declining. Among them, retail was the sector that witnessed the strongest selling pressure, falling by 2.68%. This was mainly due to the negative performance of the industry’s “big players,” including MWG (-3.52%), PNJ (-0.11%), and FRT (-2.87%). Following this was the securities sector, which decreased by 1.98%. Almost all the stocks in this group were painted red, notably the industry leaders such as SSI (-3.84%), VND (-1.27%), VCI (-3.91%), and HCM (-2.74%). However, there were a few bright spots in the sector, including FTS, BVS, TVS, and IVS, which managed to stay in positive territory.

The seafood processing industry also saw a similar lack of enthusiasm, falling by 1.89%. Stocks within this group were mixed, with many experiencing sharp declines, such as VHC (-3.06%), FMC (-1.93%), and ACL (-3.85%)… However, positive trading activity was observed in ANV (+0.92%), CMX (+3.23%), and DAT (+0.94%).

On the other hand, the plastics and chemicals manufacturing industry stood out as the brightest spot in the morning session, rising by 2.11%. This was mainly due to the recovery of GVR (+3.43%), DGC (+1.38%), DCM (+1.28%), and DPM (+0.43%) after a prolonged downward trend.

The electrical equipment group also went against the overall market trend, increasing by 0.95%. This growth was largely contributed by GEX (+1.6%), PAC (+0.73%), and TYA (+6.67%).

10:30 am: Sellers Continue to Dominate the Market, Retail Sector Performs Poorly

Selling pressure intensified compared to the beginning of the session, causing the main indices to remain below the reference level. As of 10:30 am, the VN-Index fell more than 8 points, trading around 1,223 points. The HNX-Index dropped 2.73 points, trading around the 231-point level.

Almost all the stocks in the VN30 basket faced strong selling pressure. Specifically, MWG, SSI, HPG, and FPT were the top losers, dragging down the index by 4.2 points, 1.94 points, 1.50 points, and 1.48 points, respectively. Conversely, VJC, SSB, VCB, GVR, and POW were the only five stocks that managed to stay in positive territory, but their gains were not significant.

Source: VietstockFinance

|

The retail group led the market’s decline, falling by 3.18%. This was mainly driven by the sector’s three largest stocks: MWG (-4.16%), FRT (-3.62%), and PNJ (-0.53%)…

Following closely was the seafood processing sector, which also witnessed a sea of red, with VHC (-2.78%), ANV (-1.06%), ASM (-0.31%), IDI (-2.46%), and FMC (-3.36%) being among the top losers. Only three stocks managed to stay in positive territory: CMX (+1.04%), DAT (+0.94%), and TFC (+0.53%).

The securities sector was not spared from the selling pressure, with most stocks in the red, including SSI (-3.55%), VND (-2.23%), VCI (-1.96%), and HCM (-2.15%)…

Compared to the beginning of the session, the market continued to be dominated by red. There were 518 declining stocks (including 11 stocks that hit the daily lower limit) and 119 advancing stocks (including 23 stocks that hit the daily upper limit).

Source: VietstockFinance

|

Opening: Caution Prevails at the Start of the Session

A mild sell-off was observed at the beginning of the trading session, indicating investors’ continued caution in the market. The main indices exhibited mixed performance, fluctuating around the reference level.

Green temporarily prevailed in the VN30 basket, with 11 declining stocks, 12 advancing stocks, and 7 stocks trading flat. Among them, PLX, MWG, and BCM were the top losers. On the upside, GVR, POW, and HPG were the best-performing stocks.

The plastics and chemicals manufacturing industry was one of the most prominent sectors in the market. Notable stocks in this group, such as GVR, DCM, BMP, NTP, LAS, and CSV, all traded in positive territory.

In contrast, the securities sector was painted red from the start of the session. The selling pressure was mainly driven by VND, SSI, VCI, VIX, BSI, VDS, and other securities stocks.

Lý Hỏa