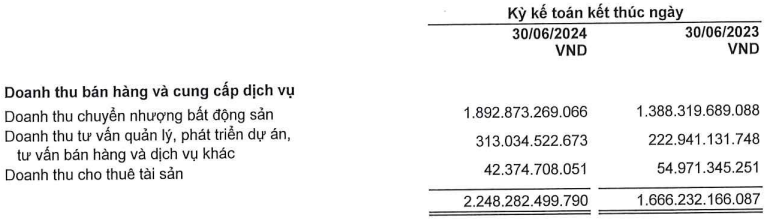

In the first half of 2024, NVL recorded remarkable growth with a 35% year-over-year increase in net revenue, surpassing 2.2 trillion VND. This success was largely driven by a 36% surge in revenue from real estate transfers, amounting to nearly 1.9 trillion VND. Additionally, consulting, management, and project development revenues also witnessed a significant boost, climbing over 40% to surpass 313 billion VND.

|

A breakdown of NVL’s revenue structure for the first six months of 2024 is provided below:

Source: NVL

|

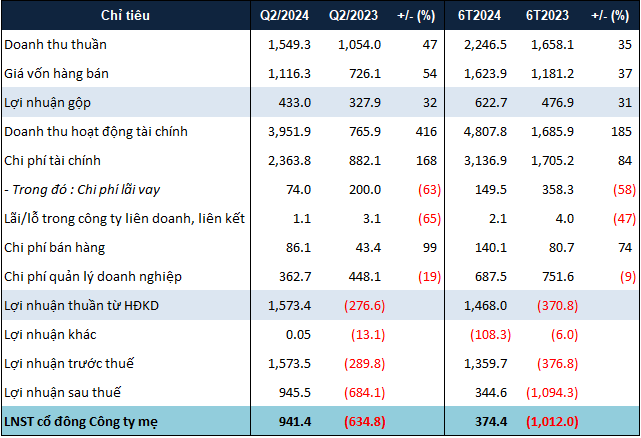

The standout performer was NVL’s financial revenue, which soared to over 4.8 trillion VND, nearly 2.9 times higher than the previous year. This impressive feat was mainly attributed to gains from investment cooperation contracts, totaling nearly 2.9 trillion VND, and other financial revenues of almost 1.2 trillion VND. Additionally, the company recognized nearly 275 billion VND in interest income from capital transfer activities.

On the expense side, while interest expenses decreased by 58%, total financial expenses still climbed by 84% year-over-year, reaching over 3.1 trillion VND. This increase was primarily driven by substantial losses from exchange rate differences, exceeding 834 billion VND, and a loss of more than 797 billion VND from the divestment of its subsidiary, Huynh Gia Huy JSC.

According to NVL’s disclosures, on April 1, 2024, the company transferred its entire investment in the aforementioned subsidiary for approximately 1.9 billion VND. Notably, this transfer price excluded the value of utility assets and existing debt obligations. The aforementioned loss of 797 billion VND represents the difference between the total transfer value and the book value.

As per NVL’s 2023 Annual Report, Huynh Gia Huy JSC had a charter capital of 725 billion VND, with NVL holding a 99.98% stake at the end of 2023. The company was the developer of the NovaHills Mui Ne (Phan Thiet) project, spanning an area of 399,310 square meters and comprising 603 villas, which were delivered in the first quarter of 2022. Huynh Gia Huy JSC’s revenue for 2023 stood at a mere 8 billion VND, a significant decline from the 638 billion VND recorded in 2022.

Returning to NVL’s performance, despite the loss incurred from the divestment of its subsidiary, the company managed to turn a profit, earning over 374 billion VND in net income for the first half of 2024, compared to a loss of over 1 trillion VND in the same period last year. This turnaround was largely driven by a strong second quarter, which contributed over 941 billion VND to the bottom line, offsetting the first-quarter loss of more than 567 billion VND.

|

Here’s an overview of NVL’s financial performance for the first six months of 2024:

Source: VietstockFinance

|

Considering NVL’s target of achieving a net profit of 1,079 billion VND for the full year of 2024, the company has only accomplished approximately 32% of its goal in the first half.

As of June 30, 2024, NVL’s balance sheet remained relatively stable, with total assets holding steady at nearly 240.2 trillion VND. While cash holdings decreased by 37% to 2.2 trillion VND, inventory levels remained unchanged at over 142 trillion VND.

On the liabilities side, total liabilities also witnessed minimal changes, totaling over 194.5 trillion VND. Borrowings increased slightly by 3% to surpass 59.2 trillion VND. Notably, NVL’s short-term debt with VietinBank stood at 1.5 trillion VND at the end of June, a significant increase from the 543 billion VND recorded at the beginning of the year.

Ha Le