|

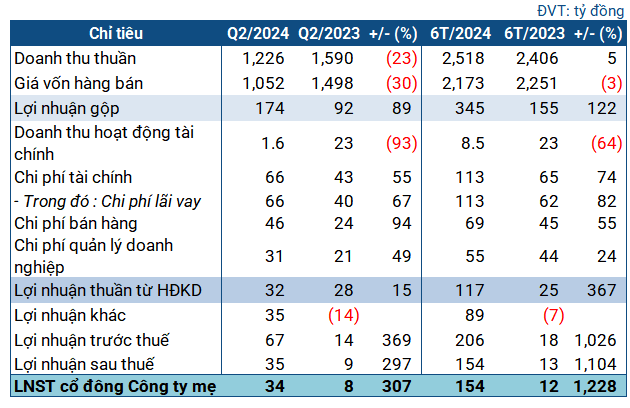

BAF’s Q2 2024 Business Targets

Source: VietstockFinance

|

In Q2, BAF recorded over 1.2 thousand billion VND in net revenue, a 23% decrease year-on-year. However, cost of goods sold decreased by 30% to over 1 thousand billion VND. As a result, gross profit increased by 89% to 174 billion VND.

Despite the decline in revenue, BAF’s pig farming business grew significantly, with revenue of 806 billion VND, a 4.7-fold increase year-on-year. The overall revenue decrease was mainly due to a drop in agricultural produce sales. Meanwhile, the ability to source feed from their two feed mills and the lower feed prices in the second half of 2023 contributed to the reduction in cost of goods sold. The gross profit margin improved from 5.8% to 14.2%.

Financial income for the period dropped by 93% to 1.6 billion VND, while various expenses increased, narrowing the company’s profits. However, the recognition of 35 billion VND in other income (compared to a loss of 14 billion VND in the same period last year), mainly from land use right liquidation, helped the company achieve better results. Ultimately, BAF recorded a net profit of 34 billion VND, four times higher than the previous year.

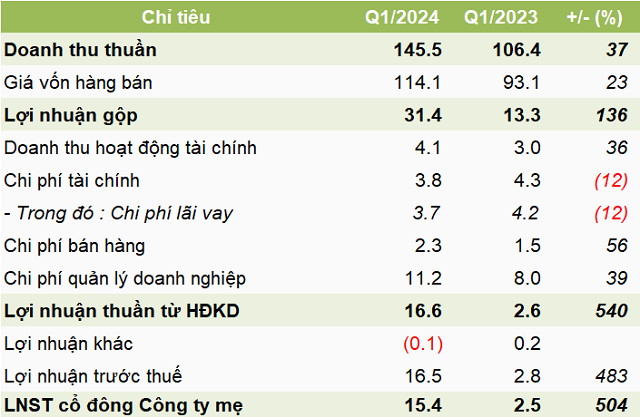

For the first half of the year, BAF’s revenue exceeded 2.5 thousand billion VND, a 5% increase year-on-year. The revenue structure shifted, with pig farming revenue accounting for 53%, a significant increase from 21% in the previous year. The remaining revenue came from agricultural produce sales, feed sales, and other services. The company’s total herd exceeded 430,000 pigs, resulting in a commercial pig output of over 720,000 pigs.

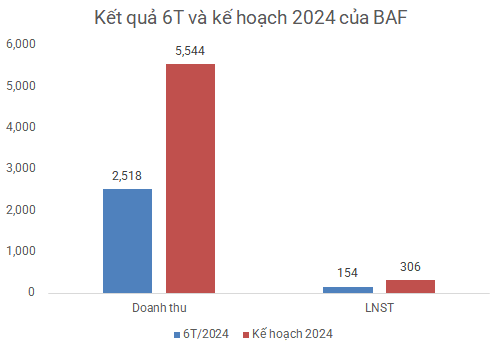

Net profit for the first six months also increased significantly to 154 billion VND (compared to 12 billion VND in the same period last year, a more than 13-fold increase). In relation to the plan approved by the 2024 General Meeting of Shareholders, the company has achieved 45% of its revenue target and over 50% of its annual after-tax profit target.

Source: VietstockFinance

|

As of the end of June, the company’s total assets exceeded 7.3 thousand billion VND, a 12% increase from the beginning of the year, with over 3.5 thousand billion VND in short-term assets. Cash and cash equivalents increased significantly to nearly 1.2 thousand billion VND, 2.7 times higher than at the beginning of the year. Inventories amounted to 1.9 thousand billion VND, a 22% increase, including various types of pigs expected to be released to the market.

Long-term assets under construction totaled over 1 thousand billion VND, a 15% increase, including farms expected to be operational in the coming periods.

On the capital side, short-term debt stood at 3.5 thousand billion VND, a 17% increase. The current and quick ratios were 1.1 and 0.5, respectively.

Borrowings increased compared to the beginning of the year, with short-term borrowings of nearly 837 billion VND (+19%) and long-term borrowings of over 1.2 thousand billion VND (+8%). The majority of the debt was from banks, with the remaining being convertible bonds issued to IFC (International Finance Corporation), totaling more than 485 billion VND. The bonds have a seven-year term and a 5.25% annual interest rate.