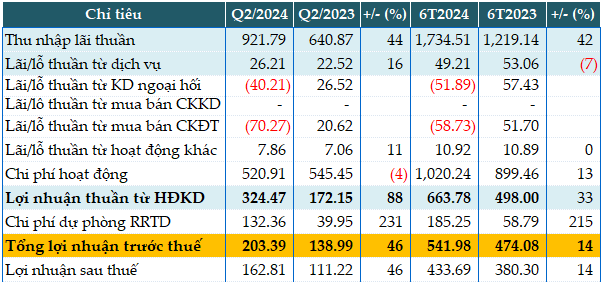

In Q2, BAB’s net interest income increased significantly by 44%, reaching nearly VND 922 billion.

Non-interest income sources were inconsistent. While income from services (+16%) and other activities (+11%) grew, trading and investment securities activities turned from profit to loss.

As a result, net income from business activities increased by 88%, reaching VND 324 billion. The bank allocated VND 132 billion for credit risk provisions (3.4 times higher), resulting in a pre-tax profit of over VND 203 billion, up 46% year-on-year.

For the first six months of the year, BAB’s pre-tax profit was nearly VND 542 billion, a 14% increase year-on-year. Compared to the full-year target of VND 1,100 billion in pre-tax profit, BAB achieved 49% after two quarters.

|

BAB’s Q2 2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

Total assets as of the end of Q2 slightly increased by 1% from the beginning of the year to VND 154,482 billion. Meanwhile, loans to customers grew by 2% (VND 102,131 billion), and customer deposits increased by 1% (VND 119,743 billion).

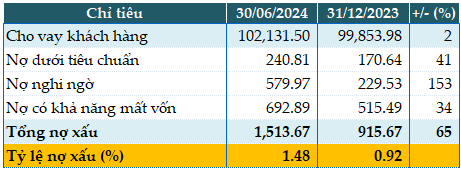

The quality of loans was a weak spot in BAB’s H1 2024 performance. As of June 30, 2024, non-performing loans (NPLs) increased by 65% from the beginning of the year to VND 1,513 billion. The NPL ratio also rose from 0.92% to 1.48% during this period.

|

BAB’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|

Hàn Đông