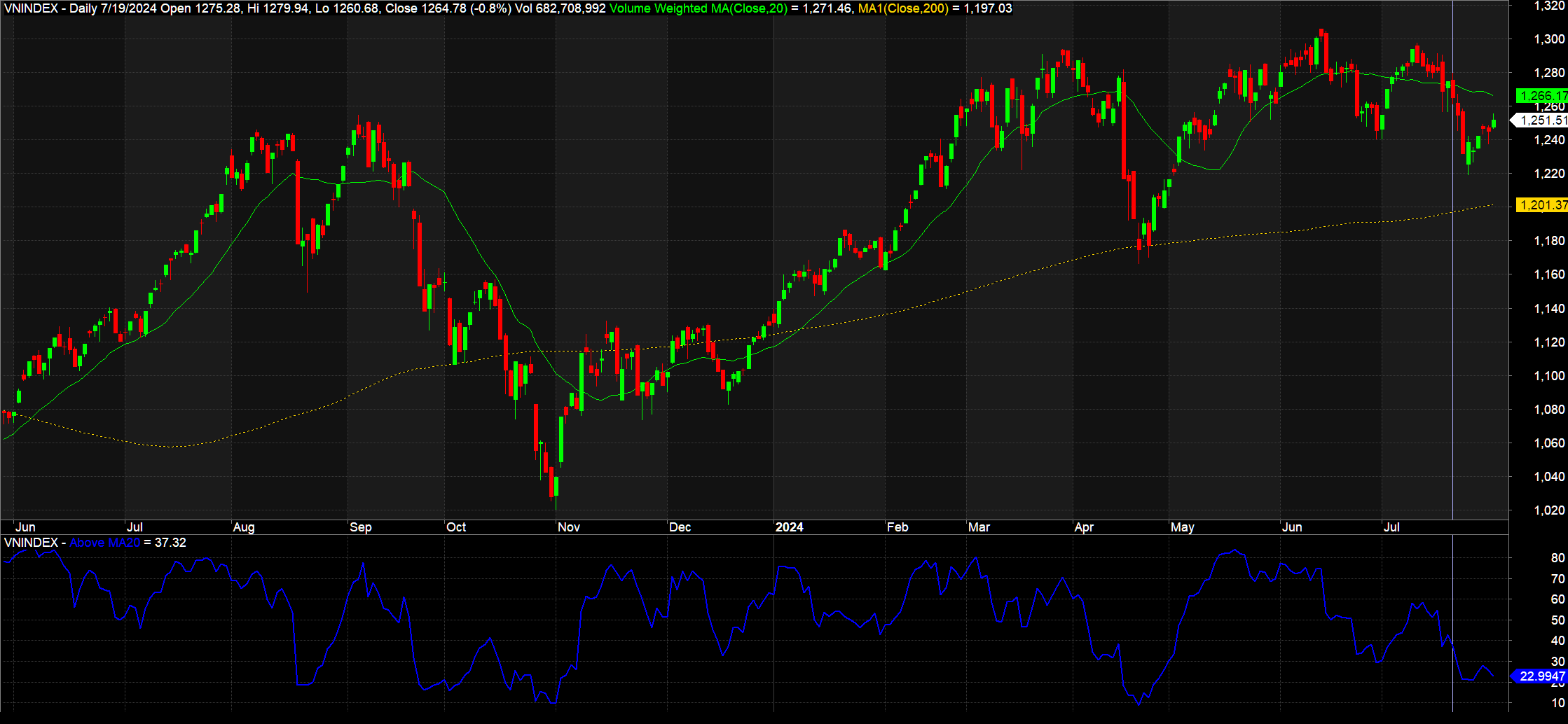

Since the trading session on July 19, the Vietnamese stock market has once again lost its short-term upward trend. Trading opportunities on HOSE also narrowed rapidly, with only about 25% of stocks maintaining their short-term trends as of July 31.

Only about 23% of stocks on HOSE maintained their short-term trends, reducing the investment probability for investors.

|

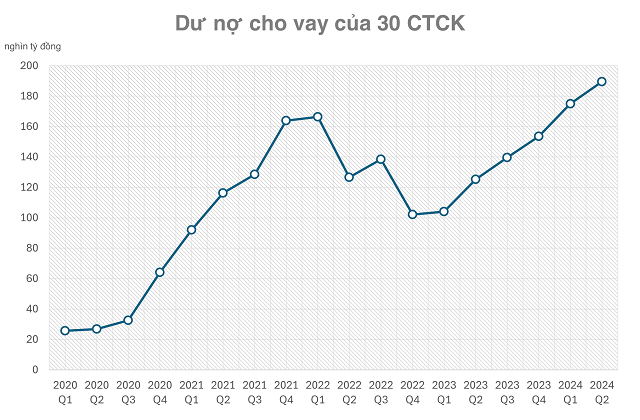

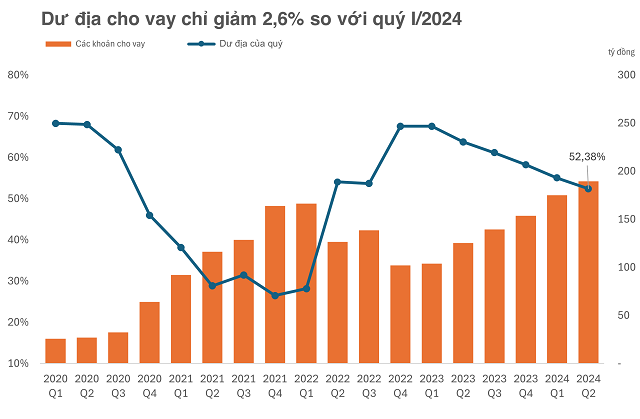

One notable piece of information during the market’s lackluster performance was the record-high outstanding loans at securities companies. This brought back memories of the end of 2022, leading some investors to believe that the market could face margin calls.

However, in reality, outstanding loans at securities companies have recovered since the end of 2022 and have grown for six consecutive quarters. In the first quarter of 2024 alone, outstanding loans broke the record set during the COVID-19 pandemic. Compared to the previous quarter, while outstanding loans continued to set new records, the growth rate has slowed down.

Outstanding loans continued to break records in Q2 2024

|

According to statistics from 30 securities companies, outstanding loans in Q2 2024 grew by 8.2%, while the growth rate in the first quarter was over 14%.

Not all securities companies recorded growth in outstanding loans. Some companies even saw a decrease in Q2, such as VPS (-2.5%), Vietcap (-7.3%), SHS (-18.2%), and CTS (-6.2%). Vietcap and SHS lost all the gains they had made in expanding their outstanding loans since the beginning of 2024.

This indicates that investors at many securities companies have been proactive in risk management and reducing margin leverage instead of giving in to FOMO during a challenging quarter for the stock market. Otherwise, the growth in outstanding loans would have been even more remarkable.

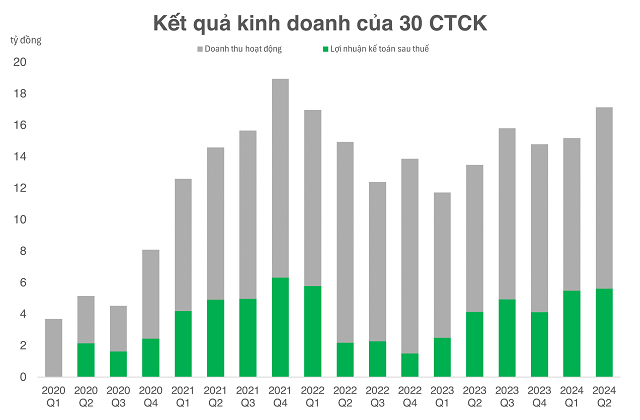

Additionally, it is worth mentioning that securities companies have improved their financial capabilities through continuous profit growth and a series of capital increases implemented since the end of 2023.

Despite a slowdown in growth, the after-tax profit of the 30 securities companies in Q2 was the highest in the last nine quarters.

|

Along with the capital increases, the lending capacity (not exceeding twice the owner’s equity) also narrowed slowly and has not returned to the level at the end of 2021.

|

According to Mr. Bui Van Huy, Director of the Ho Chi Minh City Branch of DSC Securities Company, the story of margin breaking records is a common topic of discussion during every financial reporting season. While the margin threshold has reached its highest level in history, Mr. Huy assesses that the current margin level is not dangerous.

Specifically, the ability of securities companies to provide margin has improved significantly after several rounds of capital increases. As securities companies now perform part of the lending function of banks, it is understandable that the absolute number has increased.

“There is currently an excess of lending capital, with industry insiders jokingly saying that they have too much on their hands. Even the stock warehouses are overflowing with collateral. From a professional perspective, if someone says that the margin risk is high, I disagree. After a series of calls/force last week, the margin risk at the current price level is not high,” said Mr. Huy.

Similarly, Mr. Tran Truong Manh Hieu, Head of Analysis at KIS Vietnam Securities Company, assessed that securities companies are managing margin risk well. Therefore, their lending positions usually ensure safety based on the liquidity of the underlying stocks. In case of problems, these margin positions can be quickly handled within 1-2 sessions to recover capital thanks to the good liquidity of the stocks.

The pressure of margin calls only affects a few sessions and does not last long. So, while margin pressure may cause market fluctuations in a few sessions, the overall trend is likely to be maintained.