The market faced intense pressure in the morning, with the VNI plunging below the short-term bottom of around 1220 points before surging back up at the end of the session. If the market continues its recovery next week, it will be a classic “bait and switch.”

Of course, the upward pull is not yet a definite sign that the market has hit its bottom, but when has the market ever been completely certain? The index is merely a reflection of the overall trend, while individual stocks take precedence. Many stocks have failed to break out of their accumulation patterns, while others have narrowed their losses and exhibited minimal volume during the VNI’s plunge. These are all strong signals.

For investors waiting for index signals to trade, further cues are needed. The VNI has multiple measurement methods for estimating bottoms, and without finding confirming signals, confidence remains low. However, if you are only concerned with the stocks you are monitoring, the signals will be more definitive since supply and demand dynamics at the point of weakest sentiment are more accurate. After yesterday’s session, there weren’t any optimistic analyses to be found!

The resilience of stock prices in the face of overall market pressure is a demonstration of strength. When the majority is fearful and the dominant sentiment is to cut losses, the stocks that are sold the least, with minimal price declines, are the strongest. Some robust stocks even managed to stay flat or slightly increase this morning. Overall volume was low this morning as buyers were waiting for deeper prices, but sellers couldn’t push the market down to the anticipated levels.

Yesterday, the market suddenly plummeted without any apparent reason, and today’s rebound doesn’t need an explanation either. The reaction in individual stocks is what matters. Today’s broad intraday recovery range presents a great opportunity, whether for trading or bottom-fishing. Of course, it’s safer to focus on stocks consolidating at the bottom rather than attempting to catch falling knives in clearly downward-trending stocks. A sudden market drop in a single session isn’t something to be afraid of, and likewise, a single-day recovery doesn’t warrant excessive excitement. Today’s reversal, if successful, will be a classic shakeout; otherwise, it will merely be a bull trap. However, this dynamic doesn’t necessarily hold true for individual stocks fluctuating within their consolidation zones.

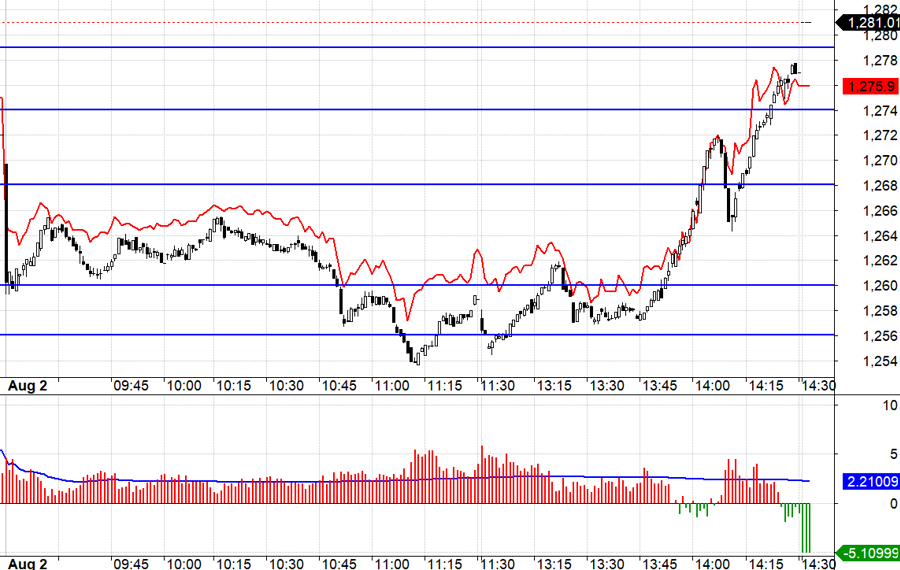

Today’s volatility in the derivatives market reflected heightened fear, as the basis narrowed compared to yesterday. The average basis for F1 today was approximately +2.2 points, which is advantageous for both Long and Short positions. However, trading was challenging as the VN30 oscillated within a narrow range of 1268.xx to 1260.xx this morning, without any clear setups. The phase when the index was trapped within the tight range of 1260.xx to 1256.xx was also tricky due to the minimal volatility. The only standard setup was when the VN30 rebounded above 1260.xx; if favorable, it would have climbed towards 1268.xx, and if unfavorable, it would have dropped back into the old narrow range with a straightforward stop-loss placement. The final strong upward move, though somewhat unexpected, is characteristic of a good setup yielding a higher probability of success.

This reversal session has a significant psychological impact over the weekend. It’s like a painkiller. Low volume will be a factor that cautious traders will consider, and they may worry about a potential bull trap. However, unless there’s a shocking event over the weekend, like missiles flying everywhere, these emotional reactions will likely subside. The strategy remains the same: look for bottom-fishing opportunities in individual stocks and employ a flexible Long/Short approach with derivatives.

The VN30 closed today at 1281.01. The nearest resistances for the next session are 1290, 1297, 1303, 1308, and 1316. The nearest supports are 1279, 1275, 1270, 1260, 1256, and 1248.

“Blog chứng khoán” reflects the personal opinions of the author and does not represent the views of VnEconomy. The assessments and investment opinions expressed are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment opinions.