Today’s market saw a shocking drop, with many stocks wiping out their gains from the previous five to six sessions in just one session. Many other stocks fell below their mid-July consolidation levels.

There wasn’t anything inherently wrong with the market to cause such a panic-selling session, but the market’s actions should be respected. A large number of stocks were dumped today, sold at any price. The 27 stocks that hit the daily lower limit were equivalent to the panic sessions of July 17.

There’s no need to look for reasons at this point; the focus should be on rebalancing your portfolio. Stocks that have broken below their bottom support levels should be trimmed as they may continue to correct. Stocks that have returned to their previous lows can be observed further. Today’s reaction was very emotional, and the panic could either continue or subside after a night’s rest. It’s important to have a plan of action for any scenario and the resources to carry it out.

The selling pressure was only intense in the afternoon, as the morning session saw a normal range of fluctuations. An important factor was the pressure from large-cap stocks, which contributed to a larger momentum. The intraday movement can be divided into two distinct halves: first, a normal profit-taking session, with stocks that had performed well in the previous sessions being sold off gently, and prices retreating without any significant events. As the blue-chips took a significant toll on the indices, a panic situation arose, and all stocks were sold off indiscriminately, regardless of their earnings reports.

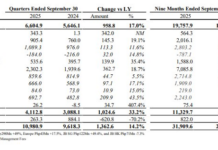

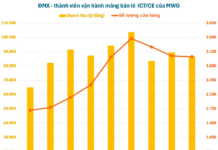

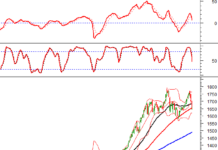

The market has experienced such strong fluctuations several times, with no apparent reason. Supply and demand are the determining factors in such sessions. Today’s trading volume was quite high, with over 22k billion VND on the two exchanges (excluding negotiated deals), especially compared to the previous six sessions’ upward trend, which saw a volume of less than 13k billion VND per day. Today’s decline sent a dangerous signal from the VN Index in terms of technical analysis, as a further drop below 1220 points would indicate a downward trend towards lower support levels. As a result, there will be all sorts of fear-driven analyses. However, as mentioned before, the VN Index does not always align with the buying and selling points of individual stocks.

Currently, many stocks are still in the process of consolidating their bottom formation, and today’s decline has made the situation worse, but it has not broken their trend. If the VN Index continues to fall, it will provide an opportunity to observe the strength of the bottom and the signals will be much more reliable, as the price’s resistance to the overall pressure of the VN Index must be revealed.

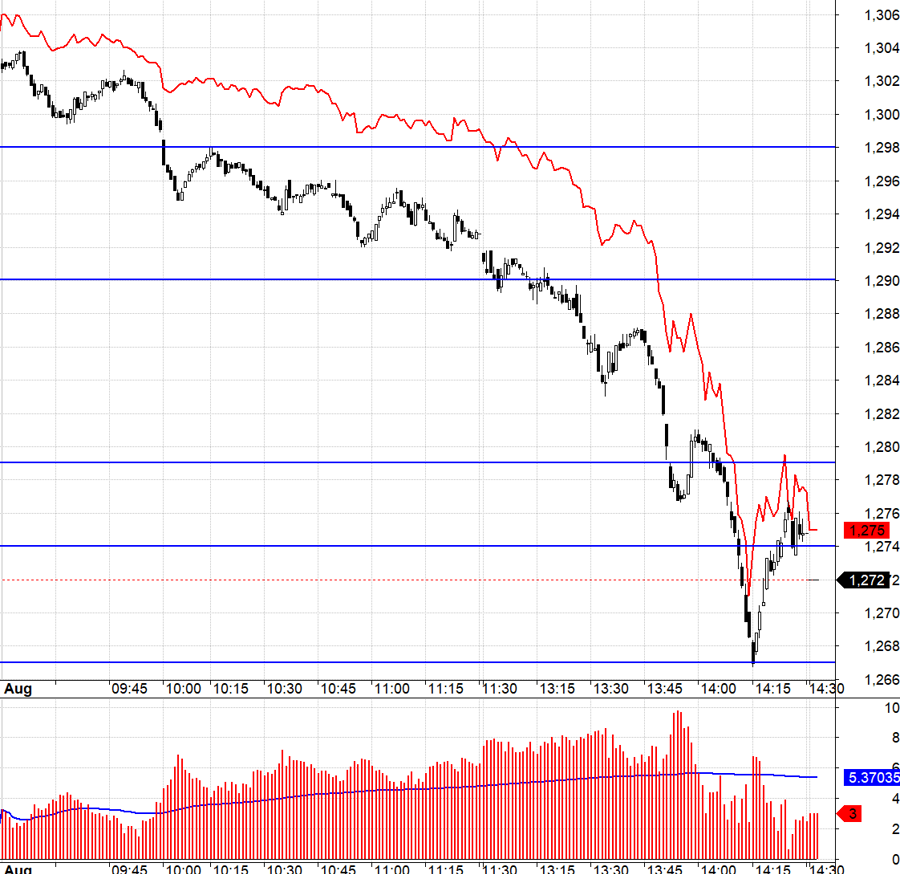

Today’s derivatives market was a “disaster” for long positions, with both basis losses and a wide decline range. The morning adjustment session for the VN30 Index was within a narrow range: at the beginning of the session, it rose above 1298.xx but failed to reach 1308.xx and then fell, with the nearest support level only reaching 1290.xx. Of course, with a wide basis of 5-6 points, it was difficult to choose a long position, but going short was also challenging as the correction could simply be a normal fluctuation, and the narrow support levels could hold.

In the afternoon, when the VN30 broke below 1290.xx, it entered a wide-range zone, with the next support level quite deep at 1279.xx. Obviously, in terms of setup, it was favorable for short positions, with both basis difference and wide-range zone advantages. However, the F1 futures contract showed strong resistance, and when the VN30 fell to 1279.xx and rebounded, the F1 adjusted very little. The final downward momentum was the widest range of the F1, and it happened very quickly, with the VN30 touching 1267.xx before stopping.

That’s the nature of the market; even though the range can be very wide throughout the day, trading scenarios don’t always yield the desired results. Only those who are lucky or know that there will be a strong selling session in the pillar stocks can profit from the entire rhythm, while those who follow the market dynamics must always pay an insurance premium against losses, thus reducing their profits.

The strong selling pressure on the spot market today pushed trading volume significantly higher than the average of the last few sessions. Bottom-fishing demand did emerge towards the end, but it was rather passive, resulting in a narrow recovery range. It is likely that the demand will continue to wait for lower prices. However, the VN30 has not yet entered a negative scenario, so there is still a chance for calm and recovery. The strategy is to be flexible with long and short positions.

The VN30 closed today at 1272. Tomorrow’s resistance levels are 1274, 1279, 1290, 1300, and 1308. Support levels are 1268, 1260, 1256, 1248, 1244, and 1238.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, opinions, and investment advice are solely those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and recommendations presented in this blog.