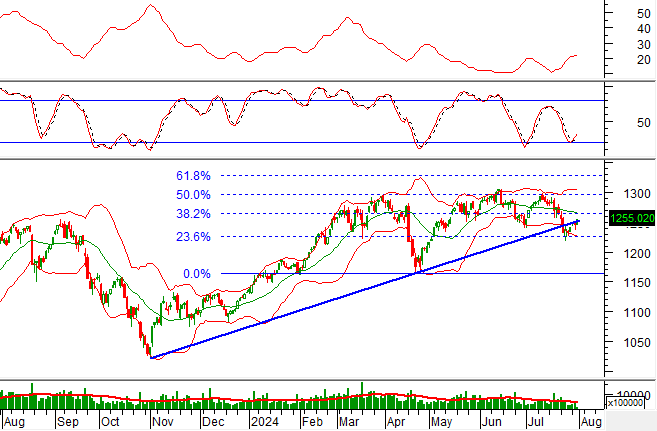

Technical Signals for the VN-Index

During the trading session on the morning of July 31, 2024, the VN-Index gained points, with a slight increase in trading volume, indicating a positive investor sentiment.

Currently, the VN-Index continues to fluctuate, with alternating rising and falling sessions, while the ADX indicator moves within the gray zone (20<>25), suggesting that this sideways trend may persist in upcoming sessions.

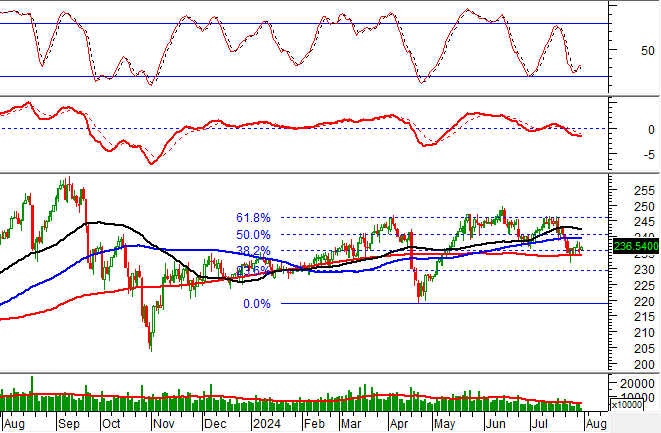

Technical Signals for the HNX-Index

On July 31, 2024, the HNX-Index rose, albeit with a slight decrease in trading volume during the morning session, reflecting investor uncertainty.

Additionally, the HNX-Index is retesting the Fibonacci Projection 38.2% threshold (equivalent to the 233-237 point region) as the MACD indicator continues its downward trajectory after a previous sell signal. If this sell signal is sustained and the index breaks below this support level, the risk of a downward adjustment in subsequent sessions will increase.

BSR – Binh Son Refinery Joint Stock Company

On the morning of July 31, 2024, BSR witnessed a significant price increase, with trading volume surpassing the 20-session average, indicating optimistic investor sentiment.

Moreover, the stock price is finding strong support at the 100-day SMA, and the Stochastic Oscillator indicator has generated a buy signal, suggesting that a positive mid-term outlook is emerging.

BID – Joint Stock Commercial Bank for Investment and Development of Vietnam

On July 31, 2024, BID witnessed a price increase and formed a White Marubozu candlestick pattern, accompanied by a substantial rise in trading volume during the morning session, expected to exceed the 20-session average, reflecting investors’ optimism.

Furthermore, the stock price rebounded after successfully testing the Middle line of the Bollinger Bands, and the MACD indicator has generated a buy signal, reinforcing the strength of the current upward trend.

Technical Analysis Department, Vietstock Consulting