VIX JSC (ticker: VIX) announced that August 1, 2024, will be the record date for a stock dividend payout for 2023, a share issuance to increase charter capital from retained earnings, and a shareholder pre-emptive right issue. The ex-date, or the first date of trading when buying shares no longer includes a right to the issue, is July 31, 2024.

Specifically, VIX plans to issue a 10% stock dividend (for every 10 shares held, shareholders will receive 1 new share). The brokerage expects to issue nearly 67 million shares for this dividend. Additionally, VIX will issue bonus shares to increase charter capital from retained earnings, also at a 10% ratio, with nearly 67 million shares expected to be issued. Thus, the total ratio of stock dividends and bonuses for VIX shareholders is 20%.

Furthermore, VIX shareholders will receive pre-emptive rights at a ratio of 95% (for every 100 rights, 95 new shares can be purchased). The expected volume of securities to be issued is 636 million units, with a price of VND 10,000/share, equivalent to raising nearly VND 6,360 billion.

The subscription and payment period for the share purchase will be from August 9, 2024, to August 30, 2024. The right to purchase these shares can be transferred from August 9, 2024, to August 26, 2024. These rights will only be transferable once.

After the above issuance plans, VIX’s charter capital is expected to increase from VND 6,694 billion to VND 14,393 billion.

All three capital increase plans were approved by VIX shareholders at the 2024 Annual General Meeting of Shareholders (AGM). Additionally, the VIX AGM also approved the share issuance plan under the Employee Stock Ownership Plan (ESOP). If all four offerings are completed, VIX’s charter capital will increase to VND 14,593 billion.

On the stock exchange, VIX shares unexpectedly attracted strong buying interest on July 31, 2024, with the market price surging to the daily limit of VND 11,250/share. Notably, the trading volume reached nearly 28 million shares, with over 8.5 million shares in the queue to buy at the ceiling price.

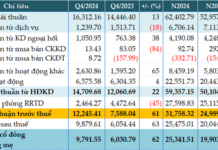

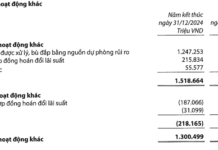

Regarding the company’s business results for Q2 2024, VIX reported revenue of VND 379 billion, a 45% decrease compared to the same period last year. This change was mainly due to proprietary trading activities, as profits from financial assets recognized through profit and loss (FVTPL) decreased by 52% to VND 222 billion.

According to the explanation provided by VIX, the Vietnamese stock market in Q2 2024 experienced significant corrections in April and June due to various domestic and international factors. This had a considerable impact on VIX’s proprietary trading portfolio. As of the trading session on June 28, the results from the “Profit from financial assets recognized through profit and loss (FVTPL)” indicator decreased by 51% compared to the same period last year.

After deducting expenses, VIX reported a post-tax profit of nearly VND 125 billion, a 78% decrease compared to the previous year. As of the end of June, VIX’s margin lending balance stood at VND 4,089 billion, a 36% increase compared to the beginning of the year.