|

Corporate bond issuance from the beginning of the year to June 21 reached approximately VND 110.2 thousand billion. Photo: Vietstock

|

Several new regulations have been updated

Circular 11 amends and supplements Circular 16/2021/TT-NHNN, including the addition of Clause 14 to Article 4 on the principles of buying and selling corporate bonds: The issuing enterprise must provide the credit institution with information about related parties as prescribed in the Law on Credit Institutions before the credit institution buys the corporate bonds. In addition, the Circular supplements Clause 15 to Article 4: Credit institutions must use non-cash payment services when making payments in the purchase and sale of corporate bonds in accordance with the law on non-cash payments.

|

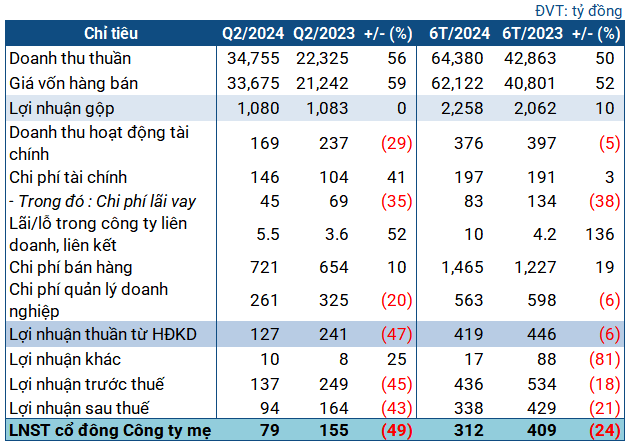

Banks issued more than 63% of the bonds Data from the Ministry of Finance shows that in the first half of 2024, 41 enterprises issued private placement corporate bonds with a volume of 110.2 thousand billion VND (2.6 times higher than the same period in 2023). Of this, credit institutions accounted for 63.2% (69.6 thousand billion VND), and real estate enterprises accounted for 28.6% (31.5 thousand billion VND). |

The Circular also amends and supplements Clause 1, Article 8 on the limit for purchasing corporate bonds. Accordingly, the total balance of corporate bond purchases (including bonds issued by the enterprise and its related parties) is counted towards the total credit limit for a customer and related parties as prescribed in the Law on Credit Institutions and the regulations of the State Bank of Vietnam.

Especially, Circular 11 contains a very important content, which is the abolition of Clause 11, Article 4 of Circular No. 16. Specifically, this clause in Circular 11 stipulates that within 12 months from the sale of unlisted corporate bonds, credit institutions are not allowed to buy back the type of bonds sold. After 12 months, the buyback must also meet certain conditions.

The nature of this regulation in Circular 16 is to restrict banks from abusing the practice of buying and selling corporate bonds before and after the financial year-end to manipulate their financial statements. However, after its issuance, this regulation also faced criticism for being too broad and restrictive, potentially hindering legitimate activities.

Some financial experts at that time opined that this was one of the reasons for the stagnation of the corporate bond market. Subsequently, in April 2023, the State Bank of Vietnam issued Circular 03/2023/TT-NHNN temporarily suspending the effectiveness of this provision of Circular 16, and now, Circular 11 has officially abolished it.

More opportunities for banks

Circular 11, with its new provisions addressing the issues in Circular 16, is expected by the financial industry to create momentum for banks to have more flexibility in participating in the corporate bond market, both as issuers and investors. At that time, one of the financial experts, Mr. Vu Duy Khanh, Director of Investment Analysis at SmartInvest Securities Company, stated that banks need to be proactive and flexible when participating in buying and selling corporate bonds, as they will often buy back from individual investors, thereby increasing the liquidity of the bond market.

With the effectiveness of Circular 11, there are higher expectations for the market and encouragement for more active participation from banks in the corporate bond market. Especially now, there is also an increasing demand from this group of investors. Mr. Tran Le Minh, CEO of credit rating agency VIS Rating, said that the trend for 2024 is for banks to continue issuing bonds and in large quantities, offering investors an alternative to bank deposits. As such, bank bonds could be a catalyst for restoring investor confidence in the corporate bond market, as they are still considered a safe asset class. “For other enterprises, I have not analyzed them fully yet, but for bank bonds, I have not seen any risk of delayed payment to investors,” said Mr. Minh.

In addition, from the perspective of investors, banks often have a significant impact on the market. According to data from the Ministry of Finance, in terms of the structure of investors in the bond market, institutional investors purchasing corporate bonds in the primary market accounted for 94.8% of the issuance volume, with the largest proportion being credit institutions (53.5%), far exceeding the second-largest group, securities companies (21.9%).

Chi Tin

Hải Hà Petro and Xuyên Việt Oil accumulate bad debts of over 11,000 billion dong

Not only did these two petroleum companies commit violations regarding the Price Stabilization Fund and massive tax debts, but they also have bad debts at banks amounting to tens of thousands of billion Vietnamese dong.