In a recent announcement, Mr. Le Viet Hung, Senior Advisor to Hoa Binh Construction Group Joint Stock Company (HBC), has registered to purchase 500,000 HBC shares to diversify his investment portfolio. The expected transaction period is from August 5 to September 3, 2024, through matching or negotiated orders.

If the transaction is completed, Mr. Hung is expected to hold nearly 1.4 million HBC shares (equivalent to 0.39% of capital). Mr. Le Viet Hung is the elder brother of Mr. Le Viet Hai, Chairman of Hoa Binh Construction Group. Currently, Mr. Hai holds nearly 47 million HBC shares (equivalent to 13.53% of the capital).

On the stock exchange, HBC shares are hovering near a decade-low, currently trading at VND 5,850 per share. According to this market price, Mr. Hung is estimated to spend approximately VND 3 billion for the above transaction.

Mr. Hung’s move to increase his ownership in HBC is quite surprising given that HBC is facing mandatory delisting from HoSE. HoSE has decided to mandatorily delist the shares of Hoa Binh Construction Group Joint Stock Company (HBC) as the audited consolidated financial statements for 2023 recorded accumulated losses after tax as of December 31, 2023, of VND 3,240 billion, exceeding the company’s paid-up capital of VND 2,741 billion.

Regarding this matter, Hoa Binh Group has responded to HoSE, stating its disagreement with the grounds for HoSE’s consideration of mandatory delisting of HBC shares.

Firstly, there is no legal guidance or interpretation regarding whether to consider the condition of cumulative losses on the audited consolidated financial statements or the audited separate financial statements.

Secondly, HBC believes that HoSE’s reliance on past precedents to consider the delisting of HBC shares is inconsistent with the current legal framework.

“The Company’s management is aware of the extremely serious consequences of delisting the Company’s shares. This directly affects more than 39,000 shareholders and thousands of employees whose livelihoods depend on the Company, as well as over 1,400 suppliers and subcontractors with hundreds of thousands of employees,” said Hoa Binh in its statement.

In the event that HBC shares are delisted from HoSE and traded on the UpCOM exchange, Mr. Hai affirmed that Hoa Binh Group plans to relist HBC shares on HoSE as soon as they meet the requirements, ensuring no adverse impact on shareholders. The Company also committed to continue disclosing information as it has been doing on HoSE, despite less stringent disclosure requirements on UpCOM.

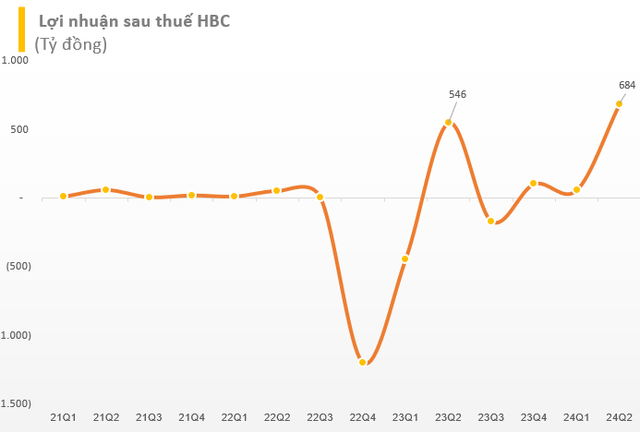

In the second quarter of 2024, the construction enterprise reported a remarkable improvement in profitability, with a post-tax profit of VND 684 billion, compared to a loss of over VND 268 billion in the same period last year. The post-tax profit of the parent company reached over VND 682 billion. This is also the highest quarterly profit ever achieved by the company since its inception.

For the first six months of 2024, HBC recorded a 10% year-on-year decrease in revenue to VND 3,811 billion. However, the profit after tax surged to VND 741 billion (compared to a loss of VND 713 billion in the same period last year). With these results, HBC has exceeded 71% of its full-year profit target.

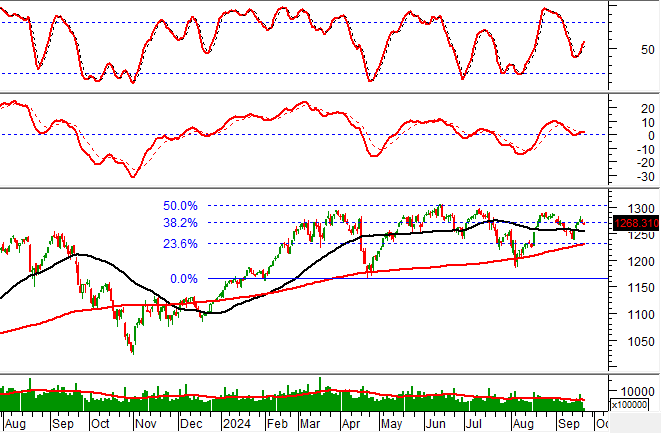

HBC shares are trading near a decade-low on the stock exchange, currently at VND 5,870 per share.

The Unfortunate Demise of Hòa Bình Construction Group (HBC): A Forced Delisting

As per the audited consolidated financial statements for 2023, Hoa Binh Construction Group’s undistributed post-tax profits as of December 31, 2023, stood at VND 3,240 billion in deficit. This amount exceeds the company’s actual contributed charter capital of VND 2,741 billion, which falls under the mandatory delisting scenario as per regulations.