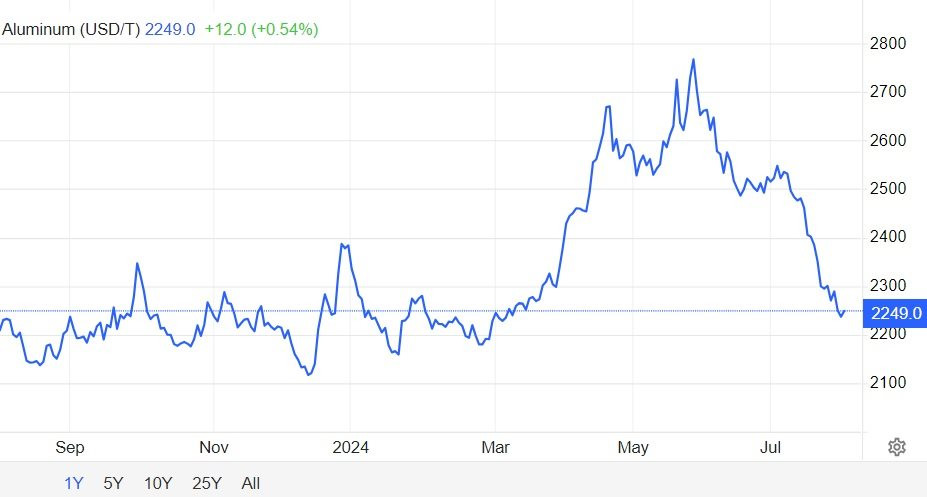

After a spring and early summer of price hikes, aluminum speculators were excited, believing that ‘green’ initiatives such as electric vehicles, renewable energy, and new power transmission technologies would push the metal’s price even higher.

However, contrary to their expectations, aluminum prices on the London Metal Exchange (LME) have consistently fallen since the beginning of June. According to Trading Economics, aluminum prices are currently at $2,249 per ton, a nearly 20% decrease from the peak of $2,743 per ton on May 30.

This decline has left aluminum speculators uncertain about future prices. In fact, many have started questioning whether the aforementioned factors are truly driving the market.

The enthusiasm for the aluminum market was largely dependent on increasing consumption in China. As the world’s largest consumer of aluminum, China’s economic downturn and corresponding demand have significantly impacted aluminum prices.

Despite economic stimulus measures from Beijing, the expected demand increase in the spring failed to materialize. Meanwhile, investments in green initiatives, whether personal or corporate, have been lackluster.

This is particularly true in Europe, where sluggish economic growth continues to hinder investment in many sectors. Weak PMI manufacturing data indicates soft industrial activity in both Europe and the US, further pressuring aluminum prices.

The price surge in the first quarter led many traders to scramble for inventory, even though they started 2024 with more stock than necessary. Weak demand has resulted in growing primary aluminum inventories in LME-registered warehouses.