Apartment Consumption in 2024 Expected to be the Highest in 4 Years

According to the OneHousing Market Research and Customer Insight Center, in the first half of 2024, the Hanoi market recorded more than 52,000 transactions, of which apartments (both primary and secondary) accounted for 54%.

New supply, transaction volume, and unit prices are all on the rise, indicating that the Hanoi market has moved past the recovery phase and entered a period of strong growth. Specifically, Hanoi’s primary supply in Q2 2024 increased for the fifth consecutive quarter, reaching 8,400 units, a 97% increase from the previous quarter and a 340% year-on-year increase. Favorable macroeconomic factors and the consecutive launch of new projects have driven the Q2 supply to its highest level since 2020.

Apartment transactions increased in both volume and selling prices. Specifically, compared to Q1 2024, the number of transactions in Q2 2024 increased by 49%, and the average unit price increased by 21%.

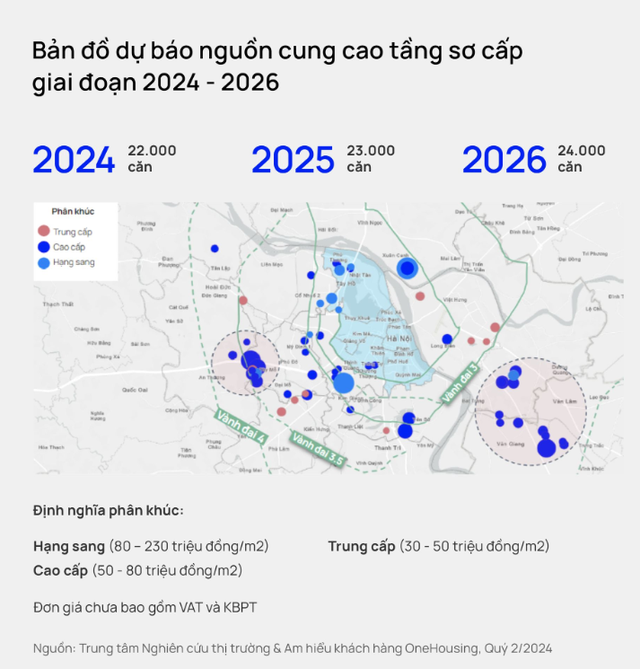

OneHousing’s research shows that in the period of 2024 – 2025, the Hanoi apartment market is expected to introduce and consume approximately 22,000-23,000 apartments annually. The supply and consumption in Hanoi during this period are forecasted to surpass the figures from 2020 to 2022 and will be the highest in the last four years.

The new apartment supply in Q2 mainly came from the luxury and high-end segments, accounting for 97% of the total market. The absence of new affordable housing projects and the minimal presence of mid-range options (~3%) indicate a shift in the market dynamic, with luxury and high-end apartments dominating the supply.

Future supply is anticipated to originate largely from the eastern and western regions of Hanoi, where new subdivisions and projects are being developed on a large scale.

Ho Chi Minh City Apartment Prices in Q2 Hit a Record High

Lagging slightly behind Hanoi’s market, Ho Chi Minh City’s apartment market is expected to enter a recovery phase in 2024 – 2025, with supply and consumption forecasted to surpass the figures from 2023.

Specifically, in the first half of 2024, Ho Chi Minh City recorded a 132.5% increase in new apartment supply in Q2 compared to the previous quarter. Experts predict that from 2024 to 2025, the Ho Chi Minh City market will recover, with an estimated supply of 8,000 – 10,000 units per year.

The luxury segment is leading the Ho Chi Minh City apartment market in the first half of 2024, accounting for 54% of new supply, with most of the newly launched projects located in the eastern part of the city.

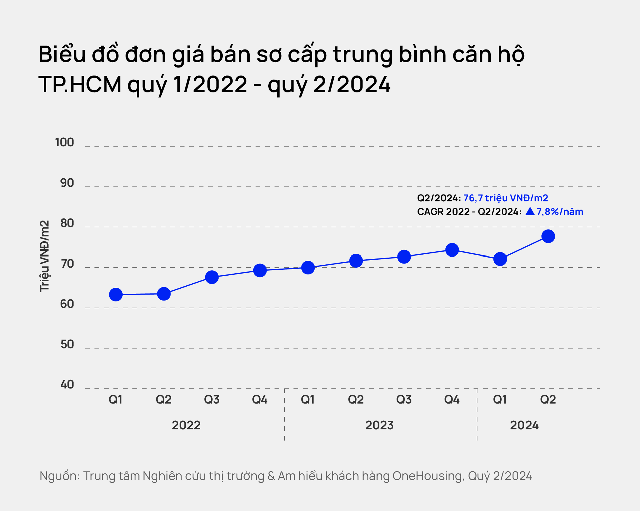

Notably, the average primary selling price in Ho Chi Minh City in Q2 2024 reached a record high of VND 76.7 million/sqm, a 6% increase compared to the same period last year. Despite the high prices, consumption in Q2 2024 still increased by 7.3% year-on-year, reaching 1,600 units, higher than the new supply (~1,200 units). The consumption of luxury and high-end apartments accounted for 80% of the total.

Mr. Tran Minh Tien, Director of the OneHousing Market Research and Customer Insight Center, believes that the positive macroeconomic indicators and the upcoming enactment of the three amended Real Estate Laws will lay the foundation for the continued growth of the apartment market in Hanoi and Ho Chi Minh City in the second half of 2024 and beyond.

Regarding the Hanoi market, the Q2 figures demonstrate a robust recovery in the apartment sector after five consecutive quarters of growth, signaling the beginning of a new growth phase. On the other hand, the Ho Chi Minh City real estate market is expected to enter a recovery phase in 2024-2025 as legal issues surrounding projects are gradually resolved and new apartment supply increases compared to 2023. The luxury and high-end segments will dominate new apartment supply in both markets. Well-planned large-scale urban areas and reputable developers with strong financial capabilities will have the opportunity to dominate the market in the coming years.