PV Gas, the Vietnam National Gas Corporation, announced its consolidated financial report for Q2 2024, revealing an impressive cash position. As of June 30, the company held over VND 43.9 trillion in cash and cash equivalents, marking a VND 3 trillion increase from the beginning of the year. This substantial cash reserve makes PV Gas the leader in cash holdings on the stock exchange in Q2.

To put this into perspective, the company’s cash balance exceeds the market capitalization of over 1,500 businesses listed on the stock exchange, including prominent names such as Duc Giang Chemical Group (DGC), Vincom Retail (VRE), REE Corporation (REE), PNJ, and even several banks.

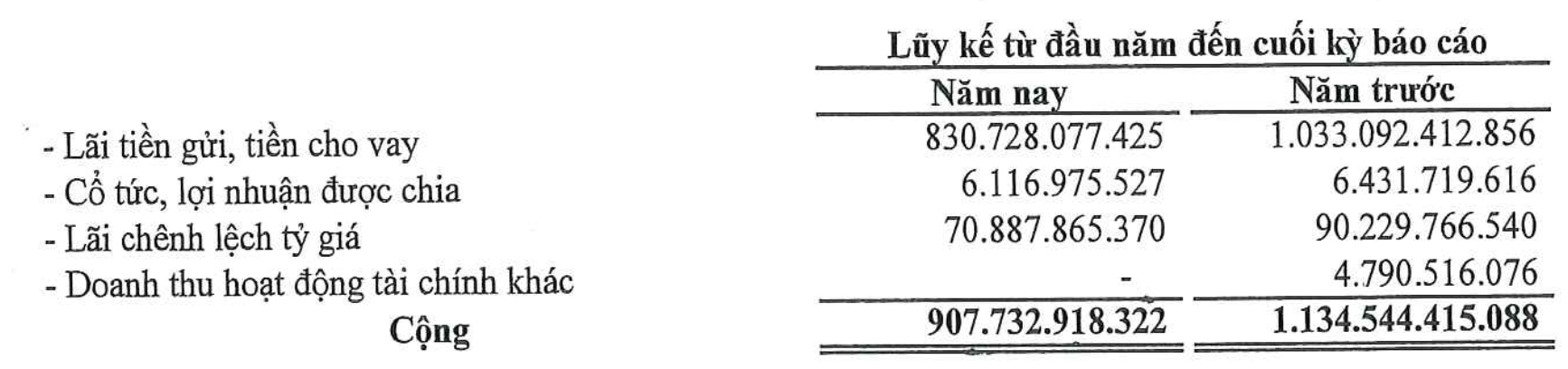

PV Gas’s significant cash deposits have generated substantial interest income. In Q2, the company’s financial revenue reached nearly VND 445 billion, mostly from interest earnings. While this figure is lower than the nearly VND 600 billion recorded in Q2 2023, it’s important to note that the decrease is mainly due to lower interest rates. For the first six months of 2024, PV Gas pocketed nearly VND 831 billion in interest income, averaging VND 4.5 billion per day.

In terms of business performance, PV Gas reported impressive results for Q2. The company achieved VND 30.052 trillion in net revenue, a 25% increase from the previous year. Net profit reached VND 3.416 trillion, a nearly 7% increase from Q2 2023. The profit attributable to the parent company stood at VND 3.321 trillion, also a 5% increase year-over-year.

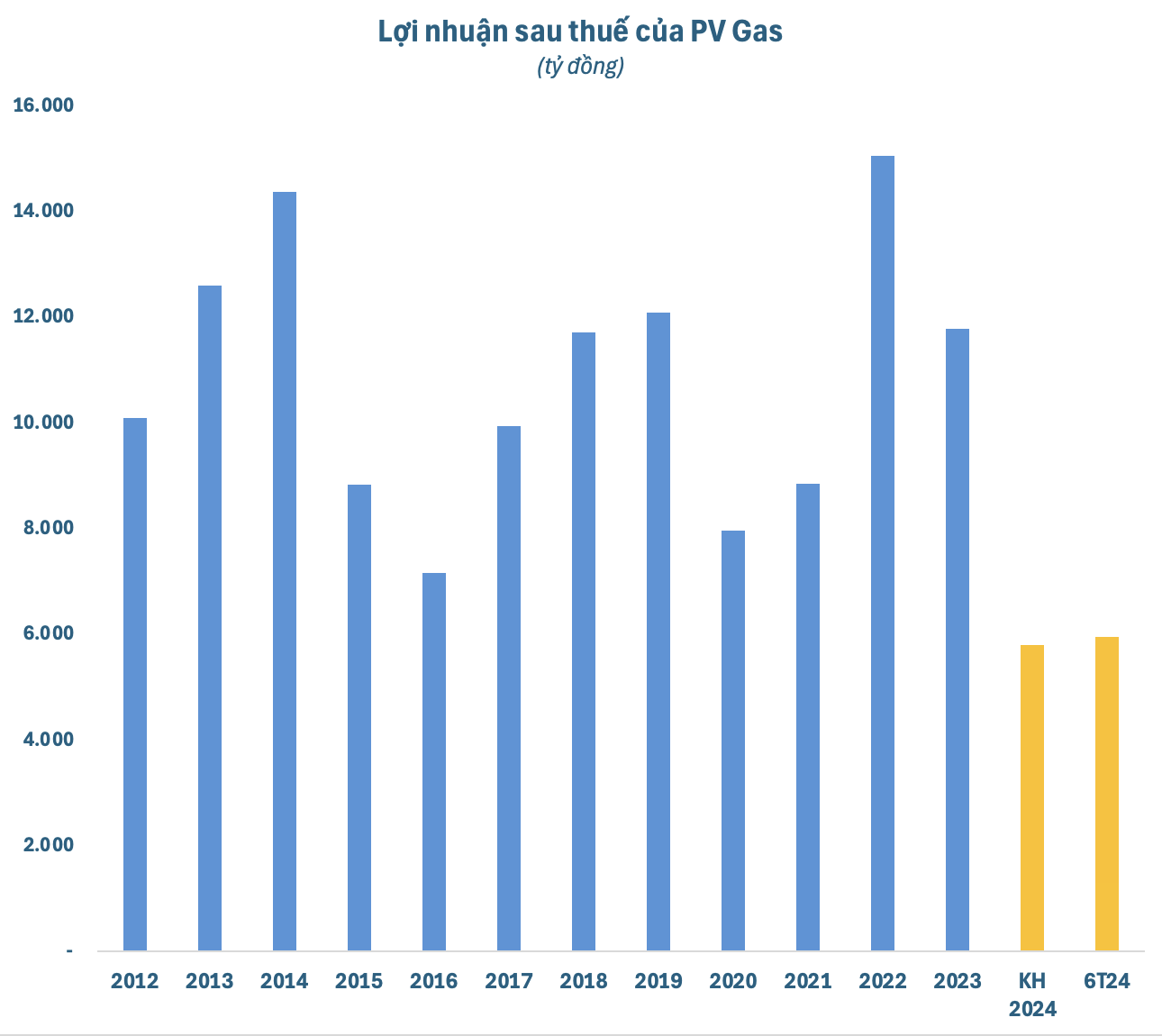

For the first six months of 2024, PV Gas recorded VND 53.367 trillion in net revenue and VND 5.960 trillion in net profit, representing an 18% increase and a 10% decrease, respectively, compared to the same period last year. With these results, the Vietnamese gas giant has already achieved 75% of its annual revenue target and surpassed its full-year profit goal.

Looking ahead, PV Gas has set a cautious tone for 2024, with a 22% and 51% decrease in revenue and profit targets, respectively, compared to 2023. This conservative plan takes into account the challenges expected in the coming year.

In a separate development, PV Gas has approved a resolution to distribute a record-high dividend for 2023. The company will pay a dividend of 60%, meaning shareholders will receive VND 6,000 for each share they own. With approximately 2.3 billion shares in circulation, PV Gas is expected to distribute over VND 13.780 trillion in dividends, with the majority going to its parent company, the Vietnam Oil and Gas Group (PVN), which holds 95.76% of PV Gas’s charter capital. The payment period is set from October 14 to November 29, 2024.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.