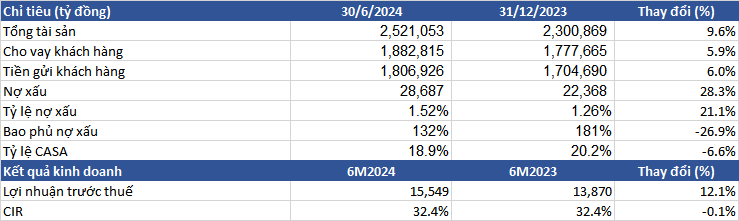

According to the recently published consolidated financial report for Q2 2024, BIDV’s total assets surpassed VND 2.5 quadrillion as of the end of June 2024, marking a 9.6% increase since the beginning of the year. BIDV is currently the largest bank in Vietnam in terms of total assets.

In the first six months, BIDV’s outstanding loans to customers increased by 5.9%, reaching over VND 1.88 quadrillion. Customer deposits also rose by 6%, amounting to more than VND 1.8 quadrillion.

As of June 30, BIDV’s total non-performing loans stood at VND 28,687 billion, representing a 28.3% increase compared to the start of the year. The non-performing loan ratio to total loans stood at 1.52%, higher than the 1.26% recorded at the beginning of the year.

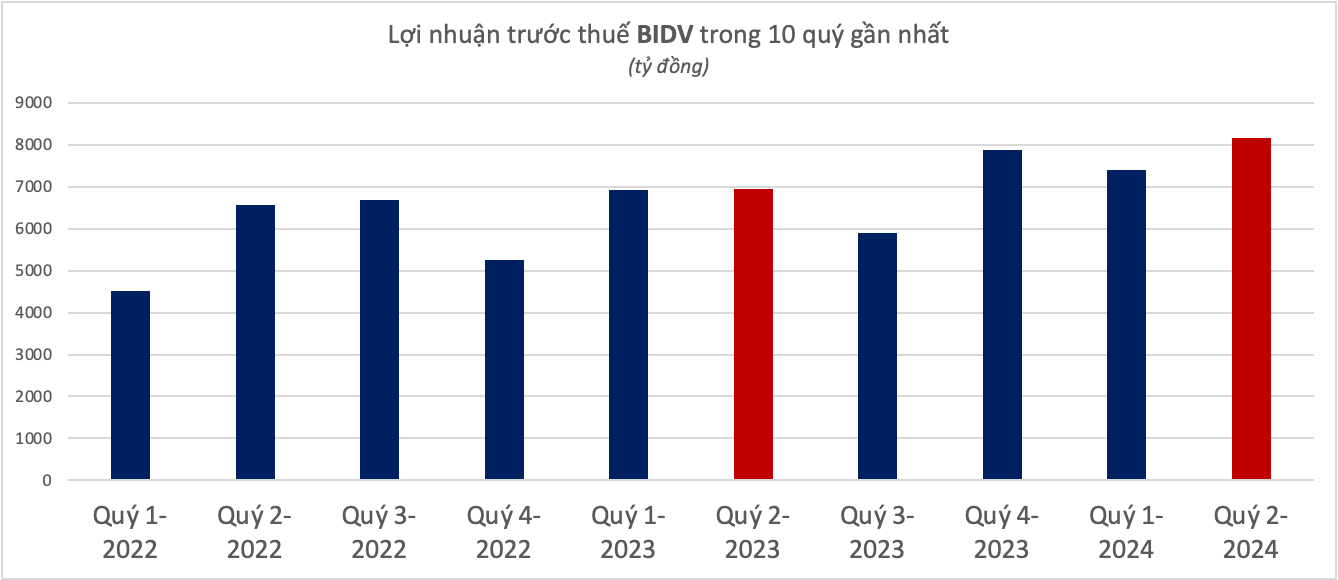

In terms of business results, BIDV’s pre-tax profit for Q2 2024 reached VND 8,159 billion, reflecting a 17.4% increase compared to Q2 2023. For the first six months, the cumulative pre-tax profit was VND 15,549 billion, a 12.1% increase. As a result, BIDV ranked third in terms of profit, following Techcombank (over VND 15,600 billion) and Vietcombank (over VND 20,800 billion).

Most of BIDV’s business segments performed well. Net interest income increased by 3.3%, surpassing VND 28,300 billion. Service income rose by 13.8%, reaching over VND 3,600 billion. Notably, foreign exchange trading income doubled to VND 3,191 billion, while income from securities investment increased more than sevenfold to VND 221 billion.

BIDV’s total operating income for the first six months reached VND 37,396 billion, an 8.3% increase year-over-year. Meanwhile, operating expenses increased by 8% to VND 12,100 billion. Provisions for risks rose by 3% to VND 9,746 billion. The cost-to-income ratio (CIR) remained unchanged at 32.4% compared to the same period in 2023. The provisions for risks accounted for approximately 38.5% of the net operating profit.