Despite a lack of positive news, the market unexpectedly surged during today’s trading session, recovering from a brutal sell-off earlier in the day. The index spent the morning deep in the red, down as much as 17 points, but staged a strong comeback to close nearly 10 points higher, approaching the 1,236 level, leaving investors bewildered.

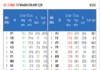

The breadth was much improved, with 267 gainers outnumbering 160 decliners. Securities led the market higher today, surging 2.89%, prompting a flood of money into other groups. The steel sector also rebounded, climbing 2.12%; Transportation rose 2.47%; Food & Beverage increased by 1.29%; and Real Estate and Banking sectors gained 0.23% and 0.27%, respectively.

Top contributors to the market’s gains today included BID, adding 1.32 points; GVR, contributing 0.9 points; TCB, with 0.86 points; and HPG and HVN, collectively lifting the market by another 1.7 points. On the flip side, VCB was the biggest drag on the market, pulling down the index by 2.71 points.

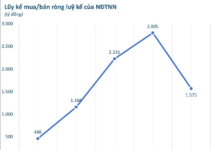

Total matched transactions across the three exchanges reached VND18,700 billion, with foreign investors net buying a substantial VND773.3 billion. Specifically, in matched transactions, they net bought VND742.6 billion.

Foreign investors’ main net buying on the matched transactions was in the Food & Beverage and Basic Resources sectors. The top stocks they net bought on a matched basis were VNM, MSN, DGC, HPG, SSI, MWG, TCB, POW, BID, and PLX.

On the selling side for matched transactions, foreign investors focused on the Real Estate sector. The top stocks they net sold on a matched basis were VIX, VHM, DXG, CTG, STB, NLG, VPI, VCB, and PVD.

Individual investors net sold VND607.7 billion, including VND570.4 billion in net selling on matched transactions. In matched transactions, they net bought 4 out of 18 sectors, mainly in Information Technology. Their top net bought stocks included FPT, DXG, VHM, STB, VIX, ACB, SHB, CTD, VRE, and HHV.

For net selling on matched transactions, they net sold 14 out of 18 sectors, primarily in Food & Beverage and Banking. Their top net sold stocks were VNM, TCB, PNJ, MBB, HPG, MWG, GMD, SSI, and REE.

Proprietary trading accounted for net buying of VND342.9 billion, including VND333.3 billion in net buying on a matched basis.

In matched transactions, proprietary trading net bought 8 out of 18 sectors. The sectors with the largest net buying were Banking and Consumer Goods & Home Durables. The top net bought stocks on a matched basis by proprietary traders today were PNJ, TCB, REE, HVN, LPB, CTG, HDB, VPB, SSB, and MSB. The sector with the largest net selling was Information Technology. The top net sold stocks were FPT, MSN, ACB, VCI, HHV, HPG, VJC, SHB, BID, and STB.

Domestic institutions net sold VND479.8 billion, including VND505.5 billion in net selling on a matched basis.

In matched transactions, domestic institutions net sold 7 out of 18 sectors, with the largest value in Information Technology. Their top net sold stocks were FPT, SSB, CTR, ACB, HAH, SZC, POW, CTD, HDB, and MSN. The sector with the largest net buying was Banking. Their top net bought stocks were MBB, GMD, CTG, REE, VIB, HPG, VJC, MWG, IMP, and VIX.

Block trades today reached VND1,236.0 billion, down 11.0% from the previous session, contributing 6.6% of the total trading value.

Notably, there was a significant transaction in BCG, with over 12.6 million units (equivalent to VND87.8 billion) sold by domestic proprietary trading to domestic institutions.

Additionally, there were transactions where individual investors sold REE and GMD to domestic proprietary trading on a block trade basis. Individual investors continued to trade KOS, MWG, and MSB.

The money flow allocation DECREASED in Real Estate, Securities, Steel, Retail, Warehousing & Logistics, Textiles & Garments, Marine Transportation, while it INCREASED in Banking, Food & Beverage, Software, Agricultural & Seafood Farming, Oil & Gas Production & Distribution, and Power Production & Distribution.

Specifically, in matched transactions, the money flow allocation increased significantly in the large-cap VN30 group while decreasing in the mid-cap VNMID and small-cap VNSML groups.

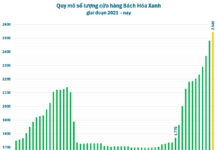

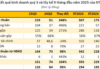

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.