Early sacrifices in the Cambodian market prove worthwhile: EraBlue’s revenue per store even doubles that of Dien May Xanh in Vietnam

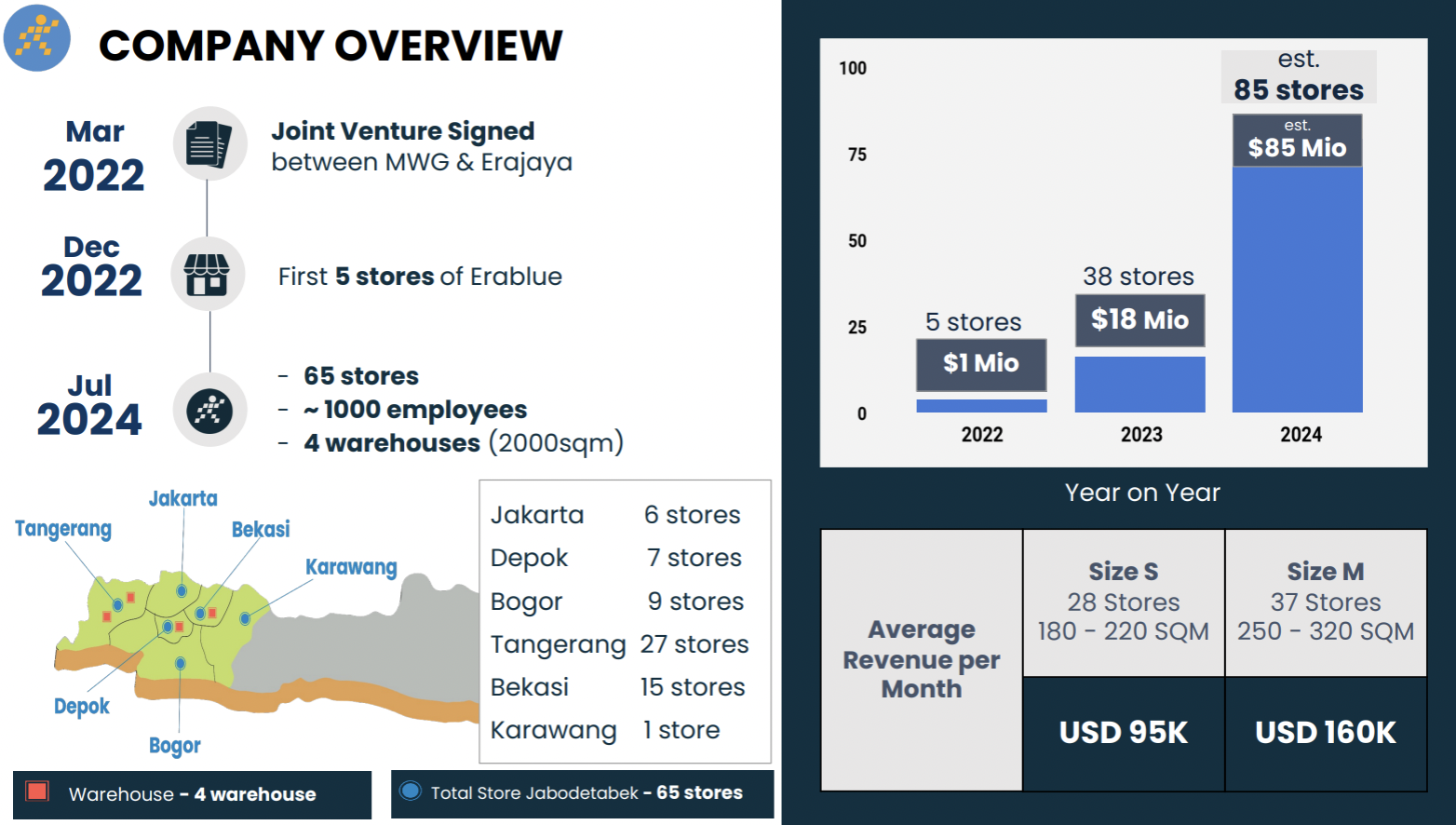

EraBlue is MWG’s new experiment in foreign markets since 2022, mainly operating in the field of retail sales of mobile devices, appliances, household goods, and other equipment and machinery in Indonesia. EraBlue is a joint venture established by a Vietnamese company and PT Erafone Artha Retailindo (Erafone), a subsidiary of the Erajaya Group.

EraBlue is built as a chain of stores specializing in retail sales of consumer electronics similar to the Dien May Xanh model in Vietnam. The EraBlue team has inherited the full range of lessons learned in Vietnam, from experience in determining store locations, negotiating with landlords, construction processes, arranging display shelves, IT operating systems, after-sales services, to serving culture.

It is important to note that by focusing on EraBlue, MWG has agreed to “pause” another plan in a different foreign market, Bluetronics in Cambodia. Despite withdrawing from Cambodia, according to MWG, the results after many years of operating in this market are valuable lessons for the company to pave the way for Indonesia. And MWG’s initial sacrifices have paid off.

According to Mr. Doan Van Hieu Em, the operational experience in Cambodia has provided invaluable insights to build an optimized model that has yielded better-than-expected results. Consequently, EraBlue stores generate almost double the revenue compared to a Dien May Xanh store of the same size in Vietnam. Specifically, the monthly revenue of the size M shops is 4 billion VND, while that of size S shops is 2.2 billion VND.

Riding on this success, MWG and its partner, Erajaya, have agreed on a target to turn a profit at the company level before the fourth quarter of 2024, just two years after its formation. In parallel, EraBlue plans to expand its scale to nearly 100 stores by the end of 2024 and 500 stores by 2027. The company expects to develop EraBlue into a Dien May Xanh-like business in Indonesia.

EraBlue will go public in 2027 when it reaches 500 stores

Regarding the IPO plan, Mr. Joy Wahjudi, Vice Chairman of Erajaya’s Board of Directors, shared: “When we first met Mr. Tai, we already had plans for an IPO in the 2026-2027 phase. Indonesia is a vast market, so the opportunity for an IPO is significant.”

Representing MWG, Mr. Nguyen Duc Tai added: “In a developing country, according to MWG’s experience, the mobile phone market will develop first. Because people will take care of themselves first. Once they have taken care of themselves, they will then take care of their families, which is why Vietnam’s appliance market is currently larger than the mobile phone market. In Indonesia, I believe the appliance market will boom in the next ten years.”

“So, the plan for 500 stores is actually a number that both parties initially discussed to make it easier to execute. But the appliance market in general and Indonesia’s macro economy are much larger than Vietnam’s, and they are in a booming trend. So we said we would open 500 stores, but in reality, it will be much more. Currently, we already have more than 2,000 stores in Vietnam.”

Photo: IPO plans for 2027 when reaching 500 stores.

In addition to three strategic advantages, Indonesia has a “peculiarity” that presents a significant opportunity for exporters, which Mr. Tai has also just learned about

Mr. Tai also shared a peculiarity about the Indonesian market that he himself had just discovered. Not all products are subject to import control when entering Indonesia. According to the representative of MWG, this will be an opportunity for exporters to Indonesia, not just MWG.

Along with this, there are three main reasons why the future of EraBlue looks promising:

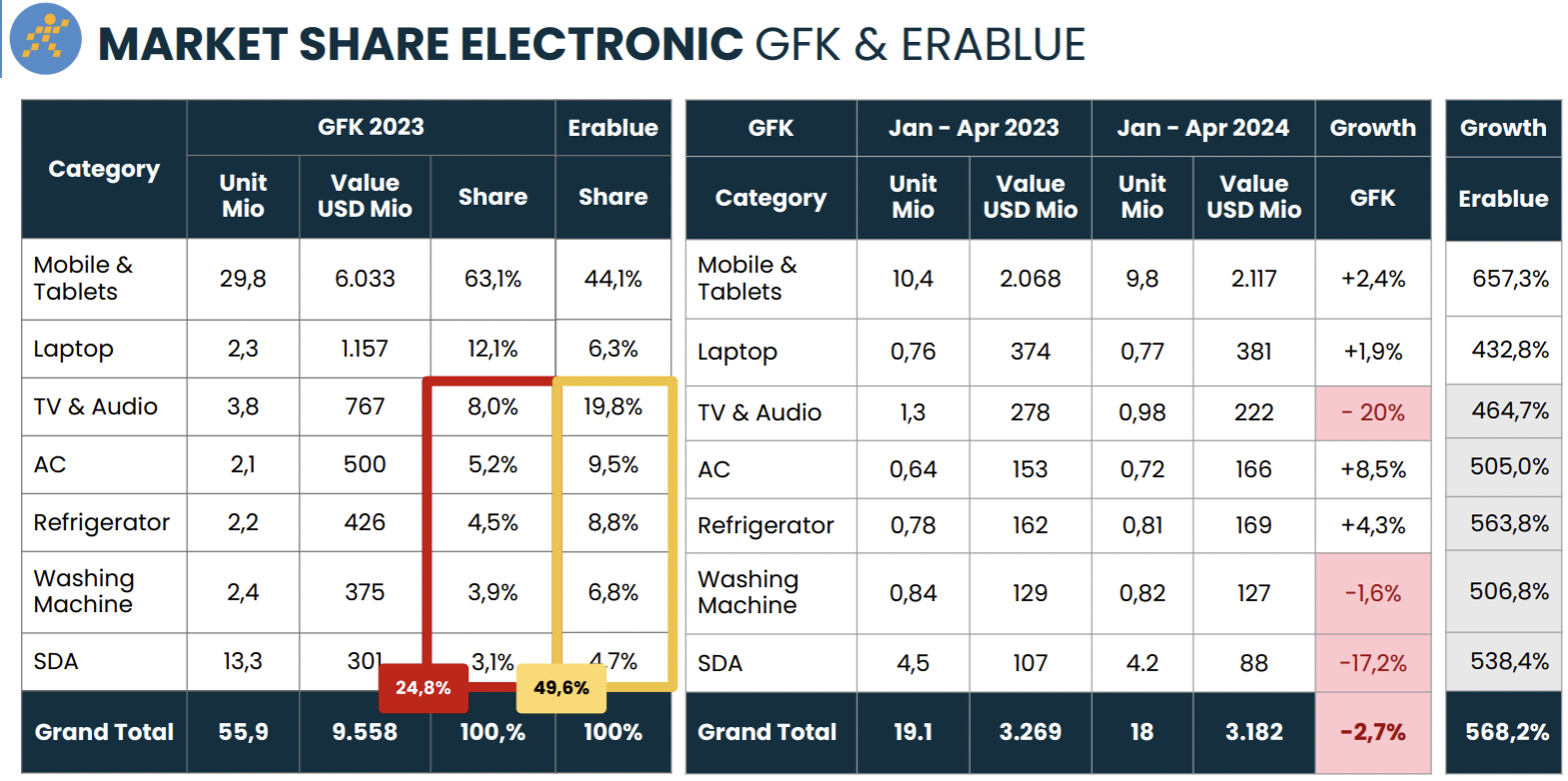

First, the electronics and appliance retail market in Indonesia is still fragmented, with the largest retail chain having only about 60 stores, while the demand is enormous.

Second, although Indonesia shares similar traffic patterns with Vietnam, with most customers traveling by motorbike, all modern retail chains are located within shopping malls. In contrast, the EraBlue model does not opt for malls but will develop outside of them. This model is quite friendly and is located on busy roads, making it convenient for customers to recognize and access the stores everywhere.

Third, delivery and installation services for electronic devices are quite rudimentary. To purchase a washing machine, customers have to wait 7-10 days for delivery and installation, while EraBlue can do it within four hours. The serving culture and dedication, which are the strengths of The Gioi Di Dong, have been applied to EraBlue and have won the hearts of Indonesian customers.

Lastly but importantly, EraBlue offers competitive pricing. Despite providing modern-equivalent services, EraBlue’s prices are comparable to those of traditional models.

Mr. Hieu Em added: “Indonesia is known for its many islands, so one might worry about logistics… But EraBlue only focuses on Java (Indonesia’s largest island and the location of its capital, Jakarta), which is already like a Vietnamese market. To date, EraBlue, with 65 stores, has captured more than 10% of the appliance market share in Indonesia. So when we expand to many provinces and cities, this number will be much higher. EraBlue chooses to develop outside shopping centers instead of inside them.”

Photo: Not all products are subject to import control when entering Indonesia.

On the other hand, according to Mr. Hieu Em’s observation, the water purifier market in Indonesia is non-existent. In contrast, the water purifier market in Vietnam has grown strongly in recent years. Therefore, MWG also sees this as another potential business opportunity.