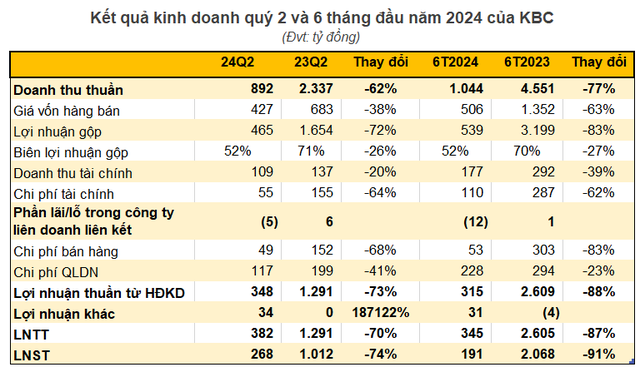

Kinh Bắc City Development Corporation (code: KBC) has released its Q2 2024 financial report, revealing a 62% year-on-year decline in revenue to VND 892 billion. While cost of goods sold decreased, it did not keep pace with the drop in revenue, resulting in a gross profit margin of 52% compared to 71% in the same period last year. Consequently, gross profit plunged by 72% to VND 465 billion.

Additionally, the company’s financial income and expenses for the quarter stood at VND 109 billion and VND 55 billion, respectively, representing decreases of 20% and 64% from the previous year. Similarly, selling and administrative expenses were significantly lower than in the corresponding period. KBC reported a loss of VND 5 billion from its associates, compared to a profit of nearly VND 6 billion in Q2 2023.

For the quarter, KBC posted a net profit of nearly VND 268 billion, a substantial drop of 74% from the previous year. Profit attributable to the parent company’s shareholders amounted to VND 237 billion.

In the first half of 2024, the real estate company recorded VND 1,044 billion in revenue, a decrease of 77% year-on-year. Net profit also plummeted by 91% to VND 191 billion. Thus, KBC has only achieved 5% of its full-year profit plan for 2024 in the first half.

As of June 30, 2024, the company’s total assets stood at VND 40,904 billion, a significant increase of VND 7,470 billion (22%) from the beginning of the year. Notably, term deposits at banks surged by VND 5,700 billion to VND 5,708 billion during this period.

The trading securities portfolio was valued at VND 1,862 billion in original value. KBC invested VND 1,855 billion in short-term securities in Hoa Sen Hotel JSC and over VND 7 billion in shares of Tan Tao Investment and Industry Corporation (code: ITA). The company has set aside nearly VND 6 billion in financial asset impairment provisions for the short-term.

Inventory at the end of Q2 was valued at VND 12,887 billion, a 5% increase from the beginning of the year. The majority of this inventory was concentrated in the Trang Cat Industrial Park and Urban Area project, with a value of nearly VND 8,311 billion, followed by the Phuc Ninh Urban Area project at nearly VND 1,117 billion, and the Tan Phu Trung Industrial Park and Residential Area project at over VND 1,002 billion.

On the capital side, total liabilities were VND 20,492 billion, a 55% increase from the beginning of the year. Financial borrowings accounted for 24% of total capital, amounting to nearly VND 4,900 billion. Other long-term payables surged from VND 27 billion at the beginning of the year to VND 5,703 billion, entirely comprised of long-term deposits received.

Notably, Kinh Bac specializes in real estate and land-use rights, either owned, leased, or rented. The company is known for its industrial and urban real estate development and is associated with businessman Dang Thanh Tam, Chairman of the Board of Kinh Bac City. The company currently manages the Que Vo Industrial Park in Bac Ninh, the Trang Cat Industrial Park in Hai Phong, and a complex of offices, commercial centers, and hotels in My Dinh, Hanoi.

On the stock market, KBC shares plunged by nearly 5% on August 1, 2024, to VND 26,000 per share, the lowest level in more than nine months.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.