The VN-Index closed the 31st trading week of 2024 at 1,236.6 points, a decrease of 5.51 points or -0.44% from the previous week, with slightly higher trading liquidity.

The average trading value for the week across all three exchanges was 18,361 billion VND. For matched orders, the average trading value was 16,850 billion VND, an increase of 4.6% from the previous week but still 7.5% lower than the 5-week average.

There were more upward sessions than downward ones (3 out of 5 sessions), but active selling volume dominated the afternoon session of August 1st, equivalent to approximately 33% of the 1-month peak, causing the VN-Index to have the deepest decline since mid-June, falling 24.55 points or -1.96%, and closing the week at a lower level than the previous week. This was also the session in which individuals strongly net sold bank stocks, including VCB, TCB, MBB, BID, and STB.

Foreign investors net sold 399.9 billion VND, but for matched orders, they net bought 573.1 billion VND.

The main sectors that foreign investors net bought on a matched basis were Food & Beverage and Retail. The top stocks net bought by foreigners on a matched basis included VNM, MWG, MSN, VCB, BID, DGC, BCM, GMD, PLX, and HPG.

On the sell side, the main sector was Real Estate. The top stocks net sold by foreigners on a matched basis included CTG, VHM, PDR, SSI, VIX, HAH, VRE, STB, and DCM.

Individual investors net sold 547.9 billion VND, including 1,468.8 billion VND in net selling on a matched basis.

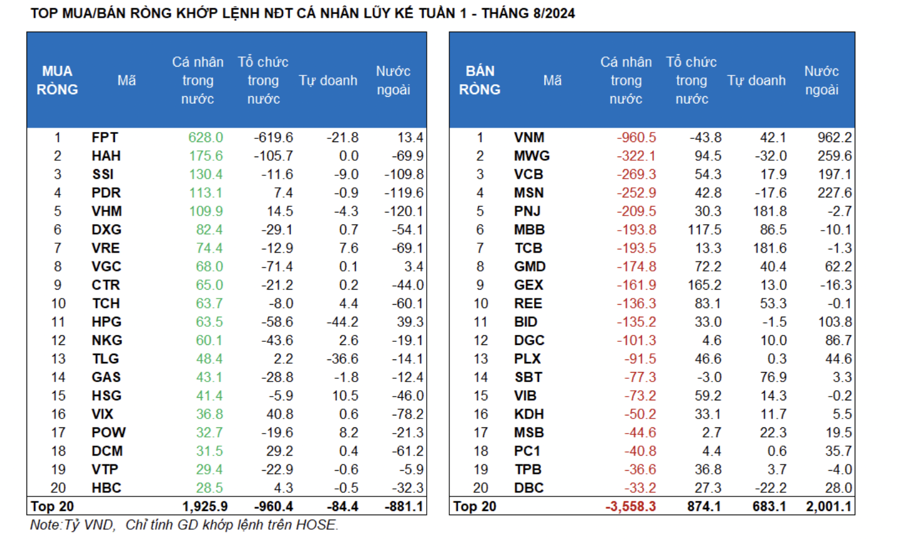

For matched orders, they net bought 7 out of 18 sectors, mainly in Information Technology. The top stocks net bought by individual investors included FPT, HAH, SSI, PDR, VHM, DXG, VRE, VGC, CTR, and TCH.

On the sell side, they net sold 11 out of 18 sectors, mainly in Food & Beverage and Banking. The top stocks in their net selling list included VNM, MWG, VCB, MSN, PNJ, MBB, GMD, GEX, and REE.

Domestic institutional investors net sold 35 billion VND, and for matched orders, they net sold 217.5 billion VND. For matched orders, domestic institutions net sold 6 out of 18 sectors, with the largest value in Information Technology. The top stocks in their net selling list included FPT, HAH, VGC, HPG, BCM, VNM, NKG, KBC, HDB, and DXG.

The sector with the highest net buying value was Banking. The top stocks net bought included GEX, MBB, MWG, REE, STB, CTG, GMD, VIB, VCB, and PLX.

Proprietary trading net bought 982.87 billion VND, and for matched orders, they net bought 1,113.2 billion VND.

For matched orders, proprietary trading net bought 13 out of 18 sectors. The sectors with the strongest net buying were Banking and Real Estate. The top stocks net bought by proprietary trading this week included PNJ, TCB, MBB, SBT, HVN, REE, KBC, VNM, FUESSVFL, and GMD. The top net sell sector was Retail.

The top stocks net sold included HPG, TLG, MWG, DBC, FPT, MSN, E1VFVN30, VCI, FUEVN100, and FUEVFVND.

Money Flow Trend: Looking at the weekly frame, the allocation of money flow increased in Food & Beverage, Steel, Information Technology, Agriculture & Seafood, Oil Production, and Textile while decreasing in Banking, Retail, Chemicals, Construction, and Electricity.

Sectors with a decrease in money flow allocation from the 12-week peak: Banking, Real Estate, Retail, Electricity, Rubber & Plastics, and Aviation. Among these, the price indices of Banking, Retail, and Aviation increased.

Sectors with a recovery in money flow allocation from the 12-week low: Steel, Information Technology, Agriculture & Seafood, Textile, Oil Equipment, Water Transport, and Building Materials. The price indices of these sectors decreased.

Sectors with a peak in money flow allocation over the 12-week period: Food & Beverage, Mobile Telecommunications, and Gas. Among these, Food & Beverage and Gas increased for the second consecutive week, but Mobile Telecommunications (VGI) fell sharply.

Money Flow Strength: Looking at the weekly frame, money flow increased in large-cap VN30 and small-cap VNSML and decreased in mid-cap VNMID.

In week 31, money flow continued to focus on the large-cap VN30 group, with the average trading value of this group increasing by 436 billion VND (equivalent to +5.9%), raising the allocation ratio to 48.6% from 45.8% in week 30.

The average trading value also increased for the small-cap VNSML group, +112 billion VND or +6.5% from the previous week. The allocation ratio for this group increased from 10.7% to 11.5%.

Conversely, the mid-cap VNMID group recorded a decrease in money flow allocation to 35% – the lowest level in nearly 2 years. Average trading liquidity for the VNMID group decreased by approximately 631 billion VND (-10.1%).

In terms of price movements, the VN30 index decreased less than the overall market (-0.06%), while the VNMID and VNSML indices decreased by -2.45% and -2.65%, respectively.