Shares of VNM, owned by Vietnam Dairy Products JSC (Vinamilk), saw a surprising trading boom during the last trading session of July, surging 5.8% to reach 71,600 VND per share, the highest price in five months. This pushed the market capitalization to 149,640 billion VND (~6 billion USD), an impressive feat.

What’s more, the trading volume for this leading dairy stock skyrocketed to over 21 million units, nearly six times the average volume of the previous ten sessions. This was also a record-breaking volume for VNM, with a corresponding value of 1,490 billion VND, the highest on the market and equivalent to 15% of the total VN30 group’s trading value for the day.

Foreign investors also joined the rally, with net purchases of VNM shares for eight consecutive sessions, totaling approximately 764 billion VND.

This strong breakout, coupled with high liquidity, has investors optimistic about a new wave for VNM. The fundamental foundation remains the company’s solid business performance, and Vinamilk has just unveiled a relatively positive business picture for the first half of the year.

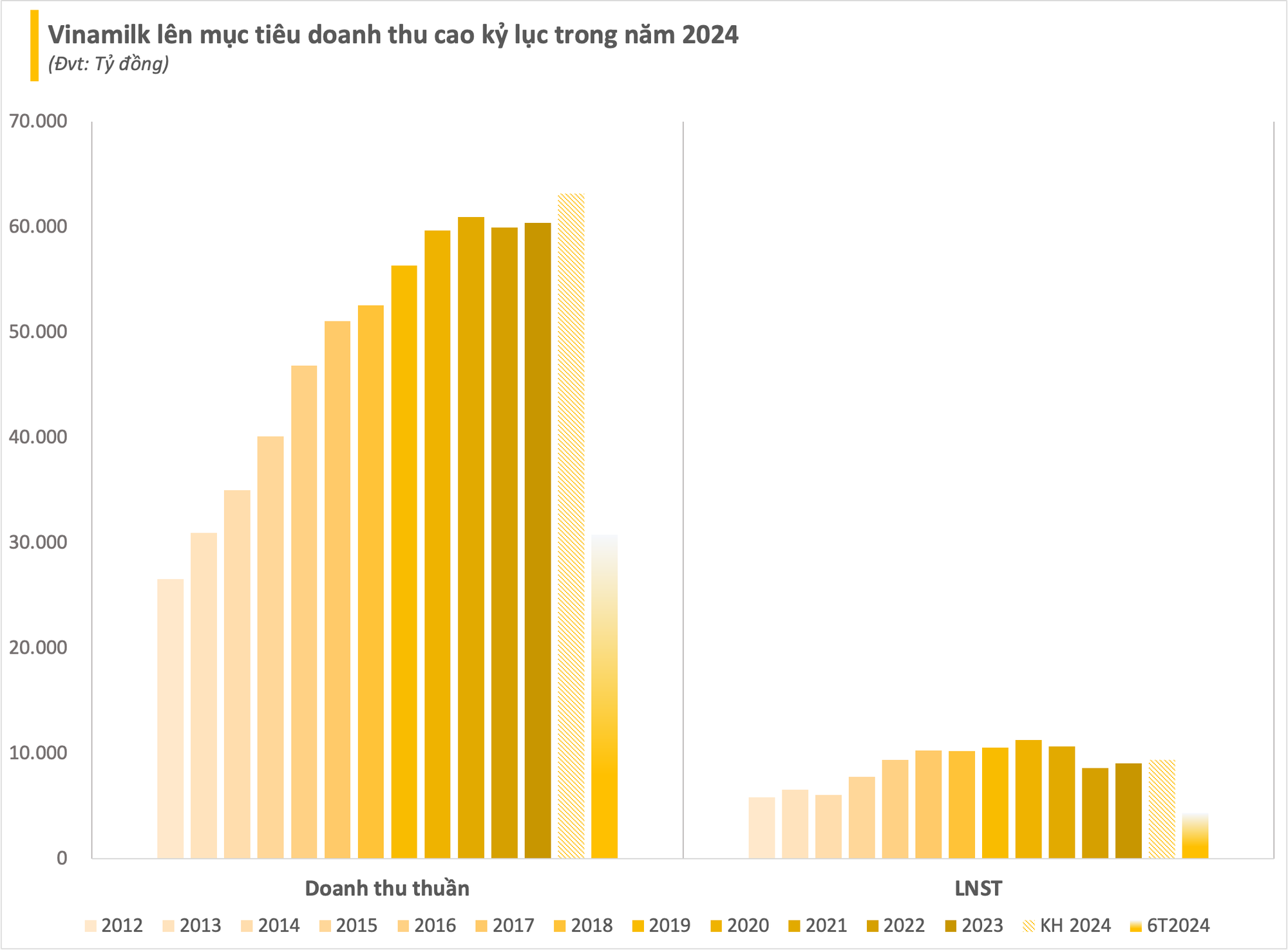

In Q2 2024 alone, Vinamilk achieved remarkable results with a record-high quarterly revenue of 16,656 billion VND, a nearly 10% increase from the previous year. This was also the quarter with the highest growth rate for Vinamilk since the beginning of 2022. Consequently, the company reported a profit after tax of 2,696 billion VND, with a net profit of 2,670 billion VND, a 21% increase from the same period last year, the highest in 11 quarters.

For the first six months of 2024, Vietnam’s largest dairy company recorded a revenue of 30,790 billion VND, a nearly 6% increase from the previous year. Profit after tax also increased by 19% to approximately 4,309 billion VND.

For the full year 2024, Vinamilk has set a target of achieving a record revenue of 63,163 billion VND and a profit after tax of 9,376 billion VND. Thus, after six months, this dairy giant has accomplished 49% of its revenue plan and 52% of its profit target for the year.

Optimism for 2024

Vinamilk is currently the leading manufacturer and trader of dairy products in Vietnam, holding over 50% of the market share. They boast the largest production scale in the country, owning 15 high-tech farms with a total herd of over 140,000 cows and 16 factories capable of producing one billion liters of milk per year. While over 80% of VNM’s revenue still comes from the domestic market, the company is striving to expand its exports to global markets.

In a recent report, KBSV stated that while the FMCG industry and the dairy sector, in particular, continue to face challenges with negative growth, Vinamilk has maintained better revenue growth than the entire dairy industry, indicating a continuous gain in market share. This growth is driven by the performance of condensed milk, drinking yogurt, and plant-based milk categories.

On the other hand, the overseas market continues to witness impressive growth compared to the previous year. Exports to traditional markets contribute significantly, and potential markets in Africa and South America are being explored for further expansion. The company’s foreign branches in Cambodia and the US have also recorded positive growth, thanks to enhanced brand positioning.

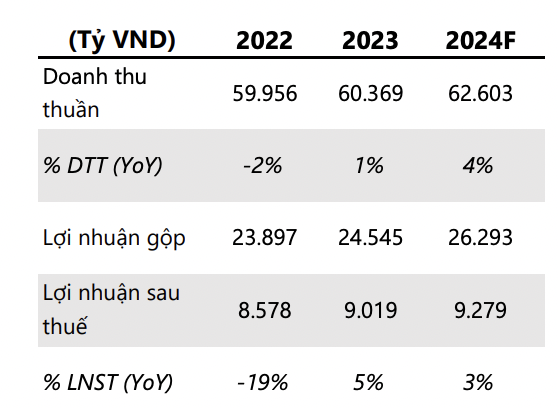

KBSV projects that VNM’s 2024 financial performance could reach a revenue of 62,516 billion VND (a 4% increase) and a gross profit of 25,936 billion VND, corresponding to a gross profit margin of 41.5%. The estimated net profit for the parent company is expected to reach 9,343 billion VND, a 5.3% increase from the previous year.

Sharing a similar sentiment, DSC believes that 2024 will witness a better growth rate for VNM compared to the 2020-2023 period, given the cooling down of input material prices. This favorable input price movement is expected to stabilize the gross profit margin for dairy businesses in 2024, with VNM potentially improving its gross profit margin to 42%.

At the same time, consumer demand may improve in the second half as domestic purchasing power recovers and the overseas market continues to grow.

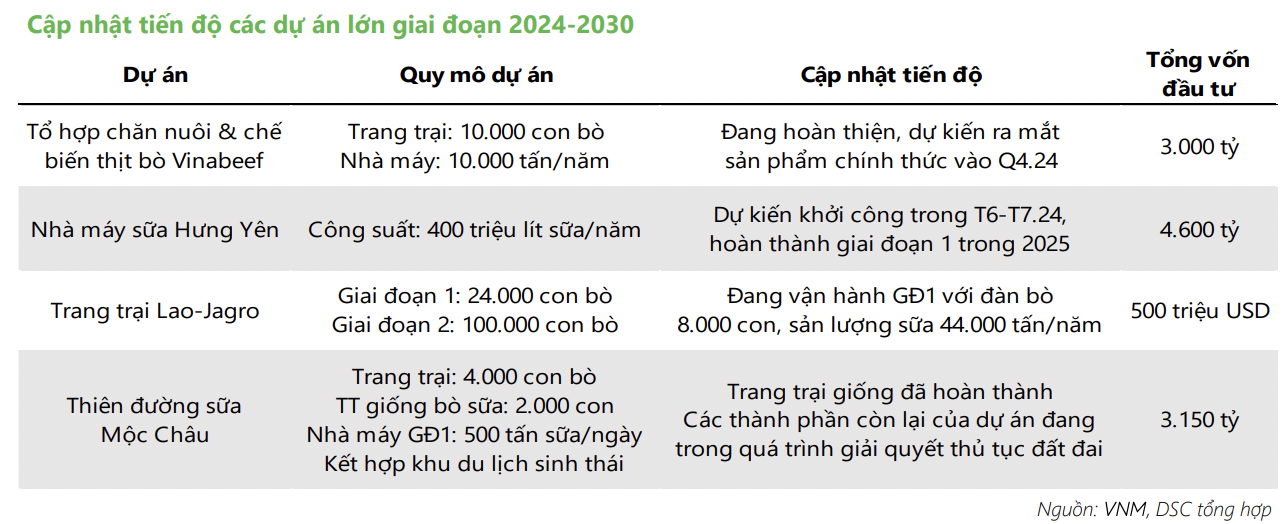

Additionally, VNM will accelerate its major projects starting in Q3 2024, notably the construction of the Hung Yen dairy factory. DSC anticipates that these projects will provide new momentum for VNM amidst a slowdown in growth in recent years.

Source: DSC