On July 31, the Bank of Japan (BOJ) unexpectedly announced an interest rate hike and detailed plans to cut back on its massive stimulus program, including a reduction in its massive bond-buying program. This move sent ripples through the financial markets and had a significant impact on the Japanese yen. The JPY/VND exchange rate surged to a five-month high, reflecting the strengthened yen.

Japan is Vietnam’s fourth-largest trading partner and has signed the most bilateral and multilateral free trade agreements with the country. Therefore, the strengthening of the yen is expected to have a notable impact on Vietnam’s economy and businesses that import and export to Japan.

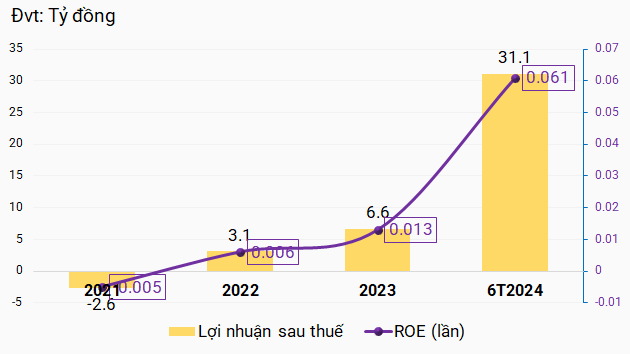

When it comes to Japanese connections, FPT, Vietnam’s leading technology corporation, comes to mind. Japan is the company’s largest overseas market. In the first half of the year, FPT’s IT services segment brought in VND 14,573 billion, a nearly 30% increase from the previous year. Of this, the Japanese market contributed more than VND 5,700 billion, a 35% increase year-over-year and accounting for 39% of the total revenue.

FPT’s revenue structure in the first half of the year

When calculated in yen, revenue from the Japanese market in the first half of the year increased by more than 41% compared to the previous year. To put it into perspective, FPT’s revenue for the first six months in the Japanese market would have increased by approximately VND 343 billion if converted at the JPY/VND exchange rate as of July 31. This indicates that FPT is experiencing a significant foreign exchange loss in the Japanese market. However, with the yen’s upward trend, this loss may narrow or even turn into a gain in the future.

Japan is expected to remain a key market for FPT in the future as the country accelerates its digital transformation and strives to reconnect its supply chains. The corporation anticipates maintaining a high growth rate of over 30% per year in the Japanese market, aiming to reach $1 billion in revenue by 2027.

A similar story unfolds for seafood companies, as Japan has been one of the largest export markets for Vietnamese seafood, particularly shrimp. Minh Phu Seafood (MPC), for instance, relies on Japan as its third-largest export market, after North America and Australia. In 2023, the Japanese market generated more than VND 2,000 billion in revenue for MPC, a decrease of over 44% from the previous year, contributing 18.7% to the company’s total revenue.

Revenue structure of Minh Phu Seafood

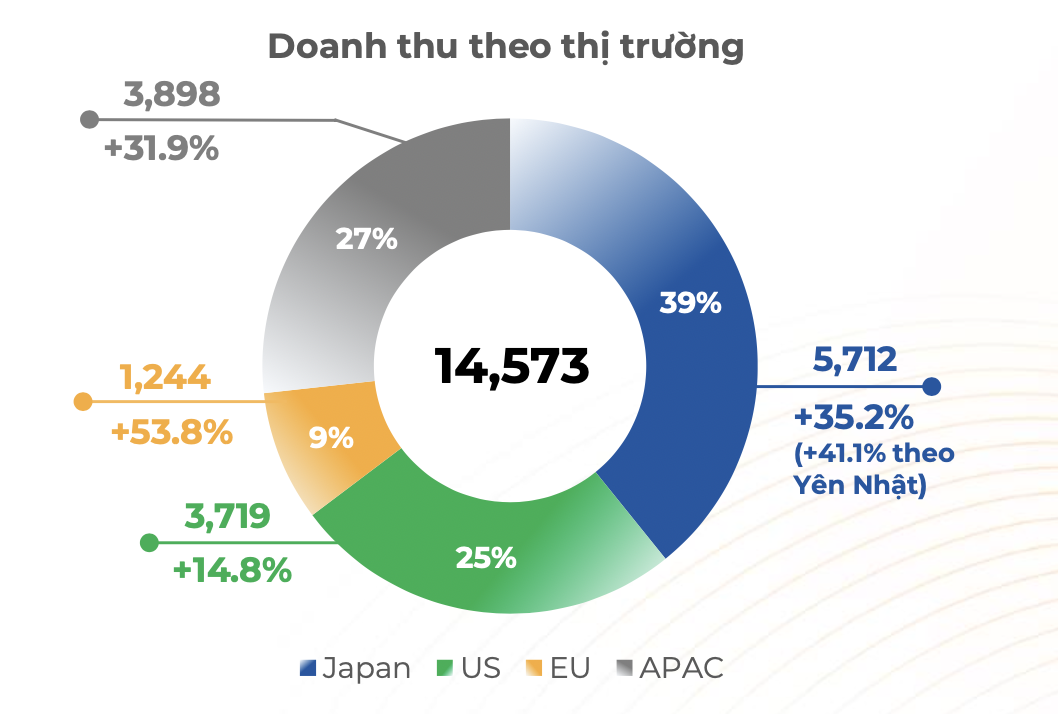

Another seafood company, Sao Ta Food JSC (FMC), is also expected to benefit from the stronger yen. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), FMC is the largest exporter of shrimp to Japan among Vietnamese companies. SSI Research’s recent report revealed that the Japanese market accounted for 45% of FMC’s revenue in 2023.

Fundamentally, a stronger yen will positively impact exporters but negatively affect importers from the Japanese market. In Vietnam, imports from Japan primarily consist of industrial machinery, equipment, tools, and parts, electronic products and components, various types of steel, fabrics, auto parts, and plastic raw materials.

Additionally, the appreciation of the yen can negatively affect businesses with foreign currency debts, such as ACV, one of the companies with the largest yen-denominated debt on the Vietnamese stock market. According to ACV’s consolidated financial statements for the second quarter of 2024, the company’s yen-denominated debt as of June 30 stood at JPY 63.5 billion in principal. When estimated at the current exchange rate, ACV’s foreign currency debt converts to approximately VND 10,650 billion, an increase of VND 200 billion compared to the figure at the end of the second quarter. This implies a temporary foreign exchange loss for ACV if the foreign currency debt remains unchanged.

In conclusion, while it is challenging to precisely quantify the impact of the stronger yen, businesses have risk mitigation measures in place, such as choosing banks with strong trade finance capabilities and utilizing financial derivatives like forward currency contracts and swap agreements. These tools help ensure that import and export activities are well-planned and managed, minimizing the potential negative effects of currency fluctuations.