The Ho Chi Minh Stock Index (VN-Index) witnessed a sudden “sell-off” session, followed by significant fluctuations on the last trading day of the week. Strong selling pressure pushed the index down to around the 1,200-point level before it rebounded strongly to close nearly 10 points higher at 1,236 points. The spotlight fell on securities stocks as they unexpectedly attracted substantial buying interest after a prolonged period of stagnation.

Notably, BSI, FTS, and CTS hit the daily limit-up with no selling orders, while other stocks such as MBS, SSI, VIX, and VCI also closed with solid gains, ranging from 3% to 6%. Trading volume in these securities stocks was exceptionally high, with VIX, SSI, and SHS among the top stocks in terms of market liquidity.

This surge in securities stocks followed a period of subdued trading activity. Many stocks had fallen over 20% from their recent highs and were hovering near multi-month lows, coinciding with a decline in market liquidity as trading value in many sessions fell below the 15,000 billion VND mark.

Mr. Bui Van Huy, Branch Director of DSC Securities, attributed the rally in securities stocks to them being in an “oversold” territory in the previous session. According to Mr. Huy, the end of the earnings season triggered a psychological effect of “sell on news.” However, when investors calmly assessed the situation, they realized there was no reason for a market sell-off, and money immediately flowed back into sectors that had been deeply discounted.

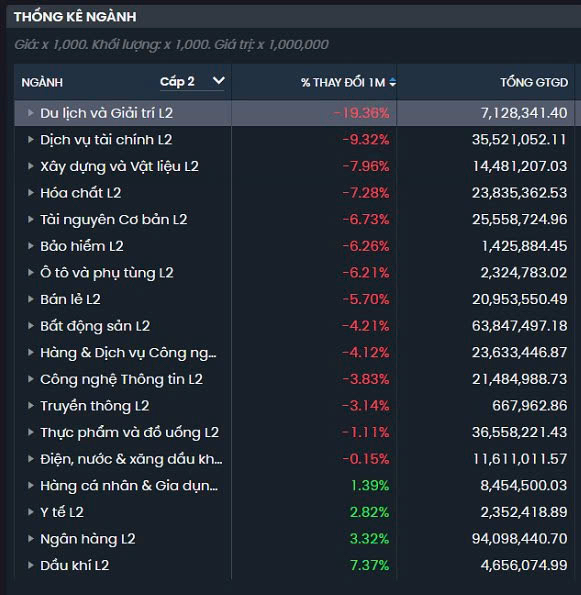

In the past month, securities stocks were among the worst-performing sectors, with a decline of more than 9%, second only to the tourism and entertainment industry. The P/B ratios of many securities stocks had also fallen to November 2023 lows, making them attractive to investors.

Performance of sectors with the biggest declines in the past month

Looking at the long-term prospects, Mr. Huy expressed optimism about the removal of the Prefunding requirement and the implementation of a roadmap for English disclosure. He believed these factors would positively impact MSCI’s and FTSE’s assessments of Vietnam in the future.

Recently, the SSC announced a draft circular amending and supplementing a number of articles in the circulars guiding securities trading. The draft includes new provisions to facilitate foreign institutional investors’ purchases of securities without requiring 100% pre-funding.

DSC’s expert opined that removing the Prefunding requirement would be a crucial step in the market upgrade process and expected it to positively impact major securities companies such as SSI, HCM, VCI, and VND.

KBSV Securities also maintained a positive outlook on the long-term prospects of the securities industry. They held a constructive view on the price and liquidity of Vietnam’s stock market in the second half of 2024. According to KBSV, the market’s overall profit growth could reach about 10% this year, and valuations remain reasonable.

The interest rate backdrop, even after the rate hike, could still stimulate stock investment as deposit interest rates may not offer attractive enough returns. Additionally, anticipated rate cuts by major central banks in the second half of 2024 and 2025 could narrow the interest rate gap with Vietnam, potentially influencing foreign investors’ selling pressure witnessed in the previous period.

Moreover, a market upgrade is expected to be a driving force for the industry in the medium to long term. KBSV acknowledged that the possibility of Vietnam’s market being considered for an upgrade in the September 2024 review was not high, as changing the pre-funding requirement would need time for authorities to establish mechanisms and for securities companies to prepare resources, systems, and appropriate risk management plans.

However, given the government’s determination, KBSV expected Vietnam’s stock market to be decided for an upgrade by FTSE Russell in 2025 and officially included in the FTSE Emerging Markets Index in 2025–2026.

In addition, the “capital increase game” continued to heat up, with securities companies expected to further increase their capital in the remaining months of 2024. According to KBSV’s estimates, the group of observed securities companies plans to increase their charter capital by more than 26,000 billion VND, equivalent to a ~23% increase compared to the first quarter of 2024, through issuances to existing shareholders, private placements, and ESOP. This new capital will boost securities companies’ business activities, including margin lending, investment activities, and investments in systems, technology, and human resources.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.