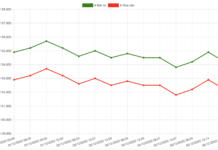

The market approached the first trading session of August with caution after hesitating at the 1,250-point resistance level. Sellers aggressively pushed for lower prices, while buyers only placed small exploratory orders, resulting in a stalemate. Despite glimpses of green at the opening, the strong selling pressure in the afternoon overwhelmed any attempts at a market recovery.

The VN-Index plummeted by nearly 29 points before closing with a slightly narrowed loss of 25 points (equivalent to -1.96%) at 1,226 points. The market was engulfed in red with 777 declining stocks overwhelmingly outnumbering gainers. This sharp drop pushed the VN-Index to its lowest level in three months, since the beginning of May 2024.

While liquidity increased compared to the previous session, it was not exceptionally high considering the extent of the decline. The matched order value on HOSE exceeded 20,000 billion VND. Additionally, the recent consistent decline in liquidity indicates a cautious market sentiment, suggesting that institutional investors may be staying on the sidelines.

Mr. Nguyen The Minh, Director of Yuanta Vietnam Securities Analysis, opined that the market, despite gaining points, experienced strong differentiation with concentration mainly in a few large-cap stocks. The “green on the outside, red on the inside” phenomenon, coupled with weak liquidity in the previous session, also made investors more cautious entering today’s session.

The expert attributed the deep market decline after the almost-completed Q2 financial reporting season to the psychological effect of “sell on news” among investors. Typically, at this time, investors reassess the growth potential of stocks.

“It is understandable that many investors expect the companies’ growth stories to be reflected in stock prices, leading to profit-taking pressure. Additionally, the cooling down of previously leading sectors caused investors to believe that the market had ‘run out of stories to tell,’ stated Mr. Minh.

Mr. Minh also identified another factor contributing to the market’s recent deep decline: leveraged sentiment. In the past period, many Penny Midcap stocks on UPCoM surged sharply without fundamental support and have since plummeted. This has rapidly increased cross-margin call pressure from sources outside of securities companies.

Furthermore, the Yuanta expert believed that escalating geopolitical tensions added to the negative sentiment among investors.

Regarding the market outlook, Mr. Nguyen The Minh anticipated that the index might dip below 1,200 points in one or two sessions, but breaking through this support level would be challenging. He attributed this resilience to several supportive factors.

“The VN-Index is in an oversold territory in terms of valuation. After sharp corrections, the market’s P/E has dropped to 13.5 times, the lowest level since April. The projected P/E for 2024 has also decreased to 11.5 times, indicating a very attractive equity yield of 9-10%. From now until the end of the year, I believe it will be difficult to find an investment channel with a higher rate of return than the stock market,” asserted Mr. Minh.

“Therefore, if the VN-Index touches the 1,200-point region, it will present a good opportunity for investors to deploy capital and seize the upcoming uptrend,” concluded the Yuanta analyst.